Dogecoin has rocketed up with a rally of over 150% during the past week as on-chain data shows the return of sharks and whales on the network.

Dogecoin Sharks & Whales Have Seen Their Count Grow Recently

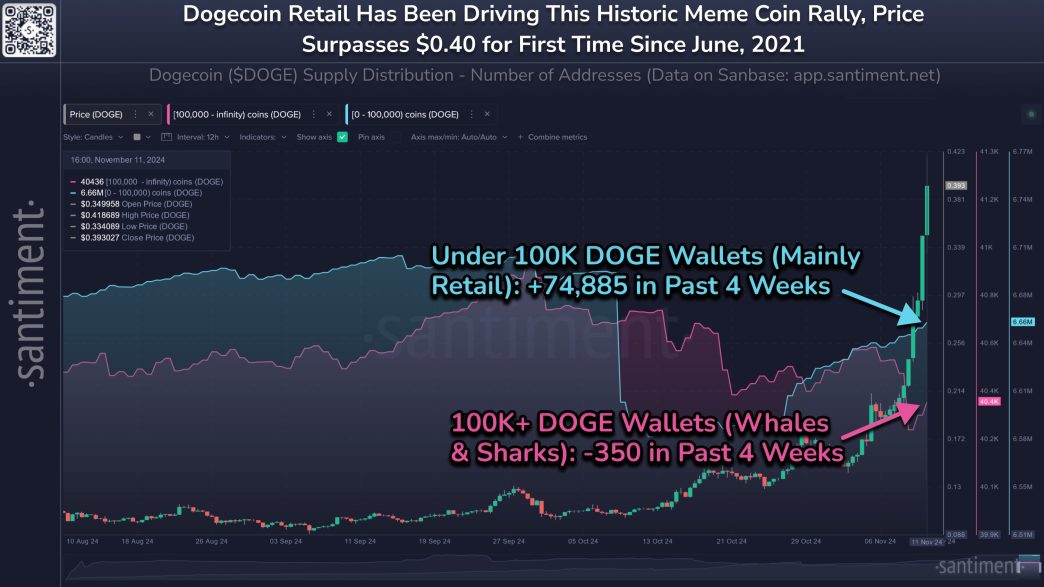

According to data from the on-chain analytics firm Santiment, the sharks and whales have shown a reversal in their count recently. The indicator of relevance here is the “Supply Distribution,” which tells us, among other things, how many addresses belong to a particular Dogecoin wallet group.

Addresses are divided into these cohorts based on the number of tokens they carry in their current balance. For instance, the 1 to 10 coins group includes all wallets holding between 1 and 10 DOGE. The Supply Distribution for this specific cohort would tell us about the total number of network addresses that satisfy this condition.

Related Reading

In the context of the current discussion, two address ranges are of interest: 0 to 100,000 coins and 100,000+ coins. The former comprises the small investor groups of the sector, like retail, while the latter includes the large entities like sharks and whales.

Generally, the influence of any address on the network increases the more they carry, so the sharks and whales, with their large holdings, can be considered key cohorts of the memecoin. Naturally, the whales are the more important of the two, as they have more massive bags.

Now, here is the chart shared by the analytics firm that shows the recent trend in the Dogecoin Supply Distribution over the last few months:

As displayed in the above graph, the Dogecoin Supply Distribution has been going up for the 0 to 100,000 coins group for a while now, suggesting more investors of this size have been popping up on the blockchain.

More particularly, 74,885 new addresses have appeared inside this range over the last four weeks. During this same window, the 100,000+ tokens cohort has seen a downtrend in the indicator, which suggests some big-money investors have been clearing out their holdings.

That said, while 350 Dogecoin sharks and whales have left the network over the past month, things appear to be turning around for the better on smaller timeframes.

Related Reading

Around 108 wallets of this size have cropped up on the network in the last couple of days, which would explain where the fuel for the memecoin’s impressive rally has come from.

At present, both retail and large holders are witnessing a rise on the network, but it only remains to be seen whether this momentum lasts. Naturally, the uptrend in the Supply Distribution of the sharks and whales is of more significance, given their placement in the market.

DOGE Price

At the time of writing, Dogecoin is trading around $0.383, up over 21% over the last 24 hours.

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Source link

Keshav Verma

https://www.newsbtc.com/news/dogecoin/dogecoin-explodes-150-shark-whale-buying/

2024-11-13 11:00:25