The DePin Grass project has officially begun trading on several exchanges following its airdrop. Despite the selling pressure from the airdrop, the price of GRASS temporarily surpassed $1 as trading volume soared.

GRASS is benefiting from the positive market sentiment, although daily unlocking activities may pose a risk to its price.

GRASS Price Exceeds $1 Post-Listing

Previously, GRASS was trading around $0.73 in the pre-market. However, after its listing, the price surged from a low of $0.65 to a high of $1.10. This surge indicates that the market has valued GRASS’s fully diluted valuation (FDV) at over $1 billion.

Fully Diluted Valuation (FDV) in the crypto market refers to the total market capitalization of a cryptocurrency project when all its tokens, including those not yet in circulation, are considered.

Although GRASS subsequently retraced to $0.87, this price remains higher than its pre-market level, reflecting sustained investor optimism for this newly launched token.

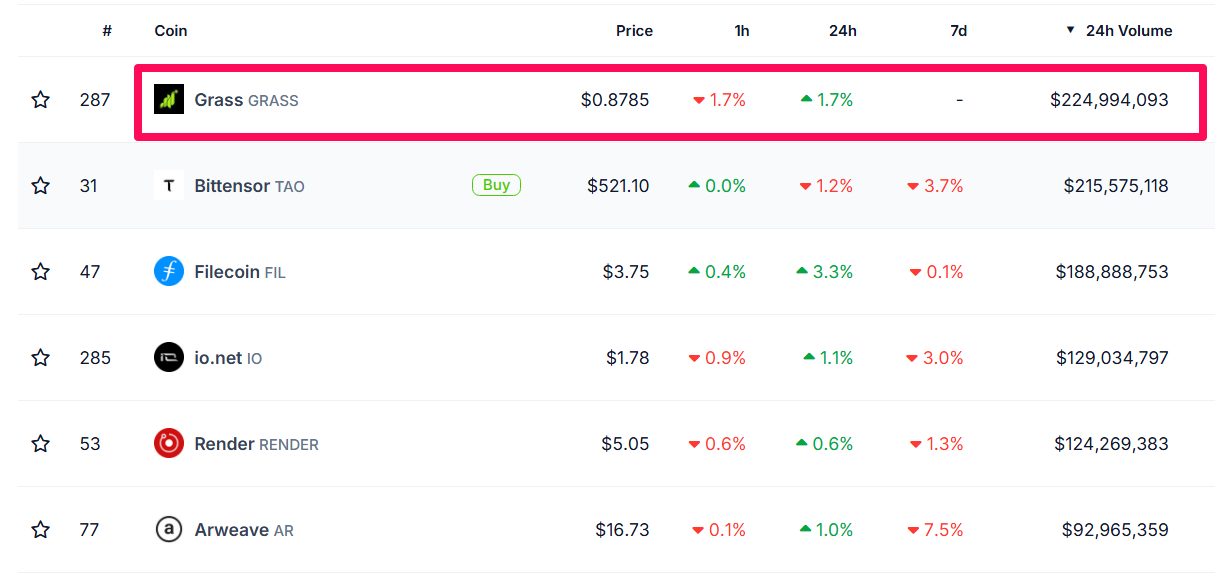

Additionally, data from CoinGecko reveals that GRASS’s daily trading volume has surpassed that of Bittensor (TAO), Filecoin (FIL), and io.net (IO). GRASS is currently the leading token in DePin trading volume, with nearly $225 million traded.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

Debate Over GRASS’s Initial Circulating Supply

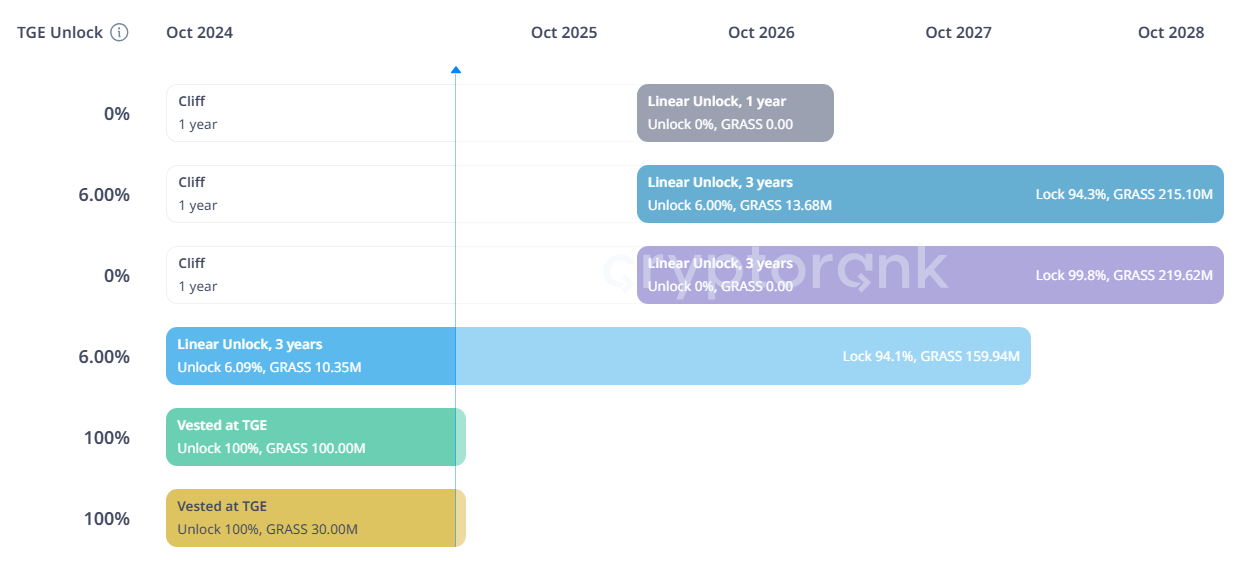

According to the monthly GRASS token distribution schedule, the initial circulating supply of GRASS is 25% of the total 1 billion GRASS. However, a recent calculation by an investor suggests that the actual circulating supply may be lower.

“Real circulating for GRASS is not 25%, its 5-6%. About 10% is for the first airdrop, which is roughly 50% claimed right now and claims are open til mid January. The other 10% is for router and staker rewards/future airdrops, which will be a linear release over years. 1.37% is for the foundation is for the foundation to use for listings, incentivising LP pairs etc. So really, the liquid supply right now is around 5-6%,” one X user commented.

Furthermore, a recent statistic from Tokenomist indicates that projects with a high FDV and a small circulating supply may pose significant risks.

“Projects that have a small circulating supply but a high fully diluted valuation (FDV) can be quite risky for those looking to invest for the long term,” Tokenomist noted.

Data from CryptoRank shows that GRASS’s Linear Unlock process will continue until 2028. Between now and October 28, 2025, 0.01% of the total supply, equivalent to 146,200 GRASS, will be unlocked daily, potentially exerting long-term selling pressure on GRASS’s price.

Read more: Top 7 Projects on Solana With Massive Potential

Grass is a DePin project developed by Wynd Network. Active users earn GRASS tokens as rewards for sharing their internet resources through a browser extension.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Nhat Hoang

https://beincrypto.com/grass-trading-volume-soars-after-listing/

2024-10-30 11:01:53