BlackRock, the world’s largest asset manager, significantly increased its Bitcoin (BTC) holdings on Friday, December 6. This development came briefly after another asset manager, Grayscale, sold BTC worth $150 million.

The bold acquisition signifies BlackRock’s growing confidence in the flagship cryptocurrency. With institutional players continually buying after Bitcoin’s $100,000 milestone, here is what could be next for the coin.

Bitcoin Continues to Get BlackRock’s Backing

Bitcoin’s price surged to $100,000 for the first time on Thursday, December 5. Arkham Intelligence reported that the milestone prompted Grayscale, a Bitcoin exchange-traded fund (ETF) issuer, to sell $150 million worth of BTC.

In stark contrast, BlackRock, which is said to hold 500,000 BTC, took a different approach. The investment giant added $750 million to its Bitcoin holdings one day later, signifying confidence in the asset’s long-term prospects despite recent price swings.

According to BeInCrypto’s findings, this massive rise in BlackRock’s Bitcoin holding was vital in helping the cryptocurrency to retest $100,000 after it briefly dropped to $97,000. But the question now is: Will BTC continue to rise?

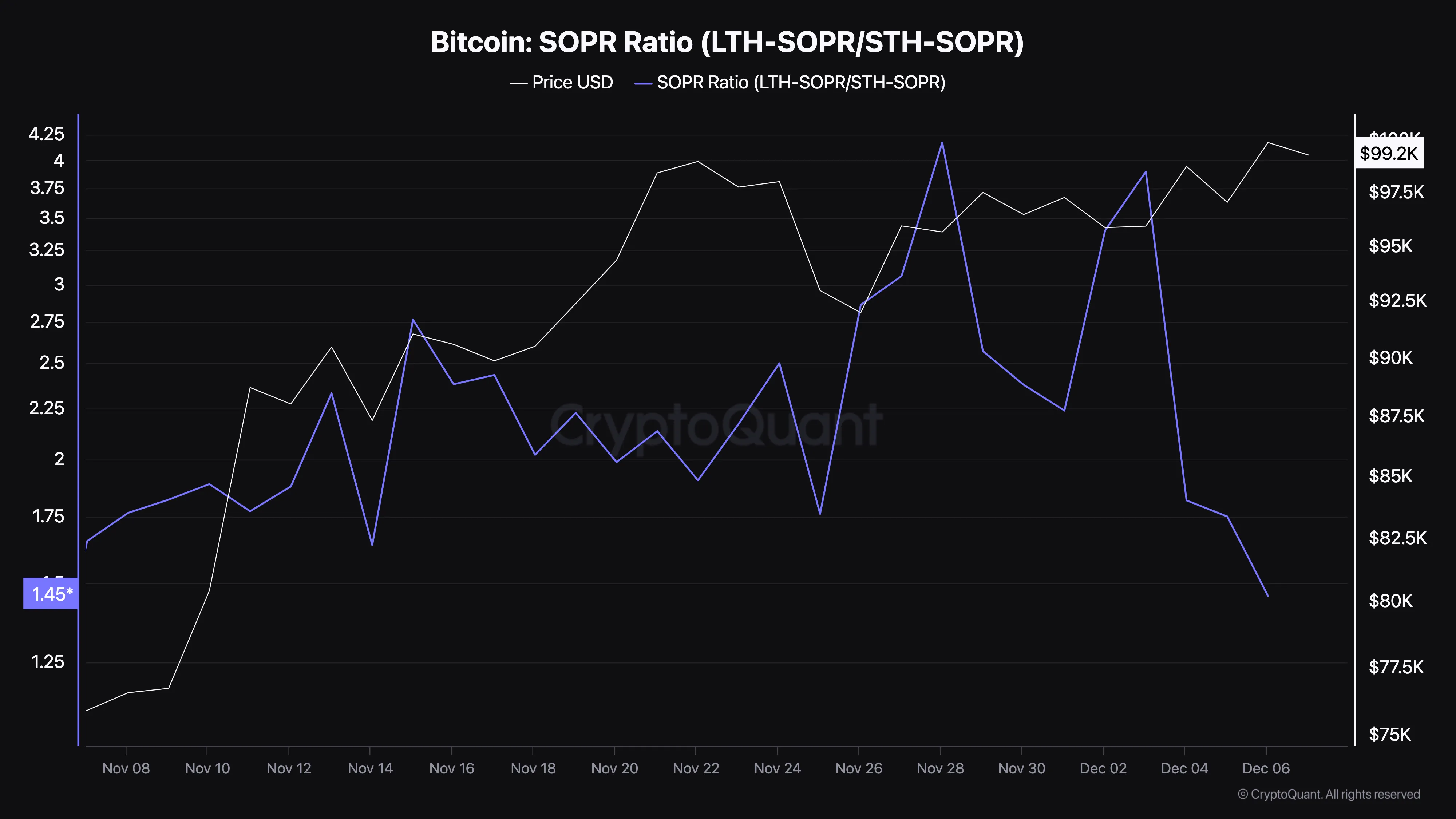

One way to know if Bitcoin’s price will continue to jump is to look at the SOPR. The SOPR stands for Spent Output Profits Ratio. It is calculated by dividing the profits held by Long-Term Holders (LTH) by the ones held by Short-Term Holders (STH).

When the ratio is high, it means LTHs have higher spent profits than STHs. In this instance, it means that the price is close to the local or market top. However, according to CryptoQuant, Bitcoin SOPR has dropped to 1.45, indicating that STHs have the upper hand, and the price is closer to the bottom than the top.

If this trend continues, then Bitcoin’s price might trade higher than $100,000 within the coming weeks.

BTC Price Prediction: $100,000 Could Just Be the Start?

From a technical perspective, Bitcoin’s price is trading within a symmetrical triangle on the 4-hour timeframe. A symmetrical triangle pattern signals a period of consolidation, where the price tightens between converging trendlines before a breakout or breakdown occurs.

A breakdown below the lower trendline often indicates the beginning of a bearish trend, while a breakout above the upper trendline typically marks the start of a bullish trend.

Furthermore, the Chaikin Money Flow (CMF) is in the positive region, indicating notable buying pressure. Should this remain the same and BlackRock Bitcoin holdings increase, BTC price could climb to $103,649.

In a highly bullish scenario, Bitcoin’s value could rise to $110,000. However, if institutions like Grayscale continue to sell in large volumes, this might not happen. Instead, Bitcoin’s price could decline to $93,378.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/blackrock-buys-more-bitcoin-after-grayscale-sale/

2024-12-07 21:30:00