Despite scalability and high gas fees facing Ethereum, the founder of EigenLayer, a liquidity restaking platform, insists the network is superior, especially against Solana. Solana is the third most valuable smart contracts platform, trailing Ethereum and the BNB Chain. Over the years since launching, it has been gulping up more market share from Ethereum, cementing its position.

Is Ethereum Superior To Solana?

While the prominence of Solana is evident, Sreeram Kannan, the founder of EigenLayer, argued in a post on X that Solana prioritizes low latency and global node synchronization over other core features.

Related Reading

On the other hand, Ethereum took a different approach, emphasizing the need for stability and decentralization. Accordingly, in Kannan’s view, the first smart contracts platform offers a more comprehensive solution than its competitor. Currently, EigenLayer manages over $12 billion worth of assets on Ethereum, according to DeFiLlama.

Although Kannan acknowledges the efficiency of Solana, the founder nonetheless picks out some limitations now that the platform is building a global state machine. At the top of the list is the blockchain’s sacrifice of programmability and verifiability.

Meanwhile, the EigenLayer lead thinks Ethereum is excelling, especially on performance, thanks in part to the success of rollups and the resulting wild adoption. This off-chain solution provides instant confirmation and is more performant than web2 applications.

At the same time, Ethereum is programmable, enabling EigenLayer to add more features like an arbitrary decentralization of verifiable tasks. As a result, the liquidity restaking platform, Kannan adds, has enabled cloud-scale programmability.

Layer-2 Platforms Thriving: Why Is ETH Struggling?

The co-founder of Celestia, Mustafa Al-Bassam, also appreciates what Ethereum brings to the table and is absent or underdeveloped in other networks. In a post on X, Al-Bassam said the first smart contracts platform is “underrated.”

Related Reading

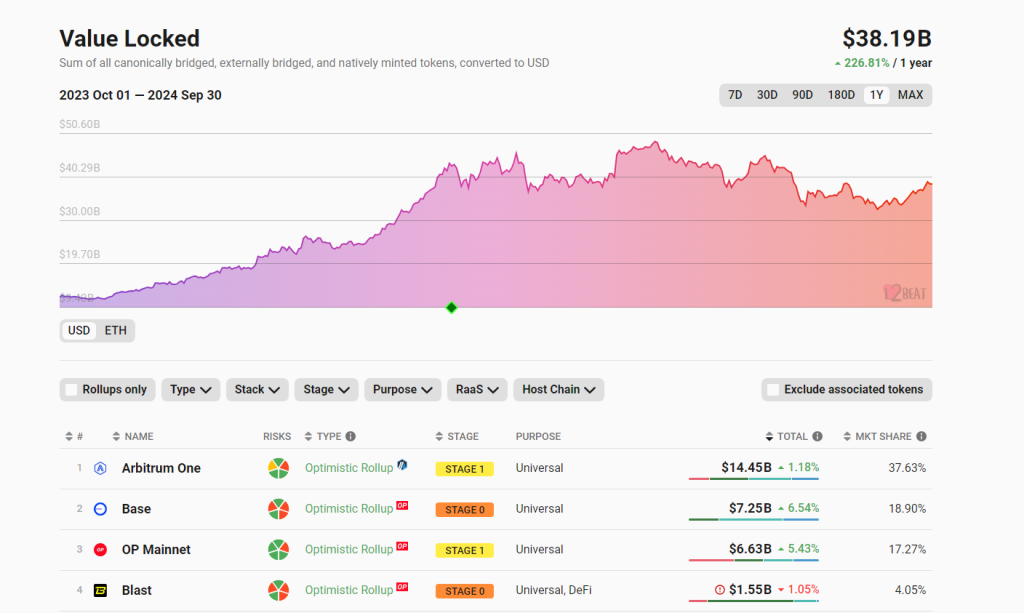

Specifically, the co-founder lauded the thriving rollup ecosystem in Ethereum, saying it is “by far the largest and most successful.” As of September 30, L2Beat data shows that the layer-2 ecosystem in Ethereum manages over $38 billion, with Arbitrum and Base among the largest platforms.

Even as Base and other Ethereum layer-2 platforms draw activity, ETH, the native currency, is struggling for momentum. The daily chart shows bulls have yet to break above $2,800, although support remains at $2,400.

Dwindling upside momentum has been partly blamed on the proliferation of layer-2 scaling solutions. The network becomes inflationary as more activity is re-routed off-chain, and enhancements like Dencun are activated to make layer-2 transactions even cheaper. Looking at Ultra Sound Money, fewer ETH are not being torched.

Feature image from DALLE, chart from TradingView

Source link

Dalmas Ngetich

https://www.newsbtc.com/news/ethereum/eigenlayer-founder-reiterates-support-for-ethereum-why-is-eth-struggling/

2024-09-30 17:30:26