On October 10, Ethena unveiled the assets selected by its risk committee to allocate its Real World Assets (RWA) reserve fund.

Previously, Ethena’s risk committee received 25 nominations but ultimately narrowed it down to four assets that met their criteria.

Ethena Picks 4 Assets for RWA Reserve Allocation

The selected assets include:

- BlackRock USD Institutional Digital Liquidity Fund (BUIDL)

- USDS stablecoin from Sky (Maker)

- Superstate’s Short Duration US Government Securities Fund (USTB) and

- USDM stablecoin from Mountain Protocol

According to the risk committee, these assets meet important criteria such as product maturity, liquidity, redemption time, and several other metrics. Currently, the total value of assets in the reserve fund exceeds $46.6 million.

Read more: What Are Tokenized Real-World Assets (RWA)?

Among these, Blackrock’s BUIDL holds the largest share at 40%, followed by Sky’s USDS at 29%. Mountain’s USDM and Superstate’s USTB have weightings of 16.5% and 14.5%, respectively.

“BUIDL will enable USDC subscriptions and redemptions. There is currently $75 million in the redemption fund. Excellent redemption time. Current AUM is high at $500 million,” Ethena Lab Research commented.

On September 26, 2024, Ethena (ENA) also announced its launch of a new stablecoin product called UStb, developed in partnership with BlackRock’s real-world asset tokenization platform, Securitize.

In response to these announcements, ENA’s price showed no significant movement. ENA is still trading around $0.27. According to CoinMarketCap, ENA trading volume remains steady at an average of $80 million, with no notable fluctuations.

In 2024, ENA’s price has dropped by 86%, declining from a high of $1.5 to a low of $0.2. While it has rebounded by 100% over the past month, ENA remains well below its all-time high.

RWA Market Share Continues to Grow in 2024

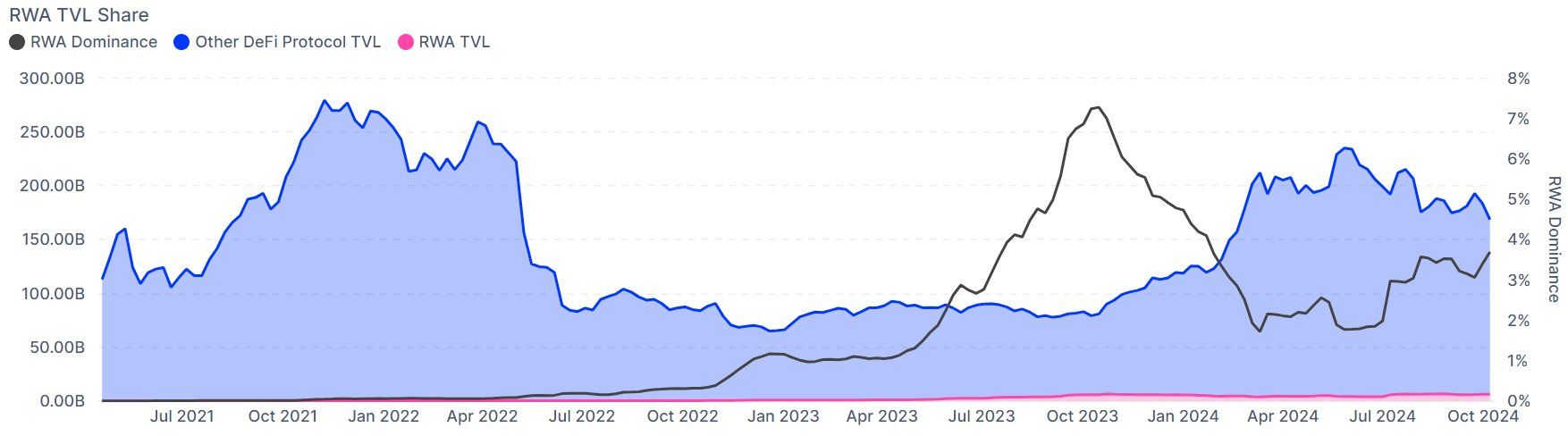

Data from IntoTheBlock shows that Real World Asset (RWA) protocols now represent 3.69% of the Total Value Locked (TVL) in the DeFi space. This share has steadily risen from a low of 1.77% in April.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

According to DeFiLlama, the TVL of RWA protocols in the market has now surpassed $6.5 billion.

“This steady uptrend shows the growing integration of real-world assets within the DeFi ecosystem,” IntoTheBlock commented.

The RWA sector is increasingly attracting the attention of traditional financial institutions (TradFi). Recently, Visa introduced a new platform to assist banks in verifying tokenized assets and smart contracts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Nhat Hoang

https://beincrypto.com/ethena-selects-assets-for-rwa-allocation/

2024-10-11 06:15:08