(Bloomberg) — Crypto exchange-traded fund provider Bitwise Asset Management is buying ETC Group, a digital-assets issuer based in London, adding to a spate of deals within the ETF industry.

Most Read from Bloomberg

Terms of the deal weren’t disclosed. At the close of the transaction, San Francisco-based Bitwise will manage $4.5 billion, the company said in a statement Monday. London-based ETC Group, whose products include a physically backed Bitcoin fund, has around $1.1 billion of assets under management, according to its website.

There’s an exchange-traded fund for just about any theme or strategy, leaving the arena saturated and spurring consolidation within the industry. US-based Valkyrie Investments Inc. this year sold its ETF business to rival CoinShares. Last year saw TCW Group, an asset manager with a long history of managing bond funds, buy an ETF business from activist investor Engine No. 1, while Cathie Wood’s Ark Investment Management acquired fellow ETF issuer Rize ETF Limited.

Some firms have been pursuing international expansion through purchases rather than developing their own products.

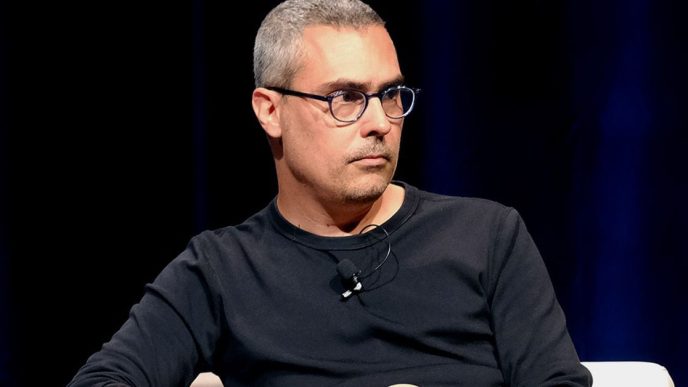

Bradley Duke, founder of ETC Group, declined to provide further details on the acquisition.

Bitwise was one of more than 10 firms to launch a Bitcoin ETF earlier this year. Its purchase of ETC Group marks an expansion into Europe, where crypto exchange-traded products have existed for a while.

The deal “allows us to serve European investors, to offer clients global insight, and to expand the product suite,” Bitwise Chief Executive Officer Hunter Horsley said in the statement.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link

Vildana Hajric

https://finance.yahoo.com/news/etf-dealmaking-continues-bitwise-acquisition-130000545.html

2024-08-19 13:00:00