GRASS token, one of the latest DePIN projects, attracts significant attention from analysts and the investing public. As a Layer-2 platform on the Solana blockchain, the Grass platform allows users to share unused internet bandwidth to train AI models using a browser extension. With its promising technology, it’s no surprise that its token launch and airdrop last October 28th was highly anticipated.

Related Reading

While the airdrop was marred by a few issues, including a three-hour outage, the token’s price rally succeeded. Last October 29th, the token peaked at October 29th, then made a massive rally from October 31st until November 2nd, breaching the $1.50 level.

After hitting a high of $1.9175 on November 2nd, it has slowed down, settled below the $1.75 level, and now trades at the $1.45 level. GRASS has rejected the $2 price, with analysts seeing a deeper pullback—so, is this the right time to buy?

A Rough Start For GRASS

Trading for GRASS started on October 28th, but a few issues delayed the token’s airdrop and launch. The team recorded technical issues, including users being prevented from accessing their tokens on their Phantom wallets. Also, the rush to claim the tokens was marred by the three-hour power interruption. Furthermore, some users reported flagged transactions, and many were disqualified from the airdrop.

WTF is this @getgrass_io @grassfdn I’m using it since Epoch 1 and after 10 months of using, it is saying that your wallet is not eligible?? Really?#grassairdrop #grassfoundation #grassSCAM pic.twitter.com/wt7BWPBI1R

— Phantom Soul (@PhantomSoulll) October 28, 2024

A total of 1 billion GRASS tokens were circulated, and 10% were given to early supporters and contributors. It’s still too early to see the full extent of these issues’ effect on GRASS, but the token started well price-wise.

Token Tries To Breach $2

It’s challenging to make sense of GRASS’s price action since it only launched a few days ago. However, analysts see a bullish trend on the chart’s lower timeframes. The token boasts above-average volume in the last 24 hours.

Also, the token’s on-balance volume and price increased starting October 30th. In short, there was buying pressure for the token, suggesting that price gains may happen soon.

However, GRASS rejected $2, making it the token’s short-term psychological resistance. Analysts said the price could dip to $1.75 since the RSI reflects a bearish divergence.

Related Reading

Other Analysts See A Deeper Dive For GRASS

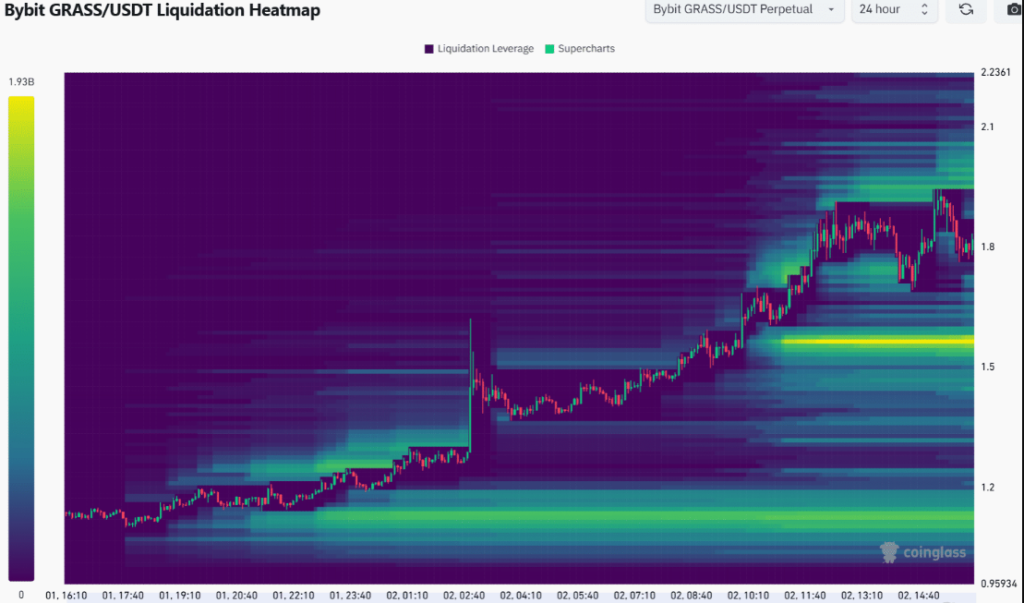

Based on the technical charts, the analysts found two notable liquidity pools at prices of $1.56 and $1.96. The current price is currently closer to the liquidity pool at $1.56, with the token appearing to reject the $1.96 level.

Since there’s a bearish momentum and a liquidity pool at $1.56, traders and holders can expect a price dip below $1,75. Swing traders and new buyers who want to enter a position can wait for the token’s retesting of $1.56 or even $1.4.

Featured image from Pexels, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/grass-token-fails-to-break-2-level-is-it-time-to-buy/

2024-11-04 00:00:54