Bitcoin’s dominance (BTC.D) within the cryptocurrency market has reached its highest point since 2021. This surge coincides with a multi-month high in BTC’s price, indicating a growing preference for Bitcoin and Bitcoin-based investment products.

However, this surge in dominance has raised concerns among analysts. Some believe it marks a local top for the coin, hinting at a possible price correction in the short term.

Bitcoin dominance measures the leading coin’s market capitalization relative to the total market capitalization of all other cryptocurrencies. As of this writing, it sits at 58.76, its highest level since April 2021.

Surging BTC.D indicates that Bitcoin holds a significant share of the market. However, since peaks in dominance often coincide with market tops, analysts frequently regard this metric as an indicator of various market cycles. Some believe that the current uptick in BTC.D signals that Bitcoin may soon reach a local top.

Read more: Where to Trade Bitcoin Futures: A Comprehensive Guide

In an October 14 post, crypto analyst Elja Boom noted that Bitcoin’s dominance is on the brink of a significant decline, signaling the potential onset of altcoin season.

“Bitcoin dominance is about to crash hard. This’ll send alts to new highs. Altseason is coming,” he stated.

Furthermore, crypto investor Coach K Crypto noted in a post on X that Bitcoin’s dominance has peaked for this cycle, and the altcoin season may soon begin.

“Bitcoin dominance (BTC.D) has touched an ATH for this cycle. It hasn’t been this high since 2021. We need to let Bitcoin rip before anything else can happen. Soon enough, there’s going to be a breakdown in BTC.D. This will lead to memes and other major alts getting a taste,” Coach K Crypto said in the October 16 post.

Additionally, in an X post on Wednesday, Benjamin Cowen opined that BTC dominance tops around 60%. Sharing the same opinion, popular analyst Michaël Van De Poppe said that the BTC.D may have reached a peak or is approaching one.

For this to be fully confirmed, there has to be a divergence between Bitcoin’s price and BTC.D. This pattern suggests that the momentum behind Bitcoin’s price may be weakening. However, Poppe noted that this bearish divergence has not yet been fully validated, meaning there is no definitive evidence to confirm a reversal in the current trend.

Poppe added that the potential for a market reversal hinges on Ethereum’s (ETH) performance. If ETH breaks through the crucial resistance level of 0.04 in terms of its dominance, it could prompt a broader reversal in the cryptocurrency markets.

Such a breakout would suggest increased investor confidence in ETH and could result in more funds flowing into altcoins, leading to a significant shift away from BTC.

Altcoin Season Remains Out Of Reach

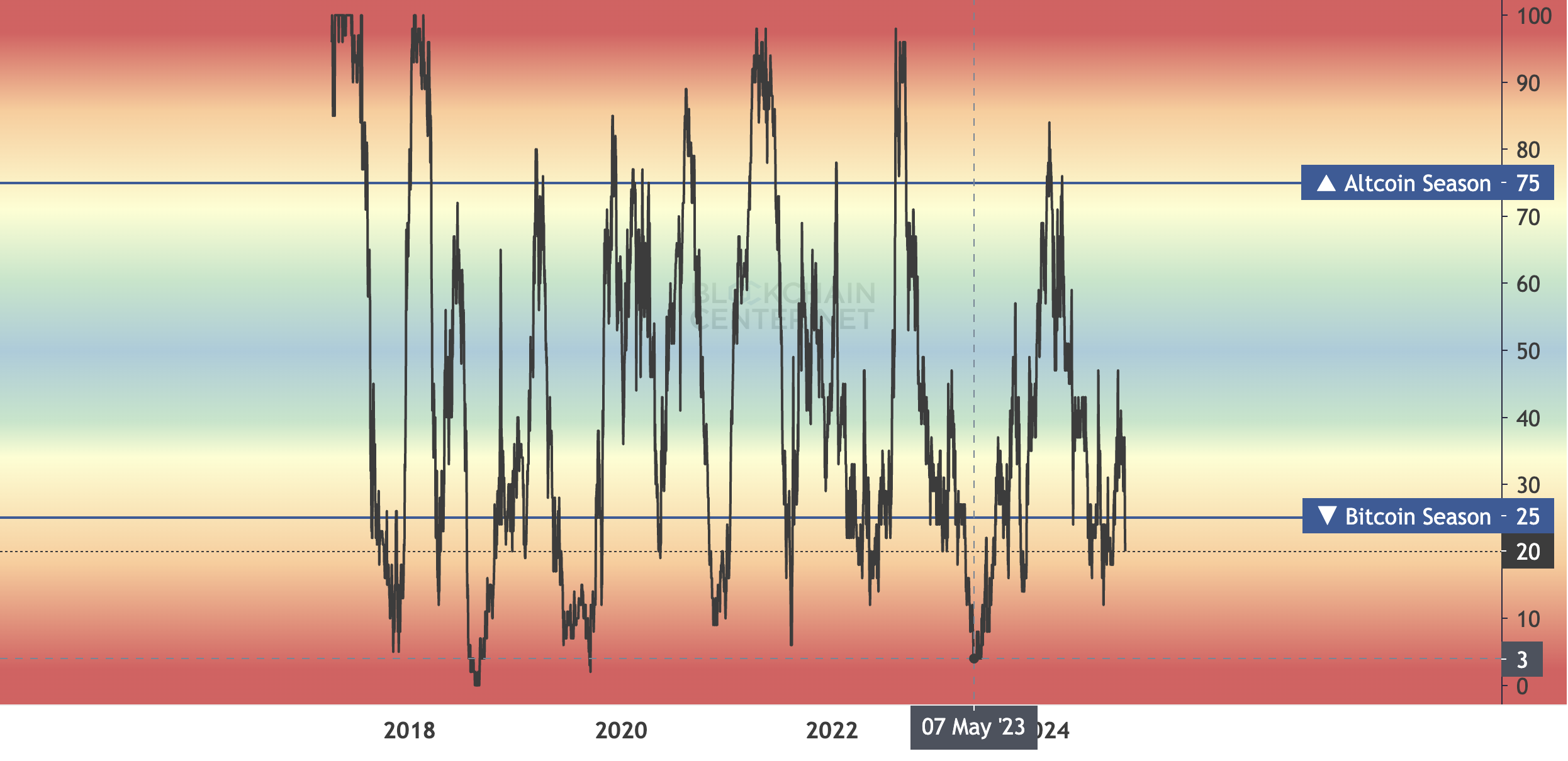

The altcoin season commences when at least 75% of the top 50 altcoins outperform Bitcoin over a 3-month period. Only 20 of these assets have surpassed Bitcoin’s performance in the last 90 days. Hence, the altcoin season has not yet arrived.

Read more: 4 Best Crypto Brokers for Buying and Selling Bitcoin in 2024

Moreover, the ETH/BTC ratio, which tracks Ethereum’s performance compared to Bitcoin, is approaching its lowest level in three-and-a-half years.

A falling ratio often reflects a preference for Bitcoin and a shift away from ETH and other altcoins.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/bitcoin-dominance-soars-to-three-year-peak/

2024-10-16 10:43:46