Solana-based dogwifhat (WIF) price has increased by 30% since September 23 amid growing interest in meme coins. While the rally has brought in fresh gains, the token is still 55% down from the peak it reached on March 31.

However, several indicators observed on-chain suggest that WIF’s breakout is only the start of a prolonged bull run. Here is why.

Dogwifhat Sees Notable Growing Interest

One indicator suggesting a potential price surge for WIF is the Open Interest (OI), which measures the total value of open contracts related to the crypto.

When Open Interest increases, traders in the derivatives market are gaming more exposure and adding more liquidity. Conversely, a decline in OI contradicts this position because it implies that net positioning is decreasing and money is moving out of the market.

Most of the time, a drop in the OI alongside a price increase reverses the cryptocurrency’s gains. In WIF’s case, the recent price increase to $2.25 has been accompanied by a notable jump in Open Interest to $311.94 million.

Read more: How To Buy Dogwifhat (WIF) and Everything Else To Know

In March, when WIF consistently recorded this kind of move, the meme coin’s price hit $4.78. Therefore, a further hike might push the price toward that level and probably higher.

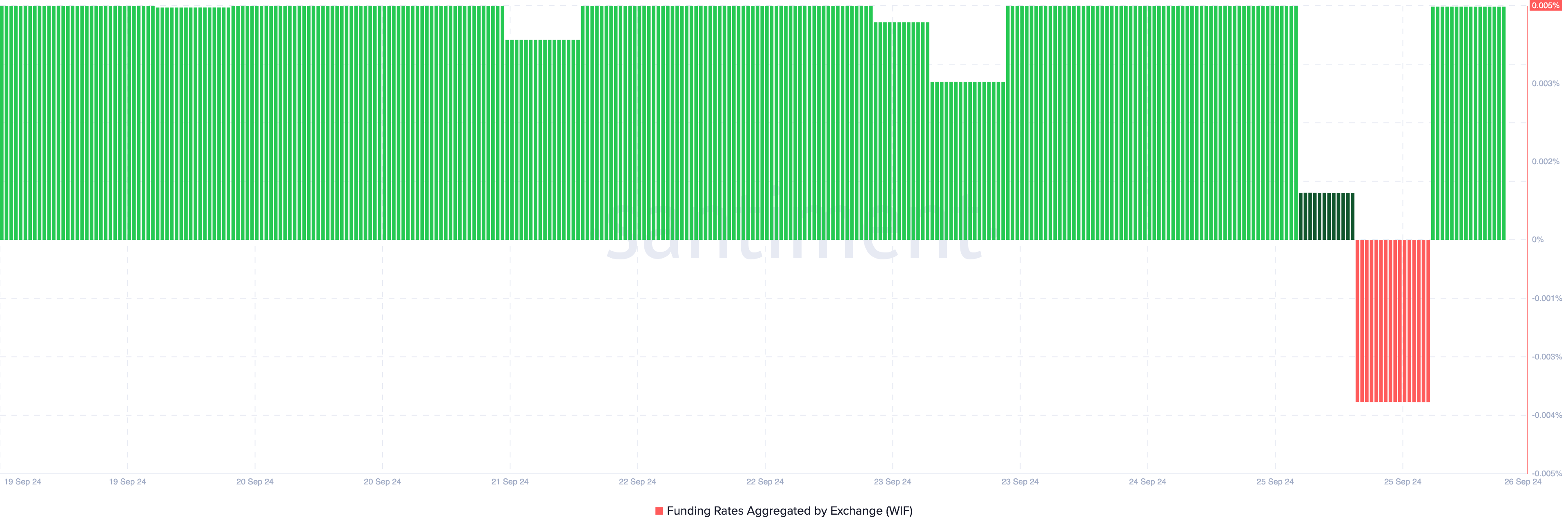

Following this shift, traders appeared to be positioning for a big run, as indicated by the Funding Rate. The Funding Rate is a periodic payment between traders in perpetual futures contracts, designed to keep the contract’s price close to the spot price.

If the Funding Rate is negative, it means the price of the perpetual contract is lower than the spot price, signaling that traders expect the price to decrease and are shorting the asset. Conversely, if the rate is positive, it suggests traders are going long, expecting the price to rise.

Since funding is positive and WIF’s price is increasing, longs (buyers) are aggressive, which is potentially bullish for the meme coin.

WIF Price Prediction: Meme Coin Eyes $5

Technical analysis of the daily chart shows that WIF’s bounce from $1.15 in August was a crucial catalyst for its recent run to $2.25. Furthermore, the Moving Average Convergence Divergence (MACD) is positive.

The MACD is a technical oscillator that measures momentum and directional strength. If the reading is negative, then momentum is bearish, and the price might decrease. However, for WIF, the MACD is positive, indicating that the momentum is bullish.

Although WIF’s price might jump past $4, it could encounter resistance at $3.78. A successful breakout will help it reach $4.58 and possibly $5.

Read more: 5 Best Dogwifhat (WIF) Wallets To Consider In 2024

However, rejection at $3.78 could invalidate this bias. If that happens, the meme coin’s value could drop to $1.69.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/wif-price-could-kickstart-bull-run/

2024-09-26 20:00:00