Goatseus Maximus (GOAT) price recently reached a new all-time high. The recent price action has been accompanied by strong technical indicators, suggesting an ongoing bullish trend.

However, some signs hint that this rally could be nearing its limit. As the analysis continues, the potential for both continued gains and the risk of a correction in the near future will be explored.

GOAT Current Trend Is Still Strong

GOAT’s ADX is currently at 27.63, down from above 36 last week. This drop suggests a weakening in trend strength.

When ADX was above 36, it indicated a strong trend. Now, with ADX below 30, the trend is still present but less powerful.

The Average Directional Index (ADX) measures trend strength. It ranges from 0 to 100, with values above 25 indicating a strong trend and below 20 suggesting no significant trend.

GOAT ADX of 27.63 shows that it remains in an uptrend, though the momentum is not as strong as before. The uptrend persists, but it may not be as forceful as it was last week.

GOAT Is Close To The Overbought Zone

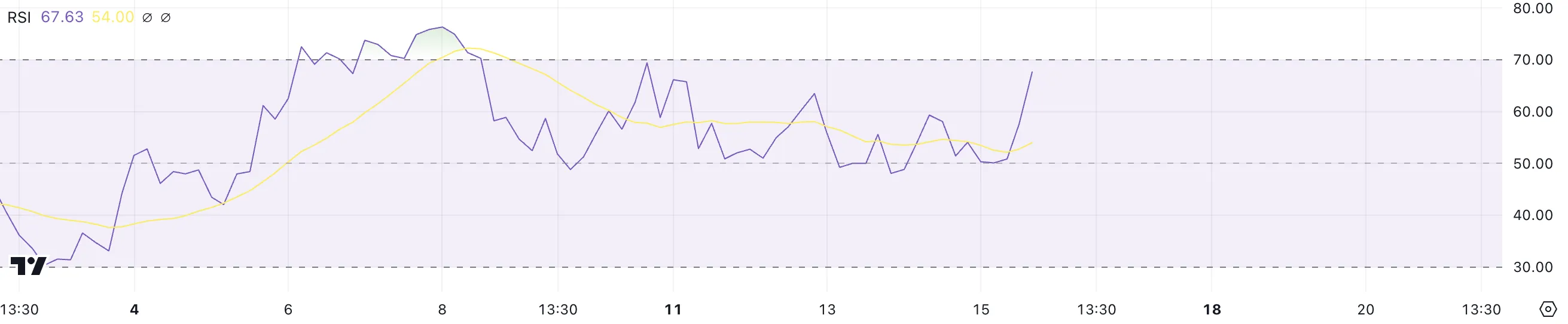

GOAT’s RSI is currently at 67.63, following a recent price jump and a new all-time high. It has risen sharply from 50 in just a few hours. This swift increase suggests strong buying momentum, pushing GOAT closer to overbought levels.

The Relative Strength Index (RSI) measures the speed and change of price movements. It ranges from 0 to 100, with values above 70 indicating overbought conditions and below 30 suggesting oversold conditions. With GOAT’s RSI nearing 70, it signals that the asset might be overextended.

The recent price surge and all-time high, coupled with the RSI’s current level, suggest that GOAT could face a strong correction soon. That would take GOAT off the top 10 biggest meme coins by market cap.

GOAT Price Prediction: Is a 39% Correction Imminent?

GOAT recently reached its all-time high, and its EMA lines are very bullish.

The price is above all EMA lines, with short-term lines positioned above long-term ones. This alignment suggests strong upward momentum, confirming a healthy uptrend.

However, the RSI indicates that the meme coin could be entering overbought territory, hinting at a potential correction. The closest support zone for GOAT price is around $0.76.

If this level fails to hold, the price could drop to $0.69, suggesting a possible 39% correction. This highlights the risk of a pullback after such a strong rally.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/goat-price-surges-record-potential-pullback/

2024-11-16 01:00:00