Editorial Note: The following content does not reflect the views or opinions of BeInCrypto. It is provided for informational purposes only and should not be interpreted as financial advice. Please conduct your own research before making any investment decisions.

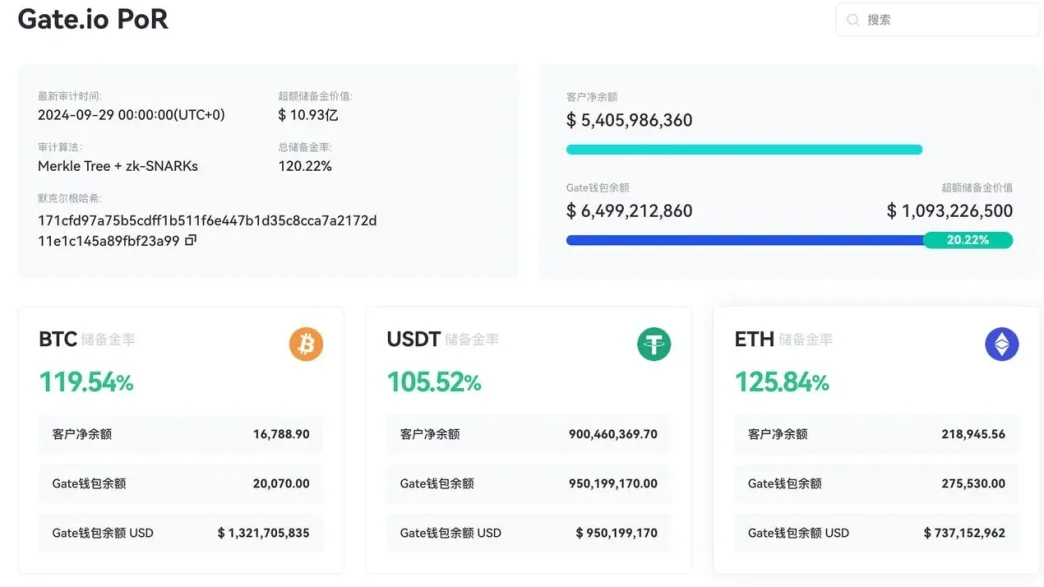

Recently, Gate.io, a leading global digital asset trading platform, released its October 2024 Proof of Reserves Report. The data shows that Gate.io’s total reserves reached $6.499 billion, with a total reserve ratio of 120.22% and excess reserves of $1.093 billion, representing a 26.6% increase since May.

Growth in Mainstream Digital Asset Reserves

The reserve data for mainstream cryptocurrencies has become a crucial metric for assessing a trading platform’s stability amid market fluctuations. Adequate reserves help the platform withstand market volatility and reflect the stability of its fund management capabilities.

The report indicates that Gate.io’s reserves cover as many as 209 different digital assets, with notable performance in reserves for major cryptocurrencies like BTC and ETH. Specifically, BTC reserves amount to 20,070 units, a 9% increase since May, with a reserve ratio of 119.54%. ETH reserves stand at 275,530 units, with a reserve ratio of 125.84%, reflecting a 16.7% increase since May.

Reserves Audit Enhances Transparency

Since launching Proof of Reserves in 2020, Gate.io has continuously improved its fund security mechanisms. The platform has already completed an audit with the independent blockchain security company, Hacken. Users can access the latest audit report on the platform’s public page, gaining detailed insights into the reserve status and verifying their personal account asset reserves at any time.

Accelerating Transparency in the Crypto Industry

In recent years, the global digital asset market has been moving toward greater standardization, with transparency and fund reserve security becoming critical factors for stable platform operations. The publication of Proof of Reserves reports and independent audits is increasingly recognized as a standard practice in the industry.

Against this backdrop, leading trading platforms that regularly release Proof of Reserves reports and undergo independent audits are taking essential steps to meet market regulation demands and ensure healthy industry development. As the market expands, the emphasis on the security and transparency of funds by trading platforms will be a key driver for the continued growth of the digital asset industry.

Disclaimer

This article contains a press release provided by an external source and may not necessarily reflect the views or opinions of BeInCrypto. In compliance with the Trust Project guidelines, BeInCrypto remains committed to transparent and unbiased reporting. Readers are advised to verify information independently and consult with a professional before making decisions based on this press release content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Advertorial

https://beincrypto.com/gate-io-releases-october-2024-proof-of-reserves-report/

2024-10-09 12:15:00