Hedera Hashgraph (HBAR) has struggled to maintain significant momentum, with its price action reflecting a bearish-neutral trend over the past month. Despite its potential, HBAR has faced difficulties rallying due to declining market enthusiasm.

Even long-time HBAR supporters appear to be pulling back as market conditions weigh on investor sentiment.

HBAR Traders Are Disappointed

HBAR’s Open Interest has dropped by $95 million in just six days, highlighting a notable decline in trader activity. This significant reduction reflects traders pulling their funds out of the asset, dampening liquidity and trading volume. The prolonged consolidation period is eroding confidence, reinforcing a bearish sentiment across the HBAR market.

The persistent lack of price movement has led traders to reduce exposure as expectations for short-term gains dwindle. This shift in sentiment has compounded bearish pressure, making it increasingly challenging for HBAR to build the momentum needed to stage a recovery. The asset remains stuck in a cycle of uncertainty.

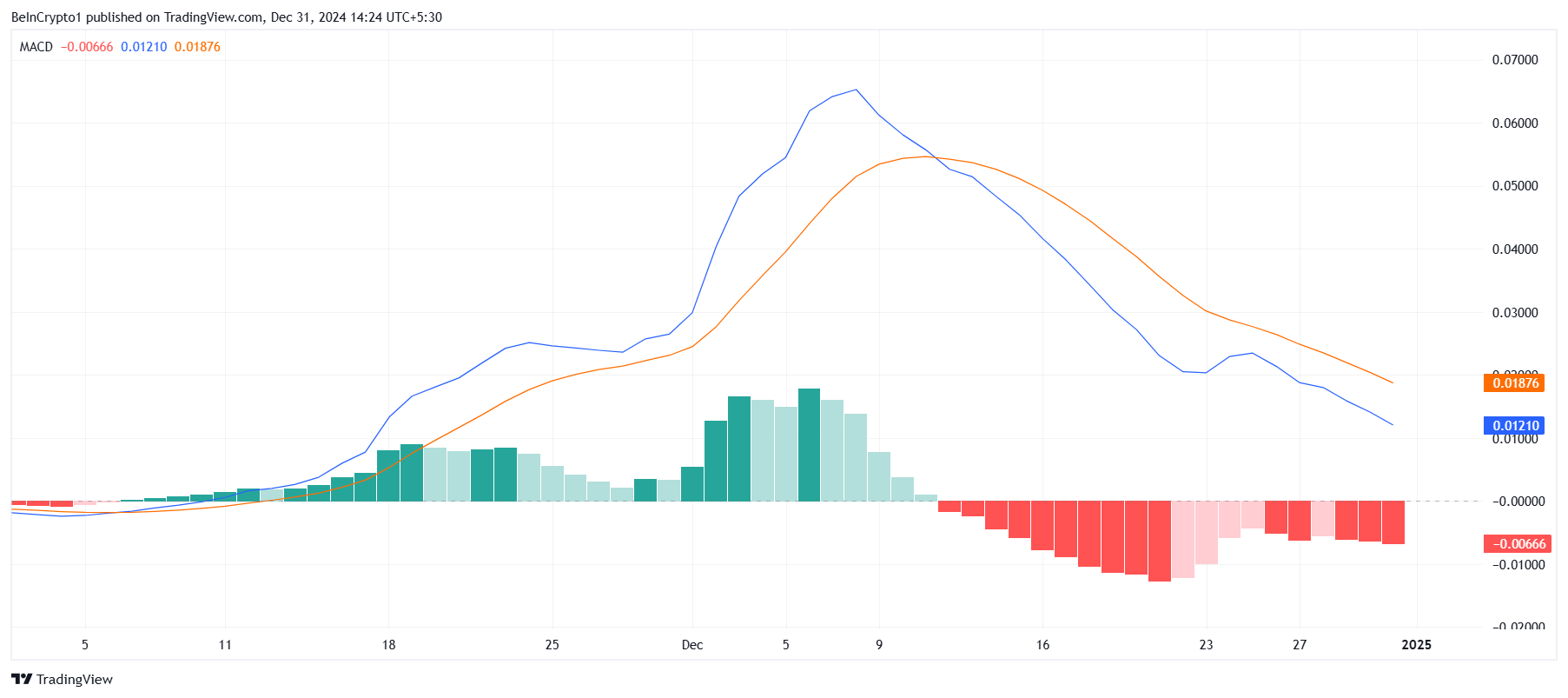

Technical indicators paint a worrying picture for HBAR’s macro momentum. The Moving Average Convergence Divergence (MACD) indicator shows bearish momentum strengthening after a brief pause, signaling increased selling pressure. This shift indicates that the downtrend may accelerate, further limiting HBAR’s ability to break out of its current range.

The bearish divergence is concerning, as it was expected to ease but has instead gained pace. This renewed momentum suggests HBAR’s price could remain under pressure unless significant bullish catalysts emerge. Without a reversal in macro trends, the altcoin may face additional headwinds in the coming months.

HBAR Price Prediction: Arranging A Breakout

HBAR has been consolidating between $0.39 and $0.25 for over a month, struggling to break out of this tight range. With the current price at $0.27, the all-time high of $0.57 remains 109% away. To reach $0.57 and potentially set a new ATH, HBAR would require sustained bullish momentum akin to its 637% rally in November.

While a rally of that magnitude is unlikely in January 2025, even moderate momentum could push HBAR higher. However, failure to breach $0.39 could extend the consolidation or lead to a decline below $0.25. In this scenario, HBAR might drop as low as $0.18.

Thus, breaking above the consolidation range of $0.25 to $0.39 is crucial for initiating an uptrend and restoring market confidence. HBAR achieving performance similar to November and posting a new ATH would depend on favorable market conditions and renewed investor interest, both of which remain uncertain for now.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/hbar-price-stalls-bearish-trends/

2024-12-31 10:38:32