Hedera (HBAR) has faced a prolonged period of consolidation, with its price trading in a narrow range between $0.25 and $0.33.

While this stability has prevented major losses, it has also kept traders from realizing gains, leading to growing impatience. HBAR’s lack of direction has left market participants looking to Bitcoin for cues.

Hedera Traders Are Unsure

The funding rate for HBAR has been fluctuating between positive and negative, reflecting trader uncertainty about its price direction. Traders are positioning themselves to profit from either a potential breakout or a further decline. This tug-of-war has kept the funding rate in flux, highlighting the divided sentiment in the market.

This uncertainty could result in abrupt trading decisions, influencing HBAR’s price movements. If traders pull out due to impatience, the cryptocurrency could face added pressure, exacerbating its lack of momentum. The erratic funding rate indicates that market participants are unsure of HBAR’s next move.

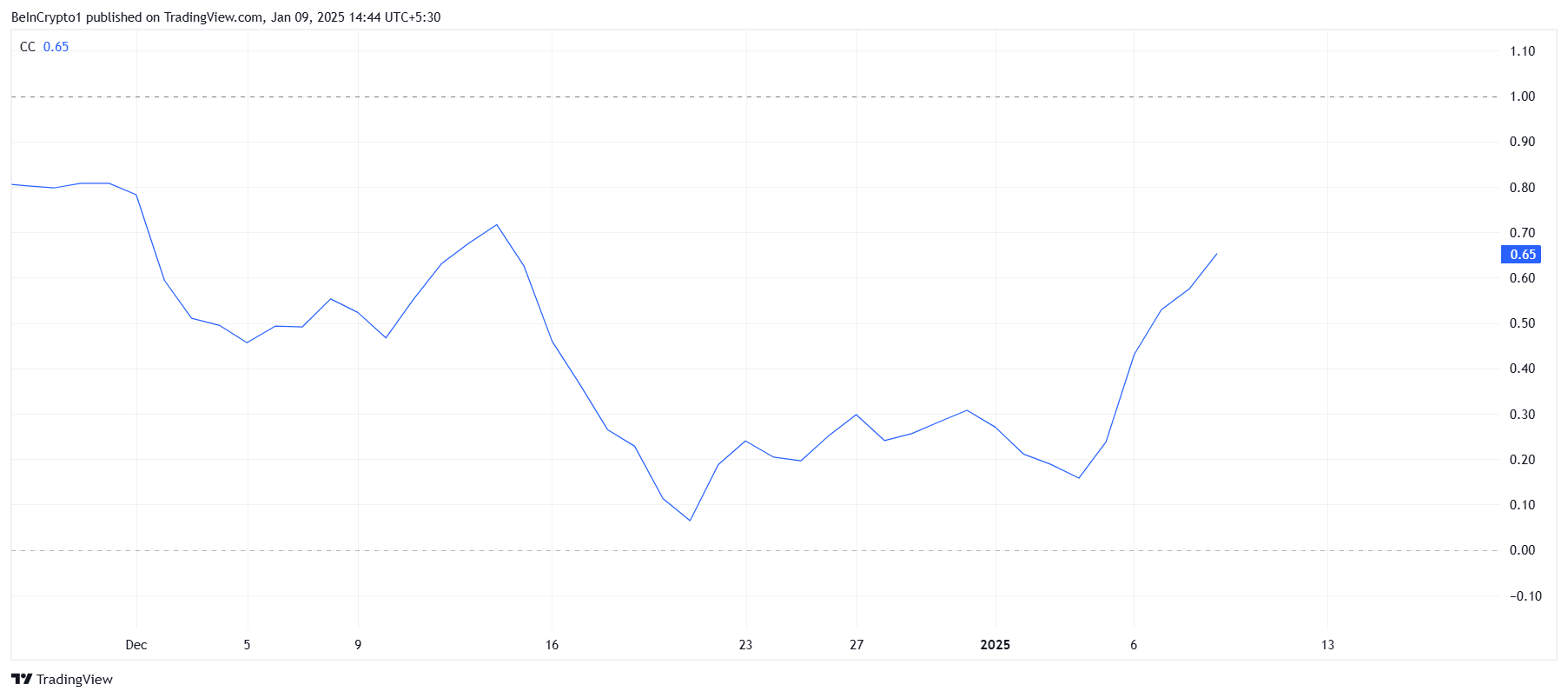

HBAR’s macro momentum is heavily tied to its correlation with Bitcoin, which currently stands at 0.65. This increasing correlation suggests that HBAR may follow Bitcoin’s price movements more closely. If Bitcoin reclaims the $100,000 level and continues to rally, it could provide the momentum needed for HBAR to break out of its consolidation phase.

A stronger Bitcoin-led market could offer a path forward for HBAR. Positive broader market cues stemming from Bitcoin’s performance may help lift Hedera’s price, enabling it to move toward higher resistance levels. Conversely, if Bitcoin falters, HBAR’s reliance on its correlation could become a liability.

HBAR Price Prediction: Finding A Way Out

HBAR is trading at $0.27, stuck in a month-long consolidation range between $0.25 and $0.33. This sideways movement reflects the indecisiveness of both traders and broader market conditions. Without a clear sentiment shift, this pattern is likely to persist.

Should the overall market sentiment lean further bearish, HBAR risks falling below the critical support level of $0.25. Such a move would exacerbate trader impatience and push the altcoin toward further losses.

Conversely, if Bitcoin manages to rally and reclaim key levels, HBAR could break out of its consolidation phase. Flipping $0.33 into support could set the stage for a move toward $0.39, helping the cryptocurrency recover and invalidating the bearish outlook. This reliance on Bitcoin’s performance highlights the importance of broader market trends in determining HBAR’s trajectory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/hedera-hbar-price-relies-on-bitcoin-to-escape/

2025-01-09 16:30:00