Ethereum is down nearly 35% from July highs and roughly 40% from 2024 peaks. While there is hope among holders that the coin will expand, breaking local resistance, the short-term trend favors sellers.

From the daily chart, not only is ETH struggling to gain momentum and push above $2,800, but sellers have been relentless, diffusing any attempt higher. As the coin is capped below $2,500 at press time and actively aligning with the selling pressure of late August, Santiment analysts have picked out an interesting development.

Ethereum Register More Users Than Bitcoin

In a post on X, the sentiment analysis platform notes that though prices are down at spot rates, the network is interestingly resilient, especially looking at user growth metrics.

Related Reading: Analyst Says Litecoin Will Outperform Bitcoin And Large Cap Cryptos With 11,000% Breakout

In the last three months, the number of unique Ethereum addresses has been growing steadily, outpacing those of Bitcoin. However, it still lags the number of USDT addresses over the same period.

To put in the number, as of September 3, Santiment analysts noted that Bitcoin had 54.18 million unique wallets, down 0.1% in three months. At the same period, Ethereum boasted of more than 126.96 million addresses, up 3.3%.

The rise in the number of new users in Ethereum signals confidence in the network and even possible rising adoption despite challenging market conditions. Meanwhile, USDT, the fiat-pegged stablecoin, had 5.99 million addresses, up 4% in three months.

Of the three, the rapid growth of USDT addresses in the last three months could signal overall apprehensiveness among traders. As crypto prices contract, holders choose to convert their holdings to USDT, explaining the increase.

Another interpretation of this development is that more new users are keen to explore crypto. By holding USDT via custodial wallets or through exchanges like Binance, they will readily splash on Bitcoin or any other top altcoin whenever the time is ready.

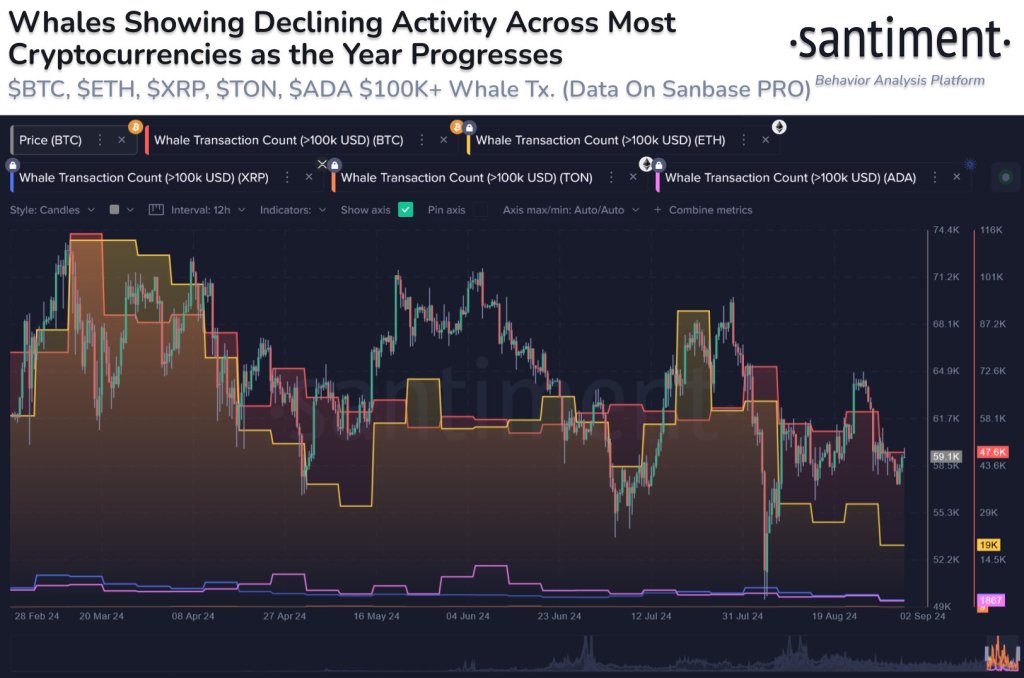

Bitcoin And Ethereum Whale Activity Declining

Even so, while there is growth in the number of users, whale activity, Santiment analysts observe, has been declining. Of note, the number of whale transactions has been down since Q1 2024 after prices peaked.

Surging prices, coupled with the approval of spot Bitcoin ETFs, especially in the United States, revived interest, explaining expansion in whale activity.

Related Reading

Considering the general contraction of prices, Santiment analysts predict whale activity to drop. This outlook will only change once there is volatility spurred by Ethereum or Bitcoin prices ripping above key liquidation levels in the short to medium term.

Feature image from DALLE, chart from TradingView

Source link

Dalmas Ngetich

https://www.newsbtc.com/bitcoin-news/ethereum-flips-bitcoin-in-this-key-metric/

2024-09-05 05:00:04