Ethereum is at a pivotal moment after failing to break above the $2,500 mark on Monday. With the entire crypto market anticipating a potential rally, Ethereum investors carefully watch for any signs of strength within the network. However, growing concerns about a possible deeper correction loom over the market.

Related Reading

Key metrics from IntoTheBlock indicate that if Ethereum breaks below the $2,300 level, a significant sell-off could follow, increasing pressure on the price. This has created a tense atmosphere among traders and investors as they wait for a clear confirmation that Ethereum can hold strong above this critical support level.

As the broader market experiences uncertainty, Ethereum’s performance in the coming days will likely determine its trajectory. Investors are hoping for bullish momentum, but many remain cautious, aware of the risks that a drop below $2,300 could trigger. The next few days will be critical in shaping Ethereum’s future price action.

Ethereum Price Testing Crucial Demand

Ethereum is at a crucial turning point as its price remains indecisive, hovering between two significant levels that could result in substantial gains or losses once the trend becomes clear. Currently trading in a tight range, ETH investors and analysts carefully observe key support and resistance areas.

Top analyst and investor Ali recently shared important data from IntoTheBlock on X, highlighting the critical nature of the $2,300 support level for Ethereum. According to the report, around 2.4 million addresses purchased approximately 52.6 million ETH around this level. This makes $2,300 a significant demand zone that, if breached, could trigger a wave of selling as investors look to protect their portfolios and minimize losses.

If Ethereum holds above this critical support, the sentiment around ETH could shift toward a more positive outlook. Traders and investors may gain confidence, leading to a potential rally. Ali’s analysis underlines the importance of the coming days in shaping Ethereum’s price action.

Related Reading

Ethereum’s performance at the $2,300 level will likely determine its short-term future, either as a foundation for gains or a trigger for deeper corrections.

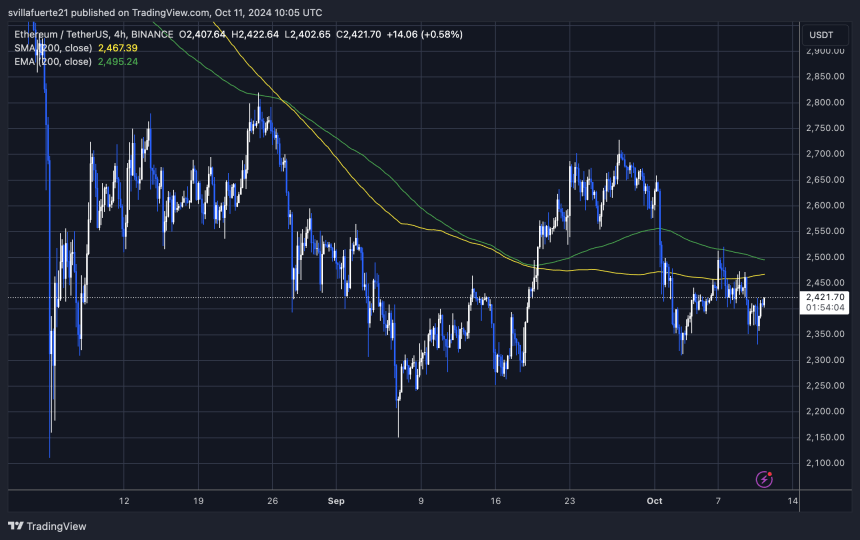

ETH Technical Analysis

Ethereum (ETH) is trading at $2,420, following a 3% rebound from the lower demand zone around $2,330. Despite the recent recovery, the price remains under 2% away from the 4-hour 200 moving average (MA) at $2,467 and about 3% away from the 200 exponential moving average (EMA) at $2,495. These moving averages are critical resistance levels for ETH in the short term.

Ethereum must break above the 200 MA and EMA and target resistance levels above $2,500 to push the price higher. A clear breakout above could open the door for further gains, with investors looking for signs of sustained momentum.

Related Reading

However, if Ethereum fails to reclaim both indicators in the coming sessions, the risk of a deeper correction increases. In such a case, ETH could retrace to lower demand zones, potentially dropping toward $2,150. Traders and investors closely watch these levels as Ethereum’s next move will likely determine the near-term trend.

Featured image from Dall-E, chart from TradingView

Source link

Sebastian Villafuerte

https://www.newsbtc.com/news/ethereum/ethereum-faces-sell-off-risk-if-it-loses-2300-resistance-analyst/

2024-10-11 13:30:12