Analytics firm Glassnode is warning that Bitcoin (BTC) is approaching a critical juncture that has previously marked the end of the bull market.

Glassnode says on the social media platform X that it is keeping a close watch on Bitcoin’s short-term holder (STH) cost basis, a metric that tracks the average price at which investors who have held their BTC for less than 155 days acquired their coins.

According to Glassnode, historical data shows that Bitcoin tends to enter bear territory when its price moves below the metric’s value.

“Bitcoin’s Short-Term Holder (STH) cost-basis model is crucial for gauging sentiment among new investors. Historically, this model has tracked market lows during bull cycles and also distinguished bull from bear markets.

BTC price is now around 7% above the STH cost-basis of $88,135. If the price stabilizes below this level, it can signal waning sentiment among new investors – which is often a turning point in market trends.”

At time of writing, Bitcoin is trading at $94,425.

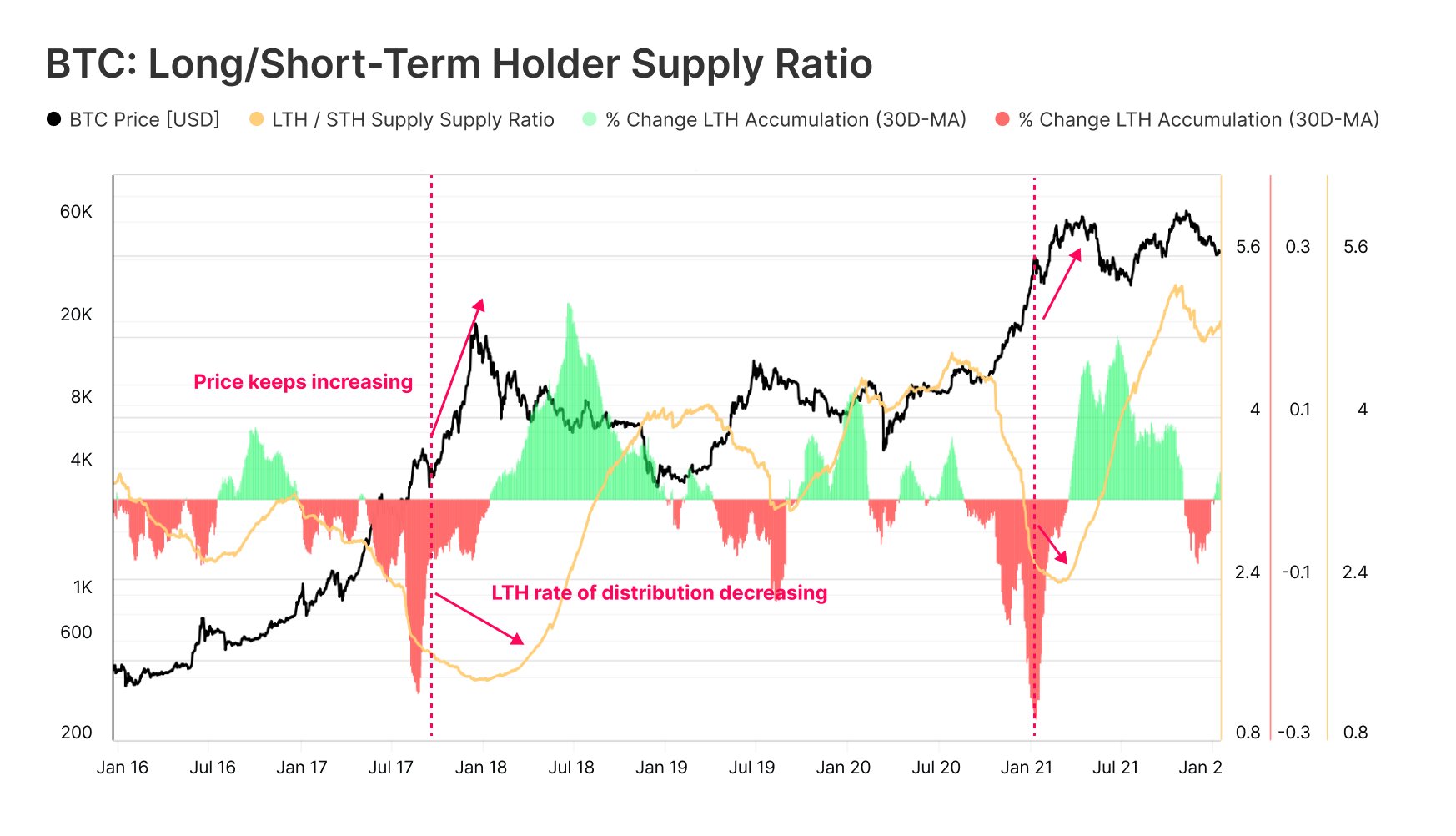

Looking at the long-term holders, or investors who have held their BTC for 155 days or more, Glassnode says the cohort is unloading their Bitcoin at a drastically rapid rate. According to the analytics firm, the extreme distribution of long-term holders does not necessarily suggest that the Bitcoin bull market is over.

“Even at prices about 12% below all-time highs, Bitcoin Long-Term Holders (LTHs) are still distributing, but at a slower rate. Yet, the 30-day percent change in LTH supply suggests that the rate of distribution has likely peaked, reaching extremes seen in previous cycles…

In past cycles, prices continued to climb even after LTH distribution peaked. This infers that a peak in distribution doesn’t always align with an immediate macro top.”

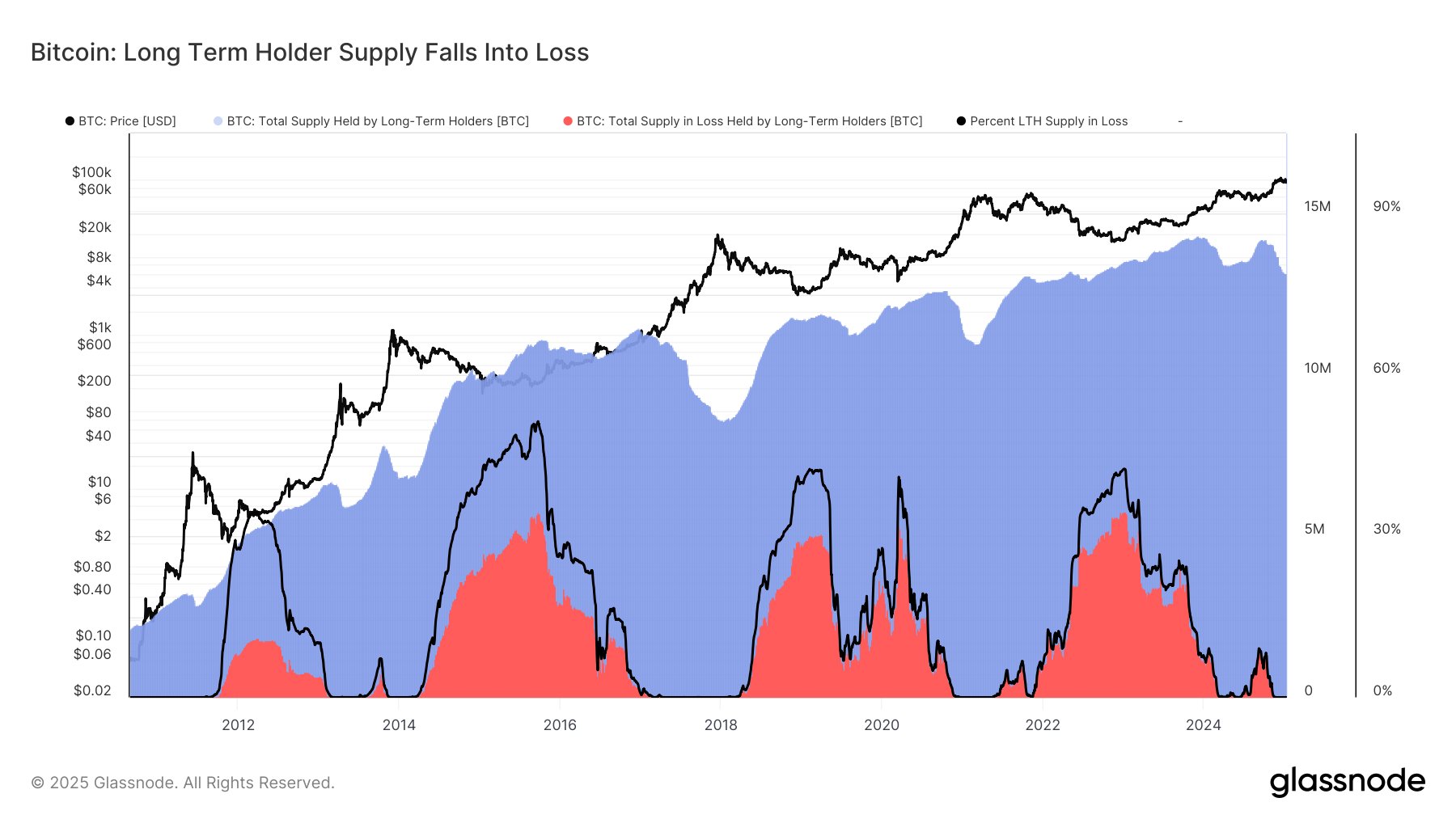

Glassnode concludes its analysis by noting that almost all long-term holders are in the green.

“Another factor to consider: Bitcoin LTH supply in loss remains at 0%. Nearly all Long-Term Holders are still in profit. Historically, when LTHs experience persistent losses that grow in severity, it has often marked the true end of a cycle. For now, that’s not the case.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Henry Kanapi

https://dailyhodl.com/2025/01/12/glassnode-issues-bitcoin-alert-says-btc-now-close-to-turning-point-that-often-signals-shift-in-market-trend/

2025-01-12 21:00:18