Large holders of Ethereum, also called Ethereum whales, have been on an accumulation trend for a while now, with on-chain data revealing a fascinating increase in their collective holdings. Particularly, data from blockchain analytics firm IntoTheBlock shows that Ethereum whales now hold about 43% of the total circulating supply of ETH.

The imbalance in ETH holdings raises important questions about its implications for Ethereum’s price and market dynamics moving forward.

Whale Accumulation Surges By Over 90% Since Early 2023

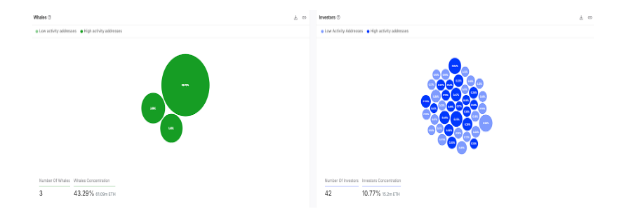

According to IntoTheBlock, the total concentration of ETH in whale addresses is currently at 61.09 ETH, which represents about 43% of the total supply. This marks a significant shift from early 2023, when whales held just 22% of Ethereum’s circulating supply. IntoTheBlock classifies whale addresses as those holding more than 1% of the total circulating supply of ETH.

Related Reading

The nearly twofold increase in Ethereum whale holdings within just a year is a noteworthy development. Naturally, such a concentration of a large supply of cryptocurrency into a few wallets would spell doom for the asset, as it would mean a few players would be able to manipulate price dynamics as they wish. However, Ethereum’s case deviates from this narrative due to the unique nature of its ecosystem and recent structural shifts within the network since 2022.

The sharp rise in whale concentration can be attributed to two major factors: the Ethereum merge and the growing appeal of ETH staking to earn rewards. The Ethereum merge, which took place in 2022, transitioned the blockchain from a proof-of-work (PoW) system to a proof-of-stake (PoS) mechanism.

As such, in-depth data from IntoTheBlock, which shows the 61.09 million ETH concentrated in only three whale addresses, makes much sense.

What this means is that these ETH are mostly those locked in the proof-of-stake staking algorithm used by block validators on the Ethereum network. By locking up their Ethereum, ETH miners and large holders have not only reduced the circulating supply but also contribute to price appreciation by reducing the amount of Ethereum available for trading.

Ethereum Holder Dynamics – Investors And Retailers

The increase in ETH among whale addresses has meant less ETH is available for investors and retail owners. IntoTheBlock classifies investors as addresses holding between 0.1% and 1% of the total circulating supply, while retail are those with less than 0.1% of the total circulating supply.

At the time of writing, there are 42 investor addresses and they collectively own 15.2 million ETH, which translates to 10.77% of the total circulating supply. Keeping in mind that the three whale addresses do not do much with price dynamics, investor addresses holding significant but more liquid portions of ETH have a greater capacity to affect market movements. Any substantial selloff from these investor addresses could trigger a sharp decline in Ethereum’s price.

Related Reading

On the other hand, retailers, which constitute over 99% of ETH addresses, are left with 46% of the total circulating supply. At the time of writing, Ethereum is trading at $3,225 and is down by 2% in the past 24 hours.

Featured image from Pexels, chart from TradingView

Source link

Scott Matherson

https://www.newsbtc.com/altcoin/ethereum-whales-control-43-of-supply-what-this-means-for-retail-traders/

2025-01-20 00:00:32