The United States Federal Reserve has issued a cease and desist order to United Texas Bank, citing deficiencies in the bank’s risk management systems, particularly in its dealings with crypto clients.

The order, dated September 4, 2024, follows an examination of United Texas Bank conducted by the Federal Reserve in May. The examination revealed issues within the bank’s corporate governance structure and identified oversights by the board of directors and senior management.

The Federal Reserve identified “significant deficiencies” centered on the bank’s practices related to foreign correspondent banking and virtual currency customers. The report specifically noted deficiencies in risk management and compliance with anti-money laundering (AML) measures and the Bank Secrecy Act (BSA).

The order did not provide specific details on how the bank failed to comply with regulations concerning its crypto clients.

In response to the findings, United Texas Bank has taken steps to strengthen its adherence to BSA and AML requirements. According to the order, the bank’s board of directors has agreed to submit a plan to enhance board oversight of BSA/AML compliance.

Head of legal at crypto compliance firm AMLBot Niko Demchuk told Decrypt that such a cease and desist order has consequences that go beyond the receiving party and its customers. He explained that “each cease and desist order plays a significant role in the market.”

“Other banks will try to gain more insights and details on what exactly was not in compliance with current AML regulations to improve their own internal AML processes,” Demchuk said, adding that, “The mention of crypto assets will alert other banks dealing with crypto assets to review their risk management systems, ensuring that all risks are considered and mitigated.”

Demchuk did not think crypto banking itself is in danger, and claimed that “if a bank has robust AML processes in place, it should not be concerned.” He added that “the crypto market is currently very lucrative, and every bank is exploring ways to start working with crypto.”

Regulatory scrutiny of crypto-friendly banks

According to its most recent quarterly report, the United Texas Bank has 75 employees and approximately $1 billion in managed assets. This enforcement action is part of a broader trend of regulatory scrutiny of banks involved in cryptocurrency-related activities.

In early August, the Federal Reserve took similar action against Customers Bancorp and its subsidiary, Customers Bank, based in Pennsylvania, identifying deficiencies in risk management systems and AML practices. These regulatory actions have prompted discussions within the cryptocurrency community about the relationship between traditional banking and the crypto industry.

Some industry advocates, including Dan Spuller of the Blockchain Association, have characterized these actions as “Operation Chokepoint 2.0,” suggesting a coordinated effort by U.S. President Joe Biden’s administration to restrict banking services to the crypto industry. The Bank for International Settlements (BIS) also issued a warning about risks faced by banks from permissionless blockchains at the end of August.

These actions follow Charles Hoskinson—creator of Cardano (ADA) and Ethereum (ETH) co-founder—suggesting in early May that the Biden administration was deliberately trying to kill the cryptocurrency industry. Ethereum co-founder Joe Lubin told Decrypt at the time that “there may be some entity—related, perhaps, to the banking lobby” that is behind a supposed United States war on crypto.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Adrian Zmudzinski

https://decrypt.co/248002/fed-issues-cease-and-desist-order-to-united-texas-bank-over-crypto-related-concerns

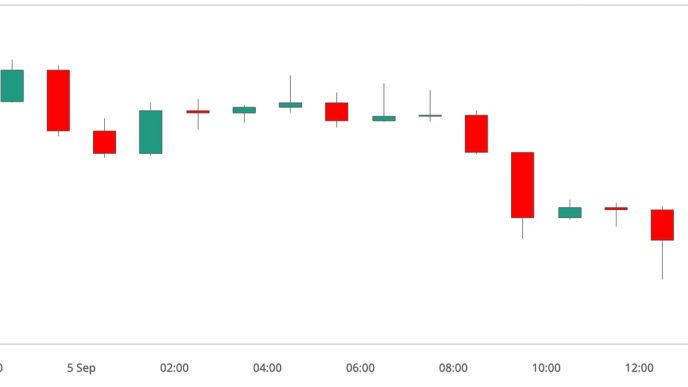

2024-09-05 11:07:38