Renowned economist Henrik Zeberg has released a technical analysis of Dogwifhat (WIF) on X, forecasting a massive 2,500% price surge for the memecoin. According to Zeberg’s analysis, WIF is poised for a significant rally, potentially reaching $78, driven by a larger ABC pattern and a series of smaller subwaves.

How Dogwifhat (WIF) Price Could Hit $78

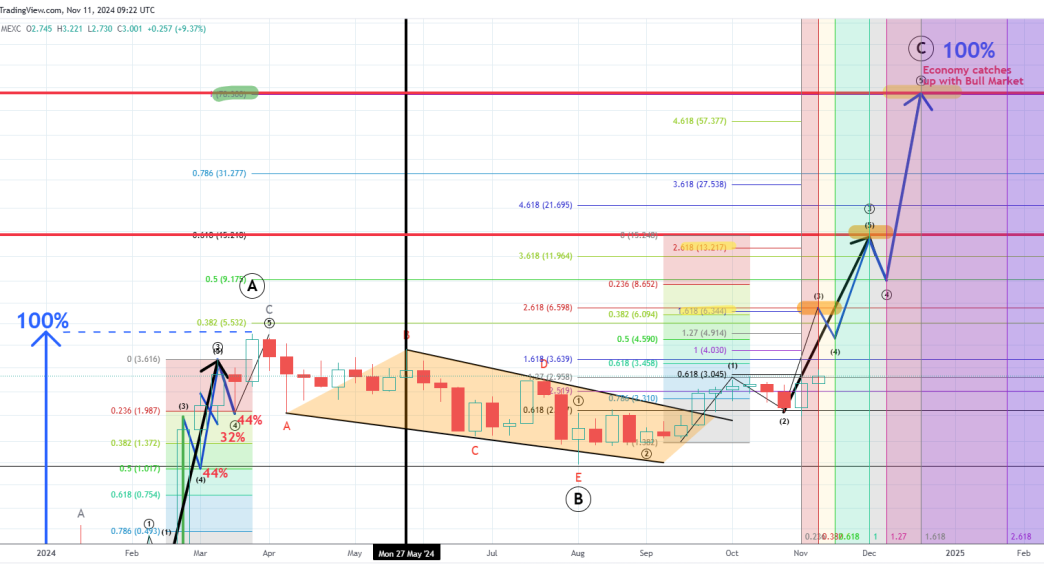

Zeberg’s weekly WIF/USDT chart illustrates a large ABC corrective pattern, a fundamental structure in technical analysis that indicates a retracement phase within a broader bullish trend. This ABC pattern, according to Zeberg’s analysis, could eventually culminate at point C around $78. This target is based on the completion of the larger ABC structure, with the price reaching new highs once the correction phase concludes which he describes with the words “economy catches up with bull market.”

Within this larger ABC structure, Zeberg also maps out a series of five smaller waves, which are part of the overall upward momentum in the market. These five waves align with the principles of Elliott Wave theory, a method used to predict price movements based on market psychology. In Zeberg’s chart, the five waves (labeled 1 through 5) represent the early stages of the price rally, with the first wave being the initial breakout, and the subsequent waves following through with increasingly higher price points.

Related Reading

The first wave drove the WIF price to a high of $3.04, followed by a correction in the second wave that brought it down to $2.00. With the correction now complete, Zeberg predicts that WIF could catapult to $6.59. For wave 4, Zeberg anticipates a dip to $4.59 before the memecoin takes off towards $15.24.

The chart also highlights important Fibonacci retracement and extension levels, which Zeberg uses to project potential support and resistance zones as WIF progresses. The 2.618 Fibonacci extension level, positioned around $6.59, aligns with Zeberg’s immediate short-term target. Following this, higher extension levels at 3.618 and 4.618 ($11.96 and $21.69, respectively) suggest further upward momentum, which could take the price to the anticipated $78 target if the market continues to follow this trajectory.

Related Reading

Zeberg’s prediction for the near term includes a price movement towards $6.3 by the end of this week, followed by a brief pullback. From there, he expects WIF to climb towards $13-$15 by late November or early December. These intermediate price targets are key milestones in the larger cycle that will eventually lead to the projected price of $78, marked by the completion of the ABC pattern.

Zeberg writes via X: “Could we see ~6.3 USD by end of week. Then pullback before move to ~13-15 USD by end of November – early December? If WIF manages these steps – well then ~78 USD is a probable target. I’m extremely BULLISH!!!!”

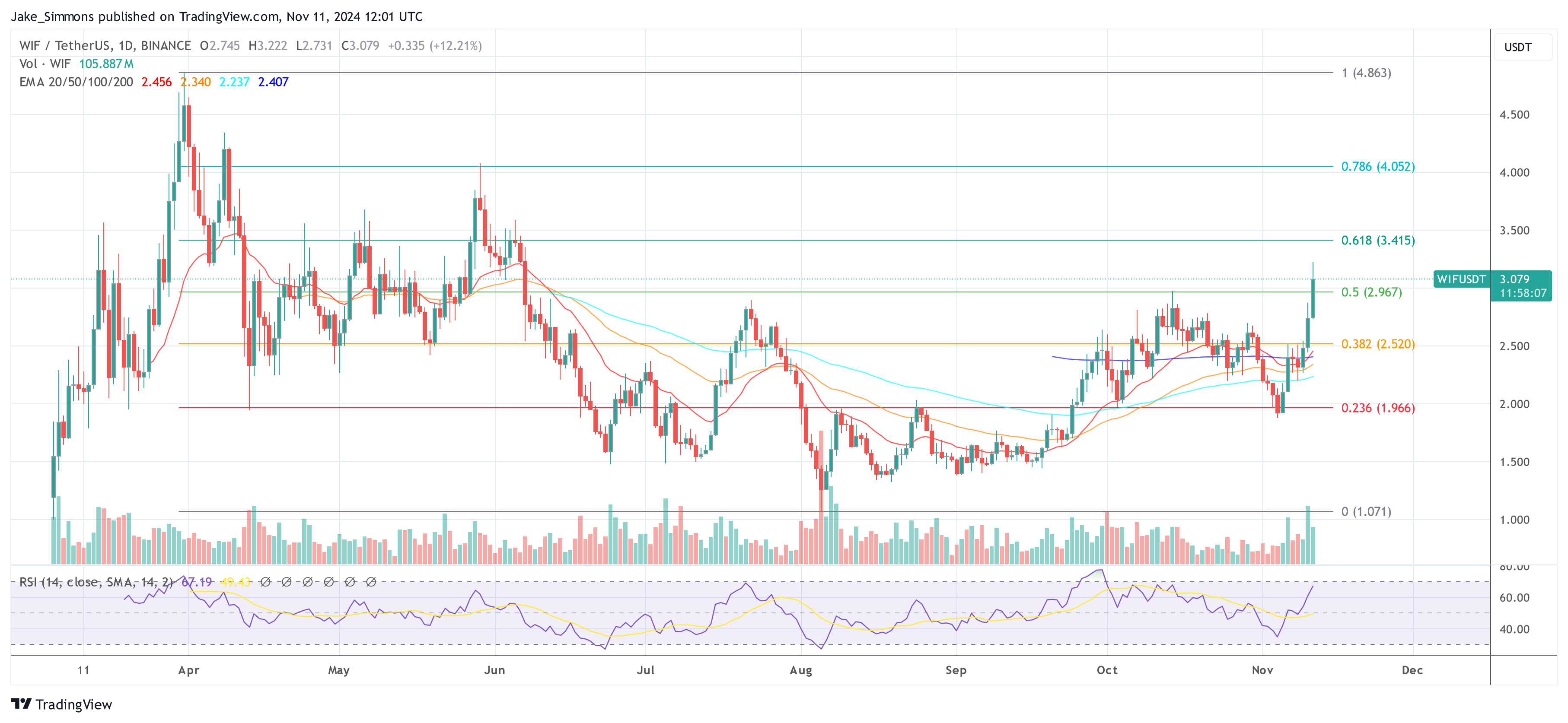

At press time, dogwifhat traded at $3.079.

Featured image from Shutterstock, chart from TradingView.com

Source link

Jake Simmons

https://www.newsbtc.com/news/dogwifhat-wif-price-skyrocket-2500/

2024-11-11 18:00:05