On August 19, the Australian Securities and Investments Commission (ASIC) announced that it has dismantled over 600 crypto scams as part of a broader initiative to combat fraudulent investment platforms.

This initiative is part of a broader effort to protect Australians from financial harm as online scams evolve and become more sophisticated.

Australia’s Digital Battlefield: Fighting Scams with Advanced Tactics

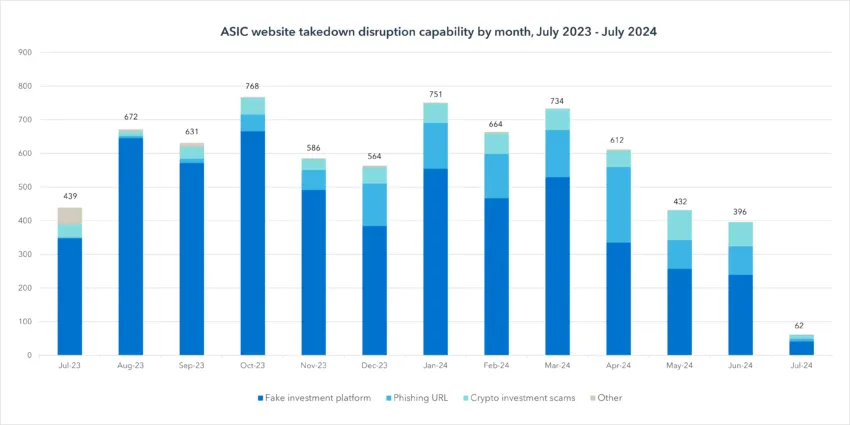

In its official statement, ASIC revealed the removal of over 7,300 phishing and investment scam websites, including 615 that specifically involved crypto investments. The agency’s actions are a critical response to the rising threat of scams, particularly those leveraging digital platforms and social media to deceive consumers.

“Scammers are criminals targeting the hip pockets of hard-working Australians – they don’t discriminate, and they use sophisticated techniques to steal information and money,” ASIC’s Deputy Chair Sarah Court stated.

Read more: 15 Most Common Crypto Scams To Look Out For

According to the agency, investment scams have become Australians’ most significant financial threat, with losses amounting to $1.3 billion in 2023 alone. These scams often involve fake trading platforms promising high returns but defrauding investors.

ASIC’s crackdown is further supported by its collaboration with the National Anti-Scam Centre. This partnership has enhanced the agency’s ability to identify and disrupt scam networks.

Scammers exploit Australians through increasingly sophisticated methods, primarily using digital platforms and social media. The rise of deepfake technology has also added a new dimension to scam methods.

Deepfake uses manipulated photos and videos to create hyper-realistic content, often featuring public figures endorsing fraudulent investments. This makes it increasingly difficult for consumers to discern legitimate opportunities from scams.

‘The scams landscape is rapidly evolving. Innovative technology developments may improve how we live and work. However, they also provide new opportunities for scammers to exploit,” Court added.

ASIC’s finding aligns with a June report from Bitget Research. It remarked that the use of malicious deepfake technology in scams surged by 245% in 2024 alone. The report also highlighted that users have lost over $79 billion to cyberattacks involving deepfakes since 2022.

Read more: Top Cryptocurrency Scams in 2024

In addition to ASIC, the Australian Competition and Consumer Commission (ACCC) has also played a critical role in identifying and reporting crypto scams in the country. A recent analysis by the ACCC revealed that nearly 58% of crypto advertisements on social media violated Meta’s advertising policies or potentially involved scams.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Lynn Wang

https://beincrypto.com/asic-crypto-scam-crackdown-australia/

2024-08-19 10:28:41