Welcome back to the Big Law Business column. I’m Roy Strom, and today we look at how much Big Law has made in a slew of crypto-related bankruptcies. Sign up to receive this column in your Inbox on Thursday mornings. Programming Note: Big Law Business will be off next week. Happy Labor Day.

Big Law firms have amassed more than $750 million in legal fees from cryptocurrency-related bankruptcies, but the lucrative work resulting from a scandal-plagued period is inching toward the finish line.

A group of 22 major law firms is working on seven Chapter 11 bankruptcies stemming from the crypto fallout that began in 2022. They have been paid or requested fees worth $751 million as of mid-August, according to a Bloomberg Law analysis of court documents.

It’s difficult to put that number in context with other bankruptcies, but the string of crypto cases is reminiscent of industry-driven surges in Chapter 11 filings like the bout of oil and gas filings in 2015 and 2016 or the pandemic-era restructurings of retailers.

The crypto legal fees are starting to wind down, and the spigot may be completely shut by the end of the year. Only three of the cases are currently generating large monthly bills for law firms, with four having largely finished.

The ongoing cases include: FTX Ltd., the crypto exchange founded by Sam Bankman-Fried who was convicted of related fraud; Genesis Global, another exchange that collapsed in the wake of FTX’s blowup; and Terraform Labs, the most recent major crypto bankruptcy case that resulted from the May 2022 implosion of its eponymous TerraUSD stablecoin.

The FTX case has a confirmation hearing scheduled for early October, signaling the upcoming end of a long-running, contentious case. Terraform has a confirmation hearing set for September. Genesis has emerged from bankruptcy, with Cleary Gottlieb, the company’s debtor counsel, announcing this week the company paid about $4 billion in digital assets and cash to creditors.

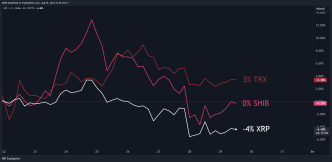

The Big Law firms working on those three cases billed a total of roughly $15 million in June, the most recent month with such information available. During some of the busier months of the crypto fallout, in mid-2023, the cases were generating more than $35 million a month combined.

For Big Law, the FTX case has generated the most legal fees by far.

It has spun off more than $312 million for five law firms. That is twice as much as the next most lucrative Chapter 11 case in the bunch, that of Celsius Network LLC, which paid four law firms about $155 million. The Genesis case has generated about $97 million in fees.

Sullivan & Cromwell has billed more than any other law firm involved in the crypto fallout cases, thanks to its work as debtor’s counsel to FTX. The New York-based firm has billed $215 million total in the case through June. The firm was consistently billing more than $10 million a month until February. Its bills have gotten slightly smaller, down to less than $7 million in the two most recent months.

While the FTX fees are large, they aren’t historic. Weil Gotshal & Manges billed more than $480 million for its work over more than five years on the bankruptcy of Lehman Brothers, which the New York Federal Reserve has called the most expensive Chapter 11 case in US history.

In 2023, Sullivan & Cromwell billed more than $138 million in the FTX case—roughly equivalent to the revenue generated by the 190th largest US law firm, according to American Lawyer data. The case accounted for about 7.5% of the firm’s $1.86 billion in revenue last year.

Kirkland & Ellis has billed the second most among any law firm, $120 million, despite most of its work having wrapped up by the start of the year. The firm won early work as lead debtor’s counsel for Celsius, BlockFi, and Voyager. Its largest single case was representing Celsius, which generated more than $75 million in fees.

White & Case billed the third most in fees, just north of $75 million, for its work on the Genesis and Celsius cases. The firm represented Celsius creditors, helping investigate the company’s former chief executive officer, Alex Mashinsky. And it represented the unsecured creditors committee in the Genesis case.

Cleary has billed the fourth most in fees, nearly $73 million. That came from its work as lead counsel to Genesis, a case that is nearly completed and generating about $2.5 million a month for the firm since April.

Although these crypto cases are nearing an end, Big Law bankruptcy practices are expected to stay busy.

A total of 346 corporate bankruptcy cases were filed in the first half of the year, the most since the first half of 2010, according to S&P Global Market Intelligence. That was helped by a record-setting surge in June, which saw more filings than any month since the pandemic era of 2020.

Even if the crypto bankruptcies will soon wrap up, the industry remains a hotbed for legal work.

Lawsuits brought by the US Securities and Exchange Commission remain ongoing, and crypto companies have become one of the largest blocks for lobbying in recent years. The industry spent nearly $79 million on lobbying in 2022 and 2023, according to a report from Social Capital Markets.

Worth Your Time

On Baker Botts: The Houston-founded law firm had a successful first half, said its chair Danny David, who added he’s not interested in pursuing a merger.

On Politics: Big Law donors are trying to help Vice President Kamala Harris build financial momentum by hosting lunches and receptions for the presidential candidate, Tatyana Monnay reports.

On Bankruptcy: Houston’s chief bankruptcy judge will oversee a multifaceted deposition of former colleague David R. Jones related to Jones’ relationship with a former Jackson Walker lawyer, Alex Wolf reports. Meanwhile, the US Trustee investigating Jones is eyeing three federal judges and a Kirkland partner to serve as potential fact witnesses in its probe, James Nani reports.

That’s it for this week! Thanks for reading and please send me your thoughts, critiques, and tips.

Source link

Roy Strom

https://news.bloomberglaw.com/business-and-practice/crypto-winter-shines-on-big-law-to-tune-of-750-million-in-fees

2024-08-29 09:00:00