With the United States Federal Reserve (Fed) poised to implement a new monetary policy in September, Bitfinex analysts warn that the agency’s decision could adversely affect bitcoin’s price.

According to a recent research report from Bitfinex, the analyst team stated that BTC could face a decline of up to 20% if the Fed decides to cut interest rates lower. They pointed out that the expected rate cut could “significantly influence both bitcoin’s short-term volatility and long-term trajectory.”

Potential Effects of Fed Rate Cut

The analysts noted that while bitcoin is often considered as a hedge against traditional financial assets, the digital asset is still influenced by macroeconomic conditions.

Per the report, BTC had surged over 32% since early August, mainly driven by traders anticipating dovish comments from the Fed. However, in the past week, Bitfinex analysts pointed out a shift in the market dynamics, with spot traders aggressively selling their BTC while futures and perpetual market spectators are buying.

The analysts predict that if the Fed implements a modest 25 basis point cut, the market would likely absorb the news much quicker, resulting in a “long-term price appreciation for bitcoin as liquidity increases and recession fears ease.”

On the other hand, implementing a more aggressive 50 basis point cut could temporarily spike bitcoin’s price by up to 8%, but this surge would quickly be followed by a major correction due to recession concerns.

One instance of the adverse effect of the Fed’s aggressive rate-cutting on bitcoin was in 2019, when a 50 basis point adjustment caused bitcoin to plummet 50% before stabilizing.

Bitfinex analysts, however, stressed that conditions are different in the current cycle. Bitcoin has undergone two halving events since 2019, and the global economy is not currently facing the challenges of a pandemic.

15-20% Drop for Bitcoin in September

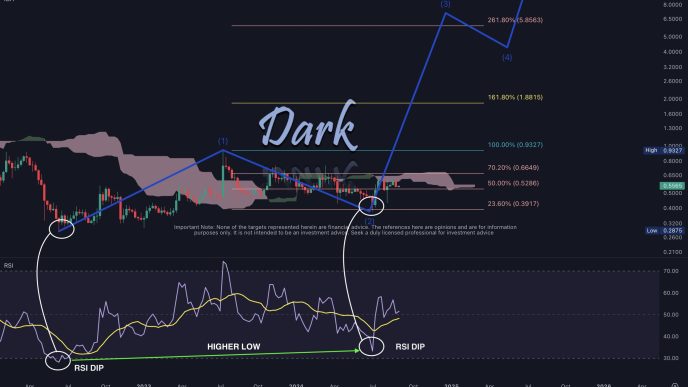

The analysts speculate that bitcoin could face a 15-20% decline in price following a rate cut. According to historical data, cycle peaks in percentage returns typically decrease by 60-70% each time, in addition to a reduction in average bull market corrections.

Thus, they project bitcoin’s price to be around $60,000 before the rate cuts, placing the potential bottom between the low $50,000 and mid $40,000.

The analysts added that September’s historic volatility, especially for bitcoin, could further affect market conditions. Since 2013, September typically has an average return of -4.78% for bitcoin and peak-to-trough declines of around 24.6% since 2014.

Despite the warnings for September, Bitfinex analysts remain bullish for bitcoin, adding that the volatility presents traders with both risks and opportunities.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Source link

Mandy Williams

https://cryptopotato.com/fed-rate-cut-could-push-bitcoin-btc-to-45k-bitfinex-analysts/

2024-09-03 11:49:54