Ethereum’s price has finally begun to rally, following Bitcoin’s run to record highs. However, it is still far behind BTC and has a long way to go before a new all-time high.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily timeframe, the price has been rallying recently after a bullish breakout from $2,800, which has held the market lower over the last few months.

The $3,000 level and the 200-day moving average (located near $3,000) have also been broken to the upside.

Yet, the market is now pulling back toward the $3,000 area as the RSI has entered an overbought region. If this level and the 200-day moving average can hold, Ethereum can continue its uptrend toward higher prices in the coming weeks.

The 4-Hour Chart

The 4-hour chart also demonstrates a similar condition for Ethereum’s price, which has been surging over the past few weeks. Yet, the cryptocurrency has been pulling back toward the $3,000 support while creating a falling wedge pattern.

If the wedge gets broken to the upside, the market will likely run toward the $3,500 resistance level. On the other hand, a breakdown of the $3,000 level could result in a 10% crash toward the $2,700 area.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

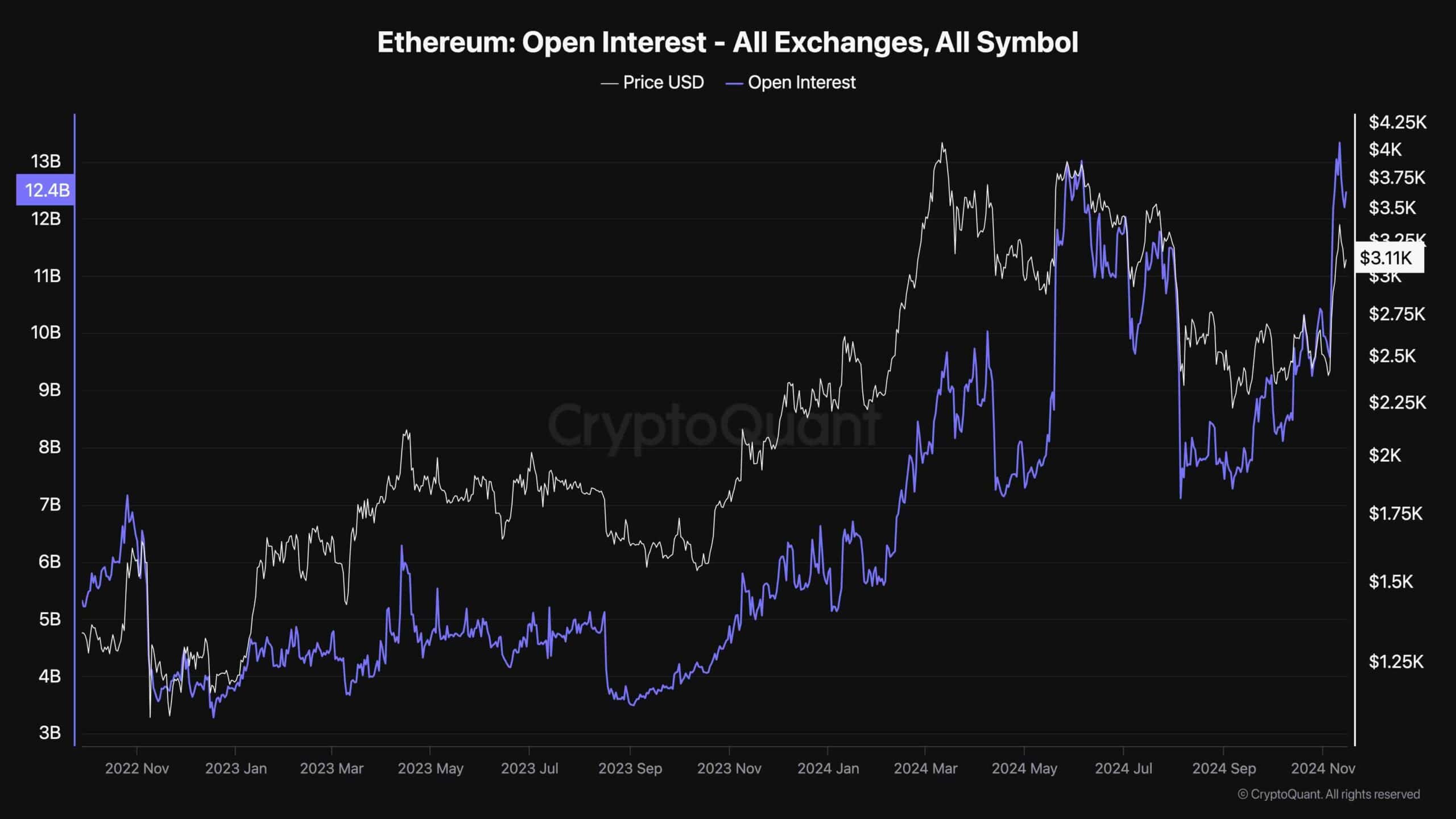

Ethereum Open Interest

Ethereum’s price is finally rallying higher after months of consolidation. While it is yet to create a new all-time high, futures market metrics display an interestingly worrying signal.

This chart presents the Ethereum open interest metric, which measures the number of open perpetual futures positions on ETH among all exchanges. Higher values are usually associated with higher volatility and more chances of a flash crash.

As the chart depicts, Ethereum’s open interest has been at its highest over the last couple of years. This is a clear divergence between price and futures market activity, as the price has yet to create a new high. As a result, the market will likely explode in the short term, but the direction remains to be seen as more data is needed to make a correct prediction.

The post Ethereum Price Analysis: Is ETH Headed to $3,500 This Week? appeared first on CryptoPotato.

Source link

CryptoVizArt

https://cryptopotato.com/ethereum-price-analysis-is-eth-headed-to-3500-this-week/

2024-11-16 14:11:09