Ethereum is finally seeing a notable rebound in its price as the second-largest cryptocurrency by market capitalization, which continues to break through significant resistance levels.

Following its upward trajectory, seeing a nearly 10% increase in the past week, discussions about Ethereum potentially reaching a new all-time high by the year’s end have gained momentum.

Notably, aligning with the ongoing ETH rally is renewed interest in Ethereum futures, with market metrics pointing to a bullish sentiment among traders.

Related Reading

More Room For Growth?

A CryptoQuant analyst known as ShayanBTC recently shared insights into the ongoing rally in Ethereum, emphasizing the role of funding rates—a crucial metric in futures trading. Funding rates reflect the sentiment of traders and indicate whether the market is predominantly bullish or bearish.

According to Shayan, Ethereum’s funding rates have seen a noticeable uptick in recent weeks, suggesting that demand for long positions is growing.

Despite this bullish sentiment, the analyst mentioned that funding rates remain below the peak of Ethereum’s previous all-time high of $4,900, signaling that “it has not yet entered an overheated state.”

Meanwhile, while indicative of bullish sentiment, funding rates also act as a warning sign for potential market corrections. Historically, sharp increases in funding rates have been followed by sudden market corrections or liquidation cascades.

However, Shayan notes that Ethereum’s current funding rates are still manageable, implying that the market has more room to grow before such risks become critical.

Ethereum Market Performance And Outlook

Ethereum is currently experiencing an upward trajectory, posting notable double-digit gains of roughly 15.6% over the past two weeks. This bullish performance has propelled ETH to break through the critical $3,500 resistance level, setting its sights on the next major resistance at the $4,000 mark.

Currently, Ethereum is trading at $3,563, reflecting a 1.3% increase in the last 24 hours. However, this price represents a slight pullback from its 24-hour high of $3,682 recorded earlier today.

Additionally, Ethereum’s current price is just 26.78% below its all-time high of $4,878, highlighting its gradual recovery within the market.

Related Reading

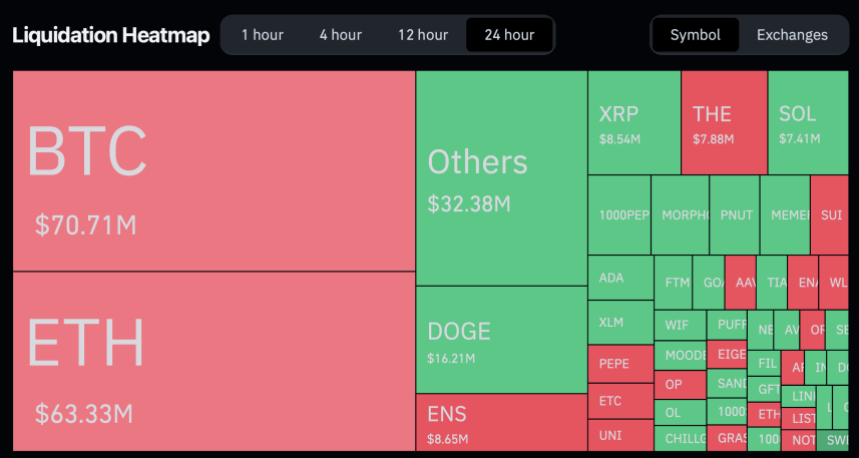

Regardless of the bullish sentiment, Coinglass data shows that in the past 24 hours alone, 98,389 traders have been liquidated, with the total liquidations coming in at $278.03 million.

Out of this total amount of liquidations, Ethereum accounts for roughly $63.33 million, with $40 million of this liquidation coming from short positions and $23.3 million from long positions.

Amid the current price performance from Ethereum, the renowned crypto analyst known as Ali on X has reiterated his target for ETH. Ali said the mid-term target remains $6,000 and long-term target $10,000.

Our mid-term target for #Ethereum $ETH remains $6,000… Long-term target: $10,000! https://t.co/X4lodGGIVY pic.twitter.com/siQsJzelzE

— Ali (@ali_charts) November 27, 2024

Featured image created with DALL-E, Chart from TradingView

Source link

Samuel Edyme

https://www.newsbtc.com/news/ethereum/ethereum-breaks-resistance-levels-analyst-predicts-room-for-more-growth/

2024-11-29 10:00:25