Zach Pandl, Grayscale Investments’ managing director, has boldly predicted that the price of Bitcoin will surge regardless of who wins in the upcoming US presidential election. He said this potential increase is because of macroeconomic trends, most especially pertaining to the assumed depreciation of the US dollar.

Related Reading

According to Pandl, the fact that Bitcoin has a supply capped makes it an excellent hedge against inflation and monetary debasement as the US government continues to sustain more debt, now approaching a staggering $33.2 trillion. He expects the dollar to depreciate over the next 10 to 20 years, suggesting this could result in increased investment in BTC as a safe asset.

Factors Driving Bitcoin’s Potential Surge

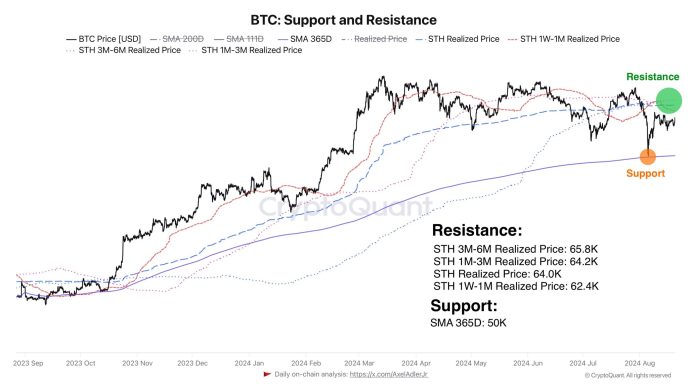

One of the major reasons that might fuel a surge in the price of Bitcoin could be its limited supply. It has a restricted supply of 21 million coins in circulation, unlike central bank-issued, unlimited-supply fiat money. It is this very scarcity that makes it an especially ideal means of investment for people hedging against inflation and depreciation of currencies.

Grayscale bets Bitcoin price will hit new records — at the expense of the US economyhttps://t.co/0HG3CPzo9O

— DL News (@DLNewsInfo) August 19, 2024

Randl pointed out that the rise of Bitcoin to a trillion-dollar market capitalization actually occurred when the dollar was strong, so it should do much better in a depreciating dollar environment. The event could pull more and more investors into Bitcoin, thus continuing to raise its price.

Skepticism Remains Despite Optimistic Outlook

Though Pandl is optimistic, the financial community still has its dose of skepticism as to whether Bitcoin can indeed play a role in your portfolio as a store of value. Many analysts have cast doubt on whether runaway inflation can be expected or even if Bitcoin might stand equivalent to traditional safe-haven assets like gold. This continues to underline the intriguing status of Bitcoin among all cryptocurrencies.

Related Reading

The key thing here is that investments in Bitcoin face too many risks, and investors should be wary of these risks before they make any investment decision. Cryptocurrencies are known to be very volatile, meaning that their prices fluctuate based on several factors.

Cautious Optimism For Bitcoin

In the wake of the US election, the Grayscale executive has made a strong case for the surging value of Bitcoin regardless of the outcome of the US election. Of course, as far as investment consideration is concerned, an investor should be extremely careful about his or her risk tolerance. With debate about whether Bitcoin can be classified as a store of value never far away, it’s anyone’s conjecture if Pandl’s predictions come true.

Featured image from DALL-E, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/grayscale-exec-predicts-bitcoin-surge-no-matter-who-wins-us-election/

2024-08-20 09:30:28