Hedera has announced an integration with Chainlink’s decentralized data infrastructure, bringing advanced capabilities to its network. This collaboration aims to enhance decentralized finance (DeFi) applications and the adoption of tokenized real-world assets (RWAs).

Developers on Hedera now have seamless access to on-chain data essential for building secure and scalable applications.

Hedera Leverages Chainlink Data Feeds

Hedera’s integration of Chainlink data feeds equips its developers with reliable, tamper-proof market data. Chainlink’s decentralized oracle network (DON) aggregates and verifies data from multiple high-quality sources, ensuring accurate and manipulation-resistant pricing for digital assets. This functionality is critical for DeFi protocols, which require real-time financial market data for operations such as lending, trading, and risk management.

The data feeds offer several key benefits, such as high-quality data, secure nodes, and decentralization.

Through this integration, Hedera developers gain access to price feed contracts for diverse assets, enabling a new wave of financial applications that bridge traditional and digital markets.

Chainlink Proof of Reserve adds another layer of trust and transparency to Hedera’s ecosystem. This feature brings real-time reserve verifications for tokenized assets, addressing critical security and accountability needs for DeFi projects. The decentralized approach eliminates vulnerabilities associated with centralized verification methods.

This capability empowers applications on Hedera to integrate transparent collateralization checks, fostering confidence among users and investors.

“By making the Chainlink standard available to our developer ecosystem, we can enable increased access to high-quality, tamper-proof data backed by decentralized infrastructure, which is mission-critical for building secure DeFi applications and scalable tokenized assets,” Elaine Song, VP of Strategy at The HBAR Foundation said in a press release shared with BeInCrypto.

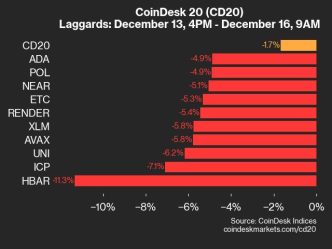

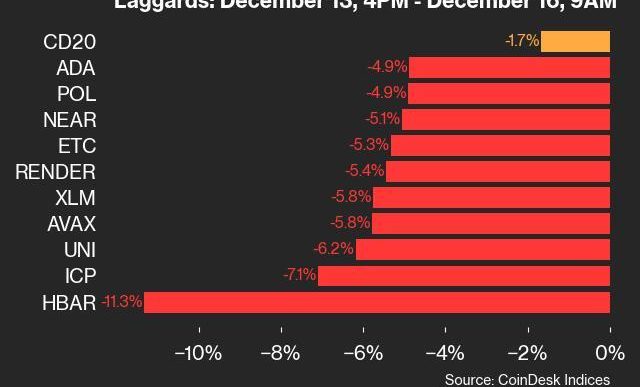

The Hedera ecosystem’s rapid advancements coincide with bullish activity in its native token, HBAR. Since November, HBAR’s market value has surged by nearly 500%.

The surge was partly fueled by the announcement of the first HBAR exchange-traded fund (ETF) filing by Canary Capital on November 12. The ETF avoids derivatives and futures, opting for direct token holdings to streamline investor access.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Harsh Notariya

https://beincrypto.com/hedera-leverage-chainlink-defi-rwa-development/

2024-12-16 14:14:14