Deutsche Bank published a report on the possible future of artificial intelligence (AI). Identifying five clues, this report examines market trends that may spell a bright future for AI.

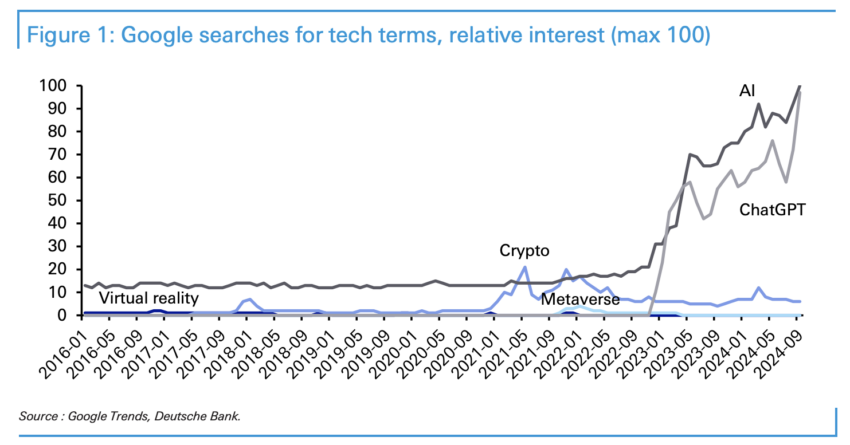

Although AI has grown dramatically in popularity, the report contends that it hasn’t truly exploded. In a few short years or months, however, Deutsche Bank thinks it could change the entire market ecosystem.

AI Is Bigger Than Crypt

Deutsche Bank has shown interest in AI’s possibilities for several months now. First, it reckons what it calls the “elephant in the stock room.” Specifically, seven leading tech stocks (Tesla, Meta, Amazon, Alphabet, Nvidia, Microsoft, and Apple) have risen dramatically in the 21st century.

Analysts claim that the rise of these seven stocks is “almost one and the same” as that of the entire US stock market.

All of them are investing in AI, with Nvidia’s stock climbing fastest. Indeed, Deutsche Bank claims Nvidia is “the purest play on AI in the public markets” and notes a series of choice comments from the other six leaders. As far as these tech companies are concerned, they have no choice but to invest in AI. And where they go, the stock market will follow.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

Additionally, these “big seven” investors are not the only source of capital for the growing AI economy. Venture capital funds and various angel investors have been eager to invest vast amounts of money in any AI-related projects fueled by precipitous growth.

Second, the construction of data centers is on the rise. As brick and mortar constructions, Deutsche Bank notes, data centers have been growing rapidly in the US markets while traditional office spaces are on the decline. Many of these data centers can easily be used for AI purposes, and ancillary needs like computer chips and electrical infrastructure are growing to meet this possibility.

Deutsche Bank goes on to state that this dynamic has created an appetite for friendly regulation, at least in the US. Many of the biggest AI projects were born in Silicon Valley, and all sectors of the multibillion-dollar tech industry are eager to embrace it.

In this respect, AI differs from a leaderless platform like Bitcoin or any of the various cryptoassets created abroad. These third and fourth factors can be very useful for future profit returns.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

Deutsche Bank’s fifth and final consideration is simple. Nobody has yet discovered AI’s “killer app,” the single-use case so useful that it causes mass adoption. There have been a few successful uses so far, but these often have suffered great criticism. None, however, has been adopted at scale.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Landon Manning

https://beincrypto.com/deutsche-bank-artificial-intelligence-ai/

2024-09-13 08:58:25