Leading altcoin Ethereum (ETH) is facing increased selling pressure as financial giant Fidelity transferred over $200 million worth of the cryptocurrency to Coinbase within 48 hours.

This significant influx of coins into the exchange has sparked concerns that it could potentially exacerbate the existing downward pressure on the Ethereum price.

Ethereum Risks Decline As Fidelity Transfers ETH to Coinbase

In a series of transactions over the past 48 hours, the crypto arm of asset management firm Fidelity has deposited $213 million worth of ETH to leading exchange Coinbase via Cumberland.

According to Arkham, the first two transactions involving the transfer of 20,000 ETH to Coinbase were completed on January 8. The last transaction executed on Thursday involved the deposit of 11,250 ETH valued at $36.51 million to Coinbase.

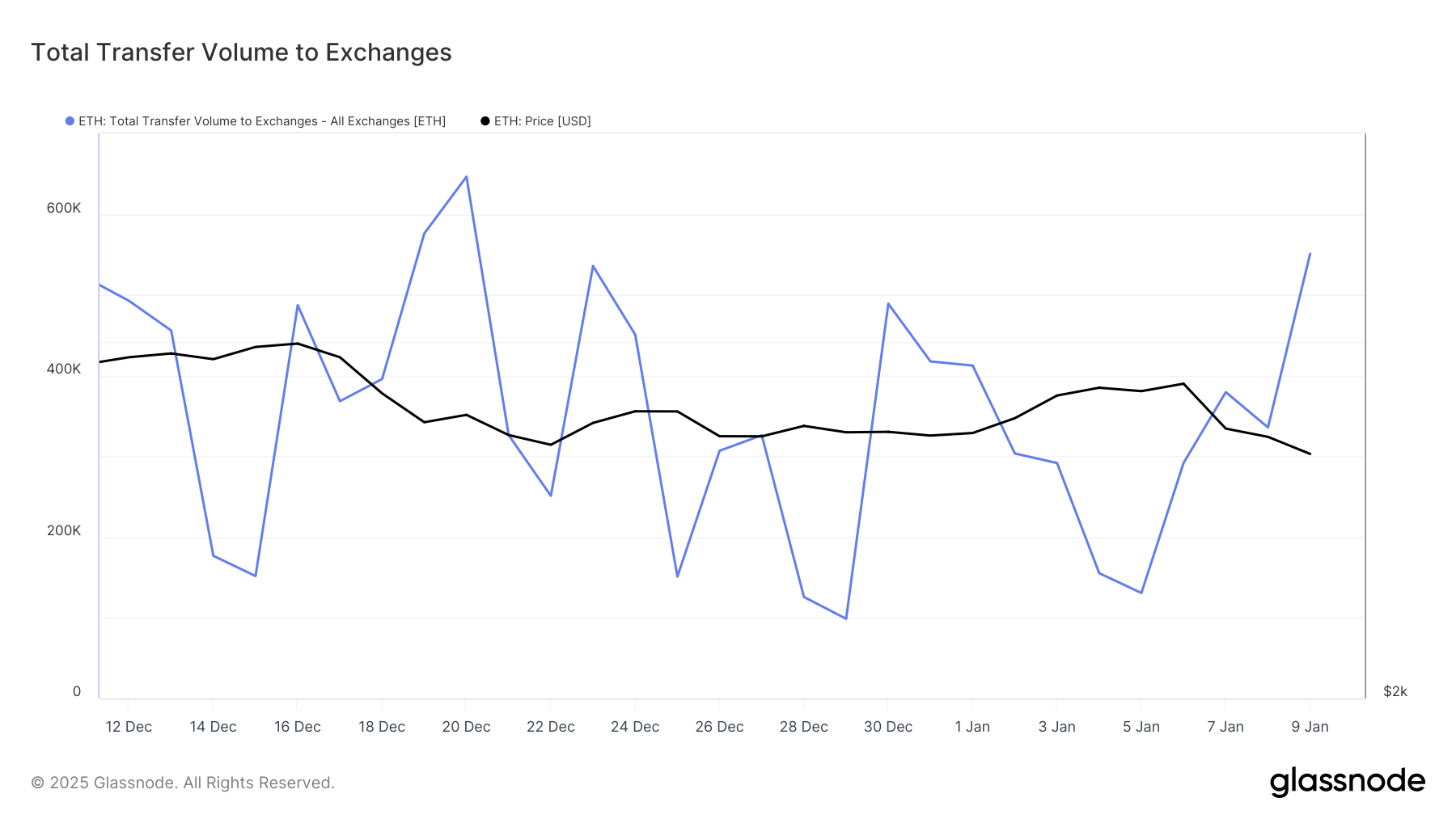

These ETH transfers have led to a spike in the coin’s exchange inflow volume. According to Glassnode, on January 9, a staggering 550,930 ETH, valued at over $1 billion, was sent to exchange addresses—marking the highest single-day inflow since December 20.

This growing accumulation of ETH in exchange wallets could intensify the downward pressure on its price if market demand fails to absorb the increased supply.

When an asset’s exchange inflow surges, it signals increased selling pressure as holders transfer assets to exchanges, potentially to liquidate. If sell orders outweigh demand, this trend can lead to downward price movements.

ETH Price Prediction: Low Demand Worsens Concerns

Readings from the ETH/USD one-day chart have shown that no such demand exists in the altcoin market to absorb the growing supply. Its declining Relative Strength Index (RSI) reflects this weakening buying pressure. At press time, this momentum indicator is on a downward trend at 42.73.

ETH’s RSI readings indicate weakening momentum, with the asset nearing oversold territory but not yet critically undervalued. If buying pressure wanes further, ETH’s price could drop below $3,249 and plummet toward $3,027.

On the other hand, if exchange inflow stalls and demand climbs, it may drive the Ethereum price up to $3,758.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/ethereum-price-risk-fidelity-coinbase/

2025-01-10 12:30:00