Helium (HNT) is continuing its upward trajectory despite the market dip. According to CoinGecko, the token is up nearly 15% since yesterday, sparked by the recent on-chain developments that will expand on Helium’s decentralized physical infrastructure (DePIN).

Related Reading

Recently, Helium’s official X account announced the voting period for two crucial proposals for Helium Mobile. Aptly named HIP 130 and 131, these two proposals have sparked speculation for HNT’s near-future performance.

Helium Proposes New Security Measure Against Malicious Activity

HIP 130, titled ‘Data-Only Hotspots’, proposes that the network should expand its reach by using any hotspot that uses passpoint authentication. These devices may come from non-certified Helium Hotspot vendors.

These new hotspots will act almost exactly as their Helium-made counterparts, except that they will be used to pass already paid-for data. Users of this new type of hotspot will be rewarded with MOBILE, one of the tokens inside the Helium ecosystem.

In addition to this, HIP 131, named ‘Bridging the Gap Between Verification Mappers and Anti-Gaming Measures’, will implement a new system to protect the reward system of the network. The proposal is an “extension” of HIP 125 (Temporary Anti-Gaming Measures for Boosted Hexes) and amends the latter to better protect the network.

The new system works by limiting the Oracle Hex boosts in points of interests (PoIs), reducing the rewards multiplier if a hotspot engages in malicious activity. To regain the boost, that hotspot only needs to submit 1 accurate Call Detail Records (CDR).

As of writing, both proposals are still under voting with only 11 hours left for the community to engage on.

Related Reading

HNT To Stabilize Between $6.8 And $7.5

As of writing, the token is trading well between $6.8 and $7.5 with the momentum on the side of the bulls. The current trajectory is eyeing gains well above $8 in the long run. This significant increase in price is accompanied by a proportional increase in HNT’s momentum. However, there might be barriers for the budding rally.

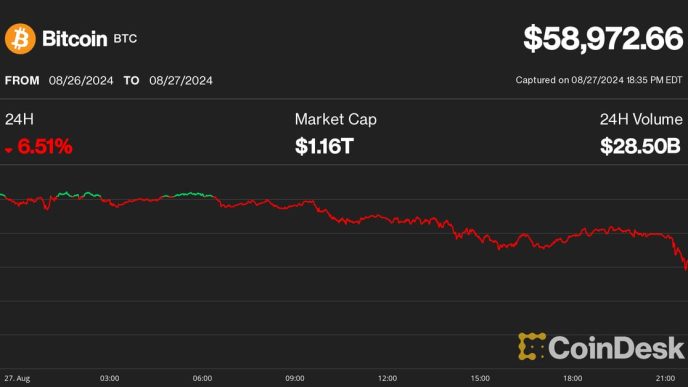

HNT’s position, although great in itself, is barred by the dip in the market that further hinders any increase in momentum. Helium can move by itself– only by a short while. How short this timeframe may be is up to speculation as it can dip next week or next month.

For now, investors and traders could buy in a small position in HNT while monitoring the broader market sentiment which today, unfortunately, is bearish. Once the situation improves, we will see a rally, breaking through $8 or potentially $10 in the long-term. Until then, caution is the name of the game to protect long-term gains.

Featured image from Fortune, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/helium-development-proposals-ignite-15-hnt-price-rally-details/

2024-08-27 22:00:40