Ethereum software giant Consensys announced on Tuesday that it has laid off 20% of its global workforce, amid a slowly recovering crypto economy that has failed, for months, to bring ETH’s stubbornly stagnant price along with it.

The decision affected 163 of Consensys’ 828 employees, and touched every department in the company, a Consensys spokesperson told Decrypt. Impacted employees will receive severance packages and extended stock option windows, and will continue to receive healthcare benefits in relevant jurisdictions.

More broadly, the contraction also marks a strategy shift for the firm, which has for years spent heavily to incubate a wide range of projects operating in, or related to, the Ethereum ecosystem. (Decrypt was one such company, and Consensys remains one of 22 investors in the editorially independent publication.)

Going forward, the company spokesperson said, Consensys plans to pull back and focus on supporting proven “core” winners in its portfolio, particularly the crypto wallet MetaMask and Ethereum layer-2 network Linea.

1/5

The broader macroeconomic conditions over the past year and ongoing regulatory uncertainty have created broad challenges for our industry, especially for US-based companies.

— Joseph Lubin (@ethereumJoseph) October 29, 2024

“Looking ahead, I see a next-generation economy not dominated by large monolithic companies; instead, smaller, agile, AI-supercharged companies with Web3-based coordination tools will operate more efficiently,” Consensys CEO and Ethereum co-founder Joe Lubin said in a blog post. “To stay competitive in this fast-growing space, we need to reshape ourselves and be more agile, more effective, and even higher-performing.”

Lubin further attributed the cutbacks to regulatory uncertainty in the United States, and “broader macroeconomic conditions.”

Consensys had dust-ups with the U.S. Securities and Exchange Commission (SEC) this year, but appeared to emerge triumphant when the SEC reportedly dropped its investigation into the security status of Ethereum earlier this summer. Shortly thereafter, though, the SEC did sue Consensys over MetaMask, dubbing the crypto wallet’s staking features illegal securities offerings.

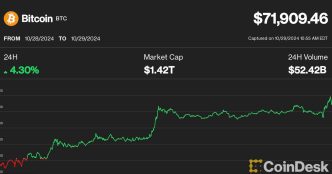

Salvation for Consensys in the crypto market, meanwhile, has remained stubbornly elusive. As mainstay cryptocurrencies like Bitcoin continue to seek new all-time highs, ETH has fallen some 35% since March, to a lackluster $2,618 at writing.

Some analysts recently expressed concern that Ethereum’s recent slew of technical achievements—chief among them, distributing on-chain traffic to a spectrum of cheaper and faster layer-2 networks—could end up significantly depressing ETH’s price in the long run by putting the token on an inflationary path.

Lubin’s fellow Ethereum co-founder, Vitalik Buterin, has in recent weeks advocated for novel fee-sharing models that could potentially help remedy those issues and drive value back to Ethereum while still reaping the benefits of layer-2 chains.

In the meantime, the 163 Consensys employees who received pink slips today find themselves in a crypto job market at a crossroads, colored by uncertainty and contraction in one sense, and cautious optimism in another. Next week’s U.S. presidential election looms perhaps largest of all, with its potential to completely reshape American crypto policy.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Sander Lutz

https://decrypt.co/288832/ethereum-giant-consensys-layoffs-eth-slump

2024-10-29 14:57:13