On Monday, November 18, MANTRA (OM) rallied to a new all-time high after the price increased by 160% in the last 24 hours. Following the landmark, crypto whales have booked some profits.

This action has caused OM’s price to retrace. But will the price continue to decrease, or is a rebound on the cards?

MANTRA Sees Increase in Profit-Taking, Decrease in Demand

Based on IntoTheBlock’s data, MANTRA’s large holders netflow has decreased in the last 24 hours. This metric tracks the activity of addresses that hold between 0.1% and 1% of a cryptocurrency.

When the metric rises, it means that crypto whales have bought more tokens compared to the ones sold. On the other hand, when the netflow drops, it means that whales have sold more tokens

In this case, it appears that MANTRA whales capitalized on the altcoin’s price rally to take out some gains. As a result, OM’s price has decreased from $4.47 to $3.86. Should whales continue to sell, then the token’s value might continue to drop.

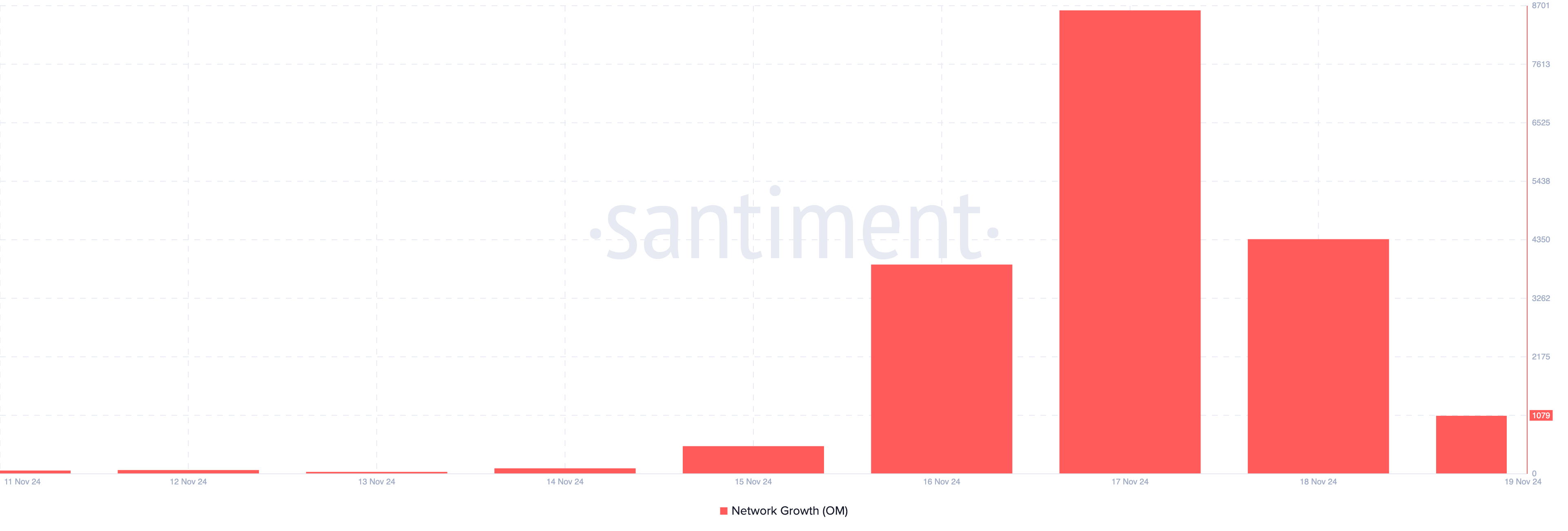

In addition, on-chain data from Santiment reveals a significant drop in the project’s network growth. For context, network growth measures the number of new addresses created and successfully transacting on the blockchain.

An increase in this metric typically signals growing demand for the token, which can drive its price higher. However, the current decline suggests that OM is struggling to attract new demand. If this trend continues, it could hinder the altcoin’s ability to sustain upward price movement.

OM Price Prediction: Altcoin Overbought

According to the daily chart, OM’s price faced resistance at $4.23, causing the altcoin’s value to drop to $3.85. Also, the Relative Strength Index (RSI) has risen above the 70.00 region, indicating that the token is overbought.

The RSI is a widely used technical indicator for measuring momentum. It measures the speed and magnitude of a cryptocurrency’s recent price changes to identify whether it is overbought or oversold.

When the reading is less than 30.00, it is oversold. But since it is above 70.00, it means that MANTRA’s price is overbought. As such, the price of the Real-World Assets project could experience a drawdown to $3.20.

In a highly bearish scenario, the token could drop to $2.58. On the other hand, if MANTRA whales begin to buy again, this sentiment might change. In that scenario, OM could rise to $4.54.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/mantra-whales-cash-out/

2024-11-19 09:00:00