Despite crypto whales offloading large amounts of Ethereum (ETH), the asset’s staunch supporters remain optimistic. Recent data highlights a trend of stakeholders moving large volumes of ETH, likely for sale, amidst a general downturn in crypto asset prices.

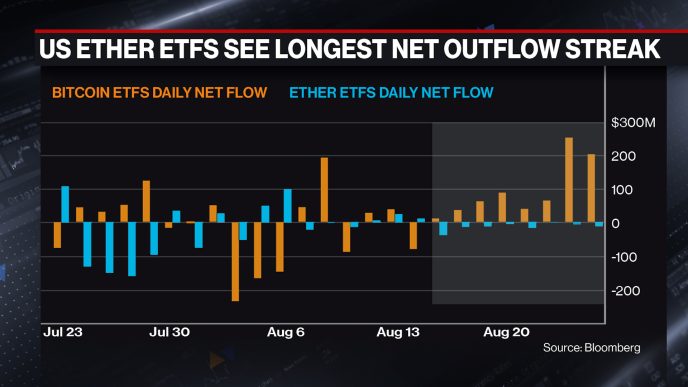

Moreover, the spot Ethereum ETFs have been recording outflows for the past eight trading days.

Crypto Whales and Institutions Move ETH to Centralized Exchanges

During this week, notable movements have captured the attention of market analysts. Spot On Chain reported that a whale’s wallet, identified as 0x46c, moved 5,088 ETH—valued at about $13.66 million—from Elixir to a deposit address at Binance.

“Notably, the whale withdrew those ETH tokens from Binance at $3,393 on average (estimated cost: $17.3 million), mostly between March 28 and April 3, 2024. If truly selling now at $2,682, the whale would realize an estimated loss of $3.62 million (-21%) after 5 months,” Spot On Chain stated.

Read more: How To Evaluate Cryptocurrencies with On-chain & Fundamental Analysis

In another transaction, an investor linked to wallet 0x75b transferred 8,825 ETH to Binance, worth approximately $24.07 million, marking a nearly 23% loss.

Concurrently, another entity believed to be associated with Amber Group moved 6,443 ETH to Binance and Kraken. Also, another address that supposedly belongs to Cumberland moved 6,439 ETH worth $17.66 million to Binance.

Generally, crypto entities move funds to centralized exchanges for the purpose of selling them.

These movements of crypto whales and institutions have collectively introduced nearly $73 million worth of selling pressure into the market. Amid these sell-offs, Ethereum’s price has decreased slightly by 2.39% in the last 24 hours. It is currently trading at $2,682.49.

Ethereum exchange-traded funds (ETFs) have also seen significant outflows, with a net outflow of $13.23 million on Monday alone. This extends the outflow streak to eight days, totaling around $112 million.

However, the community sentiment remains overwhelmingly positive. Influential figures like Ryan Adams continue to champion the blockchain’s potential and future vigorously. Adams has pointed out the strengths of Ethereum and its decentralized finance (DeFi) ecosystems, suggesting a bright future ahead.

“DeFi is awesome. ETH is an incredible asset. Ethereum is one of the most important systems on the planet. Vitalik’s leadership and vision are admirable. L2 teams are absolutely crushing. DeFi is building strong. The best is yet to come,” Adams said.

Moreover, Vitalik Buterin, Ethereum’s co-founder, recently addressed concerns regarding the platform’s viability in a tough market. He also emphasized Ethereum’s solid fundamentals and noted improvements in transaction efficiency on Layer-2 solutions.

Read more: Who Is Vitalik Buterin? An In-Depth Look at Ethereum’s Co-Founder

The enthusiasm is also fueled by the anticipation of Ethereum’s upcoming Pectra Upgrade. Scheduled for early 2025, this major update is expected to strengthen both the execution and consensus layers of the network. Planned

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Harsh Notariya

https://beincrypto.com/ethereum-bull-unfazed-crypto-whales-sell-off/

2024-08-27 06:52:19