This week, we examine Ethereum, Ripple, Cardano, Binance Coin, and Solana in greater detail.

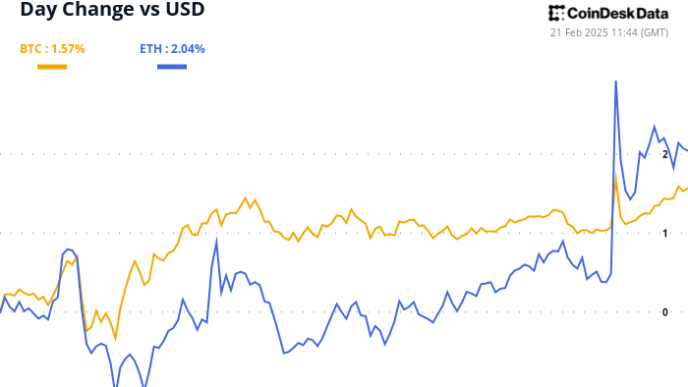

Ethereum (ETH)

Ethereum continues to consolidate and closed the week with a 2% price increase. This brings it just under the $2,870 resistance which has not been seriously challenged yet, but could soon be put under pressure.

Momentum is slowly building up for ETH which is flashing a clear bullish trend both on the daily MACD and RSI. The only missing ingredient is volume which continues to lag behind and is rather low since early February.

Looking ahead, Ethereum may attempt a breakout above $2,870, which could allow it to quickly reach $3,000 next. This would increase market optimism and bring buyers back to start a new rally.

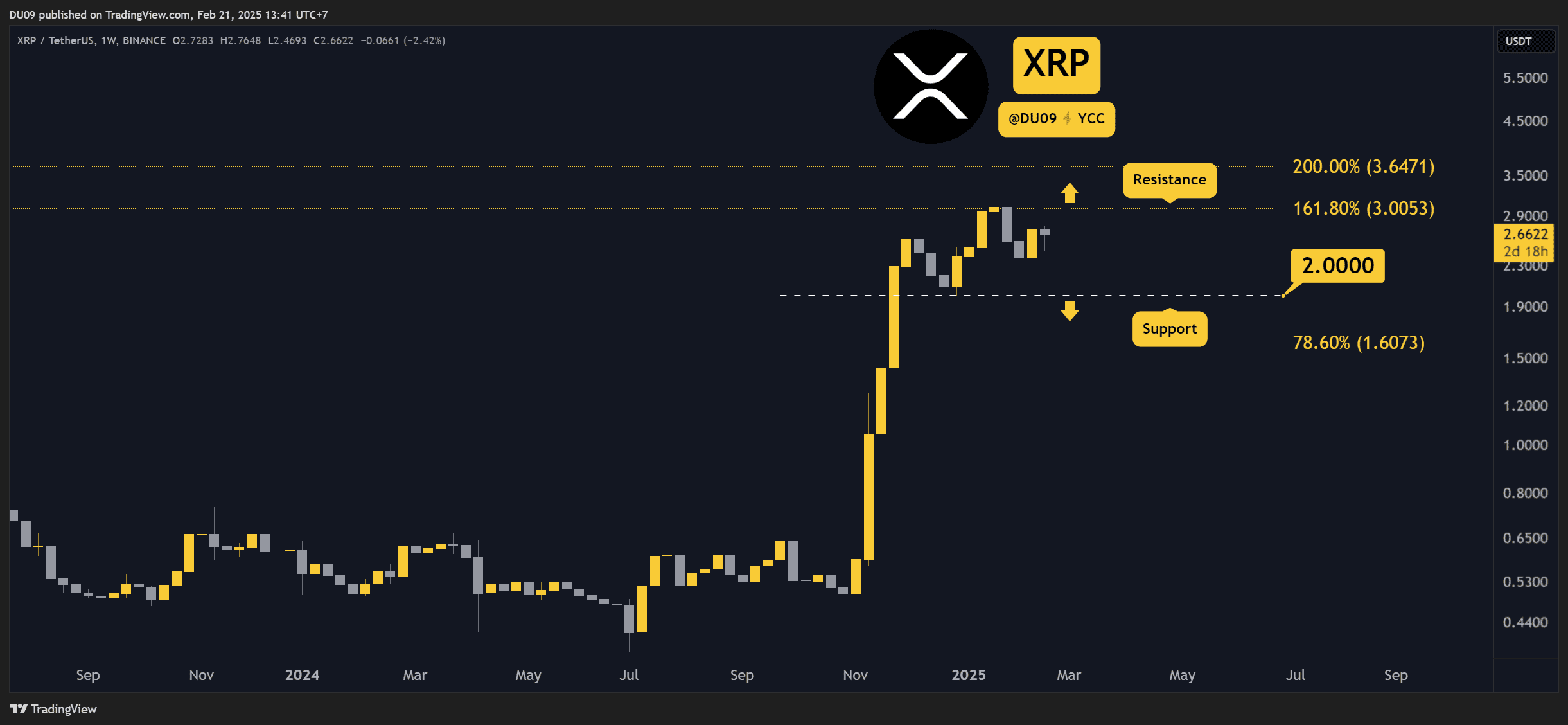

Ripple (XRP)

XRP had a good week after increasing by 5%. However, this was not enough to see the price test the resistance at $3, which continues to hold back any attempts by buyers to take this cryptocurrency higher.

While this recent advance is a positive sign for bulls, the momentum and volume still lack sufficient strength to generate a breakthrough at this time. For this reason, the price may continue to consolidate here.

Looking ahead, XRP needs a clear break above $3 if it hopes to return on a sustained rally. Anything less may be interpreted as bearish since buyers may lose interest in the lack of volatility.

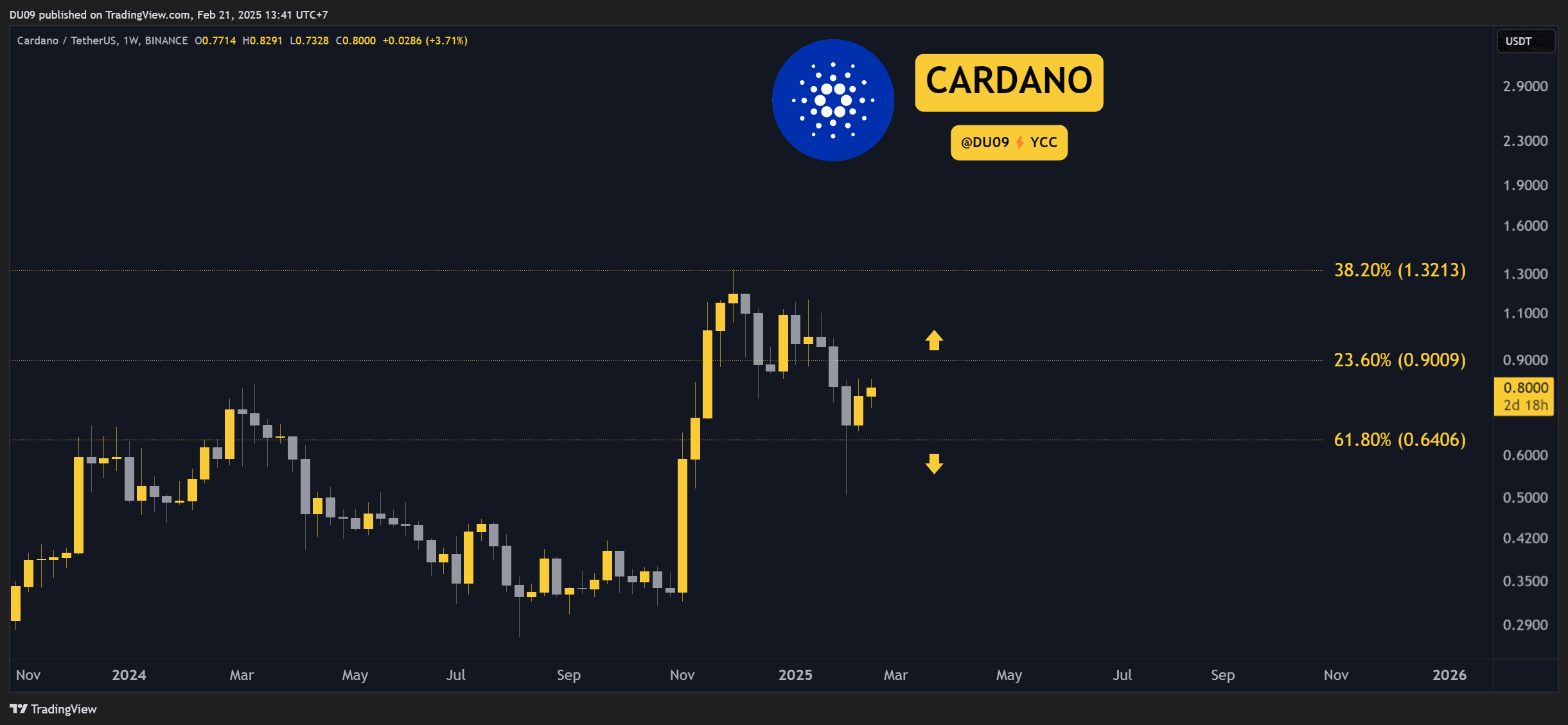

Cardano (ADA)

ADA is found at the same price of $0.8 as last week, with no significant movement. The current resistance is between $0.84 and $0.9, and buyers seem unable to push the price above it.

Sellers always returned as soon as Cardano tried to approach the key resistance. This has forced the price to move sideways under this level, but this flat price action is unlikely to last.

Looking ahead, this cryptocurrency is at a critical level. To turn the chart bullish, buyers will have to push the price above $0.9 soon. Otherwise, sellers have a clear opening to take back control and take ADA back to $0.65, which acts as support.

-

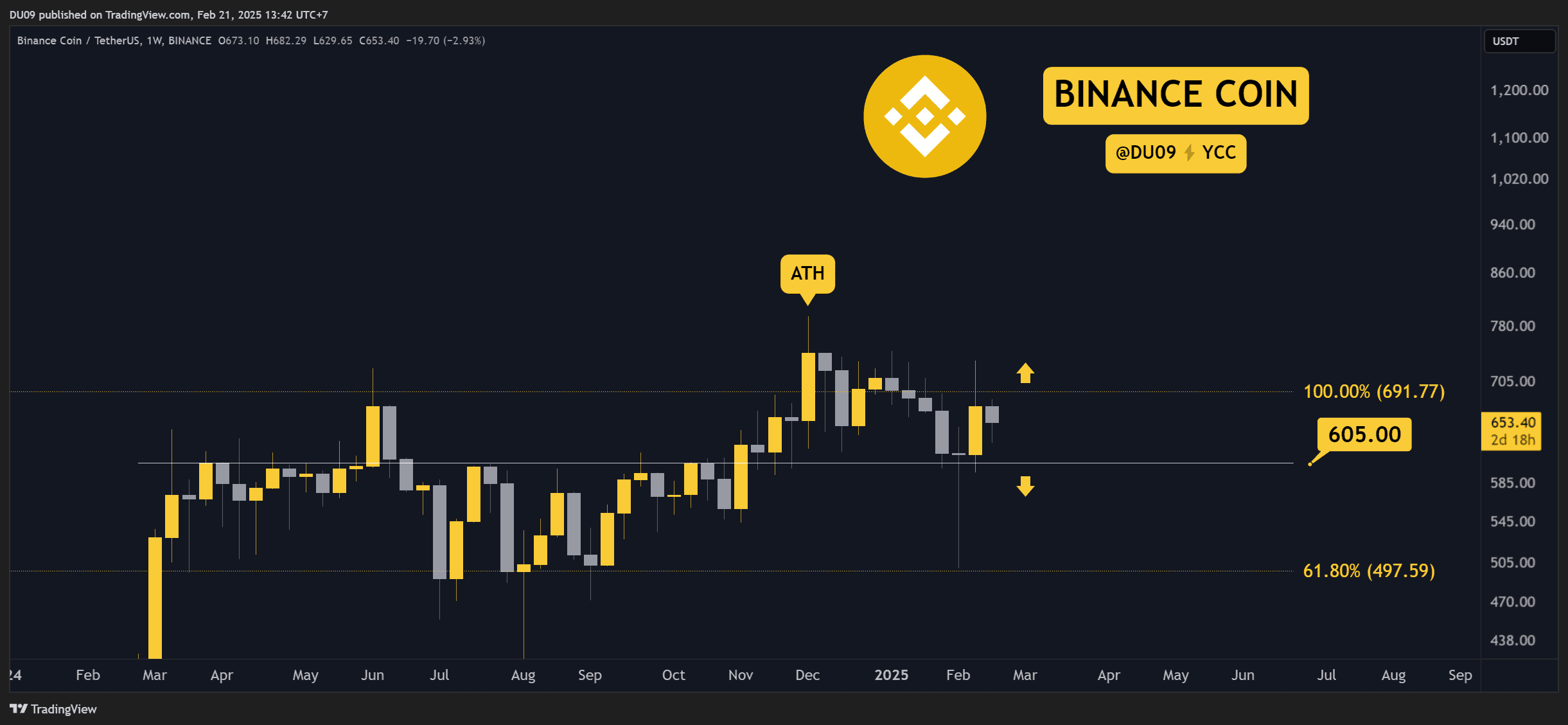

Binance Coin (BNB)

Binance Coin is found in a pullback after buyers tried to break the $700 resistance but failed. This is why the asset fell by 2% since last week. In part, this price action is normal after that sustained rally in early February.

However, buyers will have to gather their strength and make sure they defend the key support at $600 because losing that level would turn BNB bearish. So far, the price has managed to stay around $650, which is encouraging.

Looking ahead, once this pullback is over, BNB could attempt another attempt at the key resistance. For that to happen, this cryptocurrency has to maintain a price above $600.

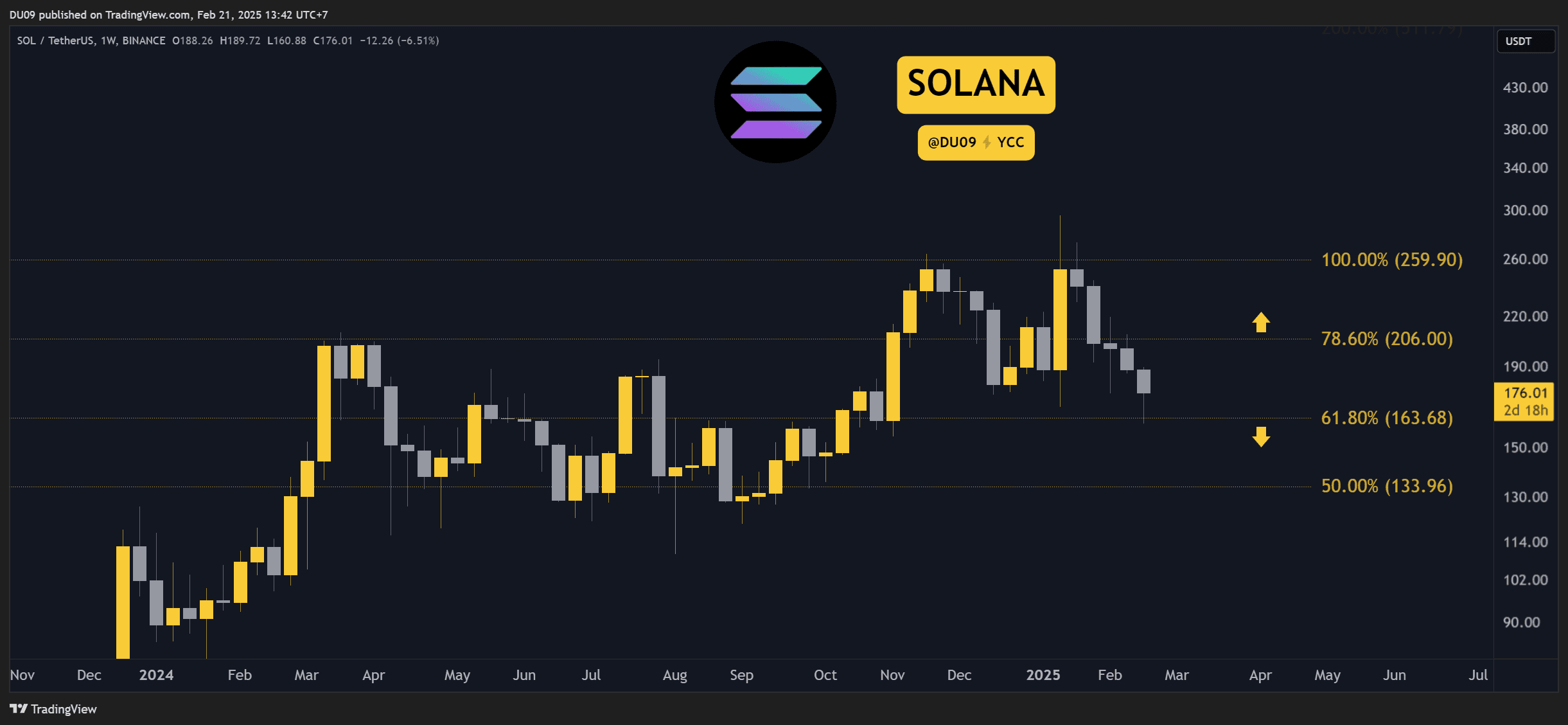

Solana (SOL)

Solana had a difficult week after its price made a lower low and fell by 11%. This goes against the current trend across the market, where most altcoins are flat or consolidating. The price also tested the key support at $164, which held well to date.

The biggest concern for SOL holders is the fact that the price made a lower low. This is a clear signal of weakness and could see the support at $164 be put under pressure again if buyers don’t return in numbers soon.

Looking ahead, Solana is found in a difficult spot with sellers having the upper hand right now. If nothing changes, we could see lower price levels in the future with $134 as the next major support level.

The post Crypto Price Analysis February-21: ETH, XRP, ADA, BNB, and SOL appeared first on CryptoPotato.

Source link

Duo Nine

https://cryptopotato.com/crypto-price-analysis-february-21-eth-xrp-ada-bnb-and-sol/

2025-02-21 11:44:39