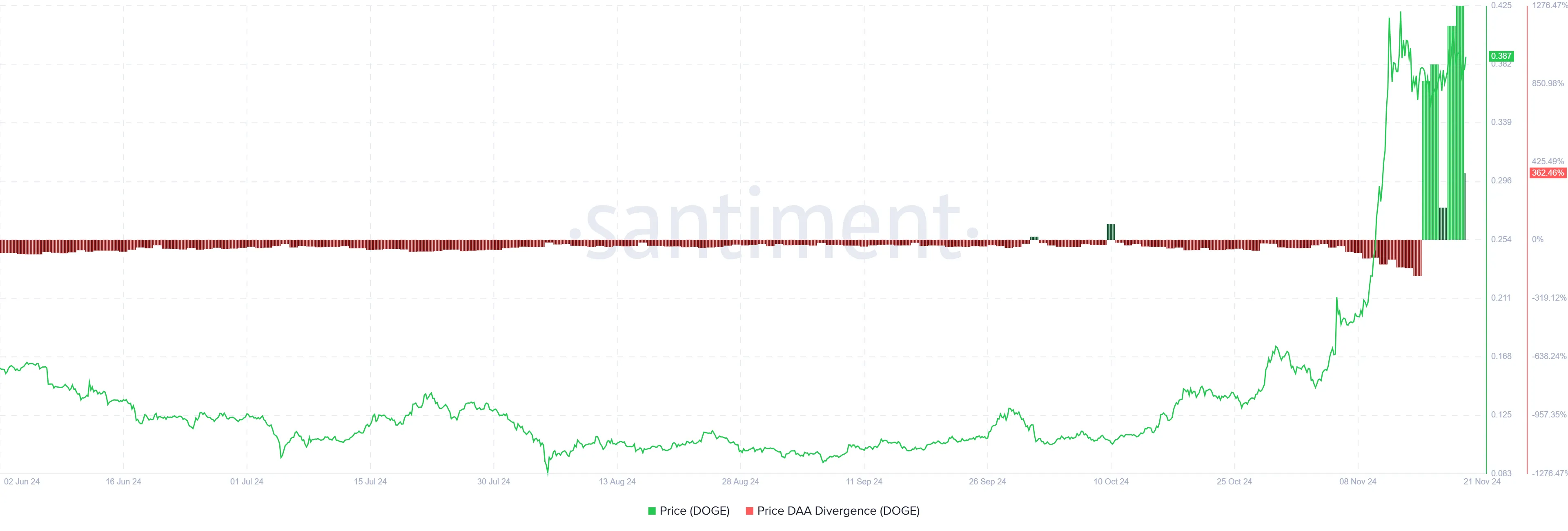

Dogecoin has displayed remarkable stability after its recent explosive rally, marking a 163% rise this month. Despite slight fluctuations, the meme coin’s bullish momentum remains intact.

Current market signals suggest the potential for further price gains, driven by increased network activity and strong investor sentiment.

Dogecoin Is Noting a Strong Growth

Dogecoin’s active addresses have hit an all-time high, surpassing 1.33 million daily participants. This surge reflects heightened network demand, a bullish indicator for the cryptocurrency. Increased participation often correlates with rising prices, as high activity showcases strong investor interest and broad adoption of DOGE.

The expanding transaction volume indicates widespread engagement, adding to Dogecoin’s credibility. Elevated network activity has historically supported price increases, and this trend suggests DOGE could capitalize on its current momentum. Investor enthusiasm, combined with broader market cues, is likely to sustain upward pressure on the meme coin’s price.

The Dogecoin Price Daily Active Addresses (DAA) Divergence metric is flashing a strong buy signal, further bolstering Dogecoin’s outlook. This indicator highlights the harmony between rising prices and increasing participation, both of which reflect healthy growth. As network activity aligns with price movements, DOGE appears positioned for continued gains.

Additionally, macroeconomic factors, including Bitcoin’s sustained rally, are creating a positive environment for altcoins. Dogecoin’s recent performance aligns with this broader trend, and with Elon Musk’s influence on the cryptocurrency, market hype continues to support DOGE’s growth trajectory.

DOGE Price Prediction: Securing Gains

Dogecoin is currently holding steady above the $0.36 support level. To sustain its rally, DOGE must breach and secure $0.45 as a support floor. Achieving this milestone could pave the way for further gains, potentially propelling the price higher.

The bullish momentum remains supported by rising market demand and strong investor sentiment. If these factors persist, Dogecoin could see continued accumulation, driving its price toward new highs. Broader market optimism and renewed excitement about DOGE’s utility also contribute to this positive outlook.

However, a loss of the $0.36 support level could lead to a correction. In such a scenario, DOGE may drop to $0.32 or lower to $0.28. Any decline beyond $0.28 would invalidate the bullish thesis, signaling the potential for further downside.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/dogecoin-rally-sparks-buy-signal/

2024-11-21 07:00:00