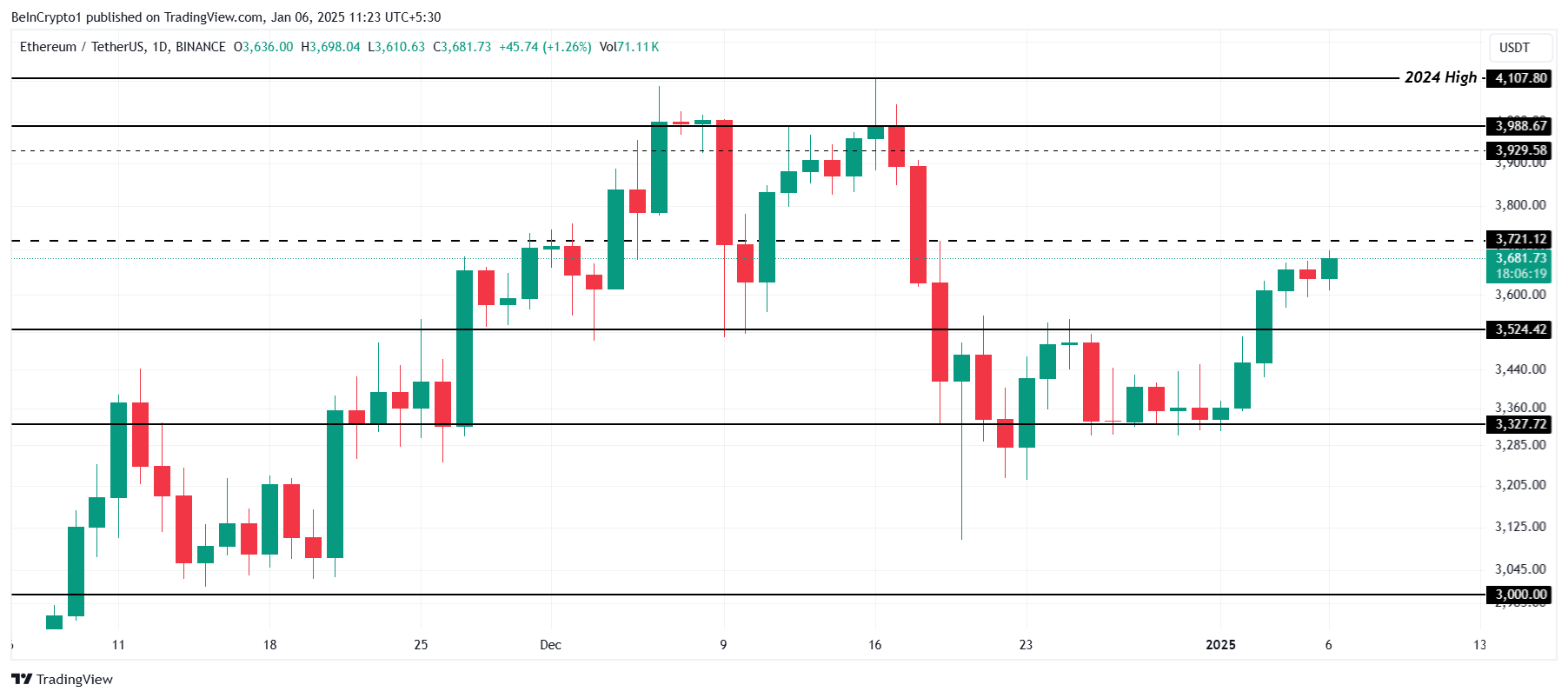

Ethereum (ETH) has broken free from nearly two weeks of consolidation under $3,524, marking a significant price breakout.

The altcoin king is now closing in on the critical $3,721 barrier, with bullish momentum supported by strong investor activity. Ethereum appears poised to continue its climb toward the $4,000 milestone.

Ethereum Investors Are Bullish

The exchange net position change highlights a substantial outflow of 89,000 ETH, equivalent to approximately $323 million. These outflows signify heightened accumulation as investors transfer their assets off exchanges to secure long-term holdings.

As Ethereum’s price rises, the fear of missing out (FOMO) could further drive demand for the asset. The ongoing accumulation aligns with this sentiment, suggesting that Ethereum holders are optimistic about the asset’s future growth and its potential to reach new highs in the coming weeks.

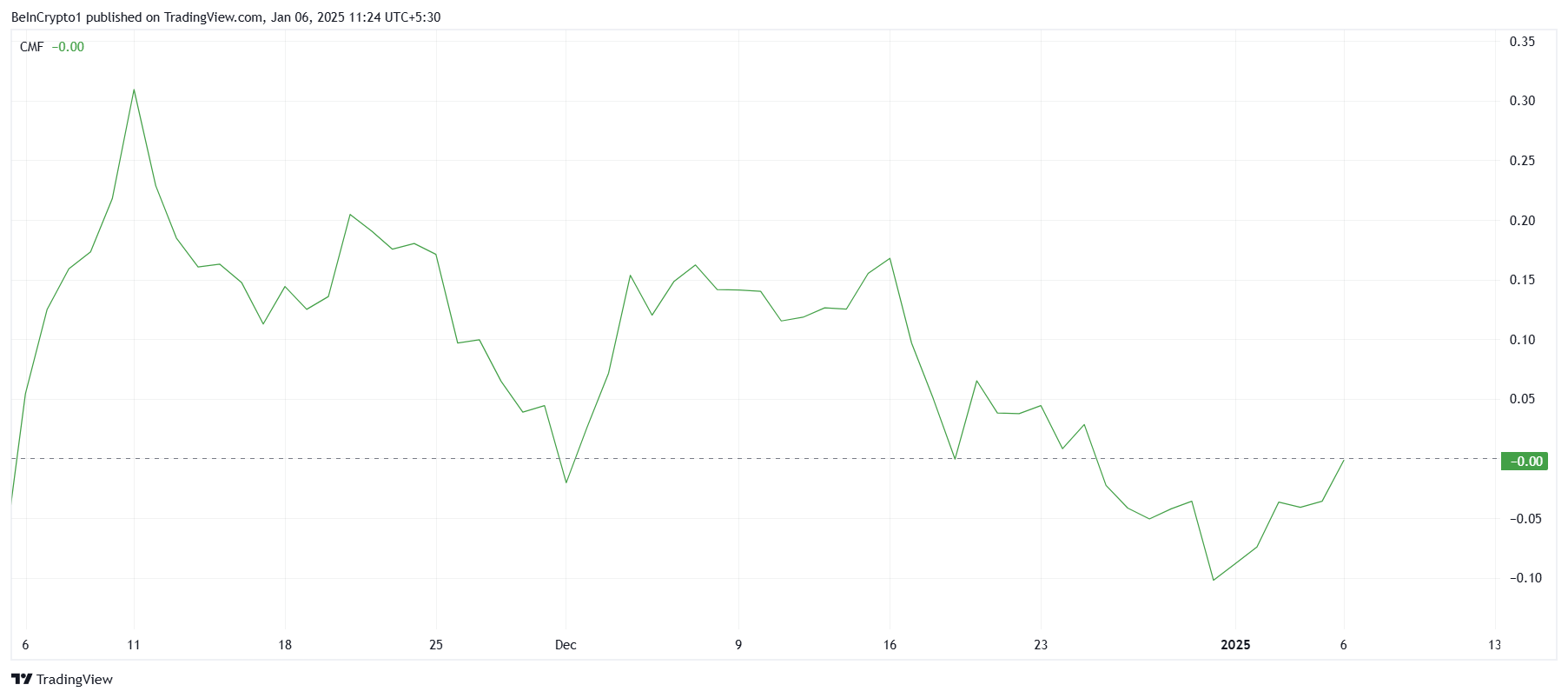

The macro momentum for Ethereum remains strong, bolstered by the Chaikin Money Flow (CMF) indicator. Currently nearing the neutral line, the CMF is on the verge of flipping into bullish territory, a clear sign of increased inflows. This indicates that investors are actively pouring money into Ethereum.

As inflows grow, Ethereum’s accumulation trend strengthens, reflecting robust support for its current price action. The CMF’s positive movement suggests continued investor interest, further reinforcing the potential for ETH to achieve its next price targets.

ETH Price Prediction: Aiming Higher

Ethereum is currently trading at $3,681, just below the resistance of $3,721, a key resistance point and the final hurdle before Ethereum reaches $4,000. Flipping this level into support would set the stage for a rise to the 2024 high of $4,107.

The combination of bullish investor sentiment and favorable macroeconomic conditions indicates that Ethereum could reach $3,988. This upward momentum would mark a significant recovery and solidify the altcoin’s position in the market.

However, failure to surpass $3,721 could push Ethereum back to $3,524, invalidating the bullish outlook. Such a pullback would delay Ethereum’s recovery, emphasizing the importance of maintaining upward momentum to secure its price targets.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/ethereum-price-faces-final-resistance/

2025-01-06 07:00:00