BONK price is currently looking to break out of a bullish pattern it is currently moving in, which may not happen.

This is because investors’ pessimism is clouding the potential for reversal as they expect a downtrend.

BONK Investors Choose the Dark Side

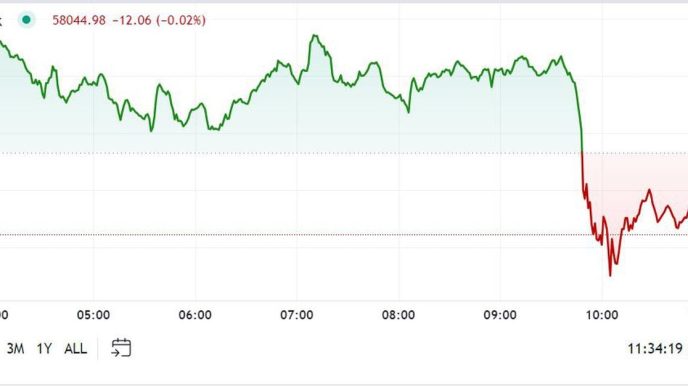

BONK price’s downtrend appears to be gaining momentum, as indicated by the Average Directional Index (ADX). The indicator is now positioned above the critical threshold of 25.0. This level suggests that the bearish trend could continue to drive the price lower.

The rising ADX value signals that the strength of the downtrend is becoming more pronounced. This could lead to increased selling pressure, further solidifying BONK’s pessimistic outlook in the near term.

Read more: Bonk Airdrop Eligibility: Who Can Claim and How?

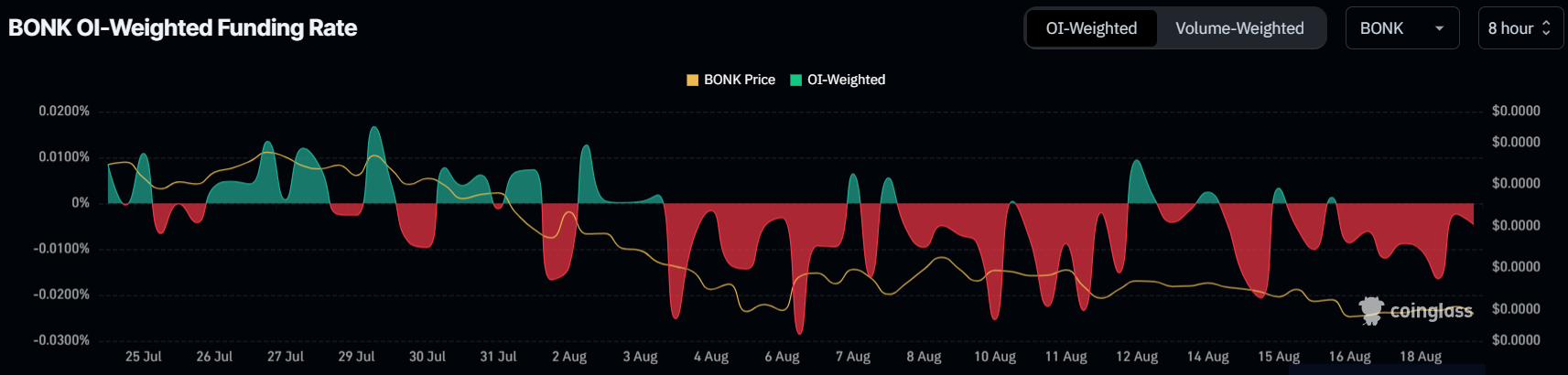

Adding to the concerns is the heavily negative funding rate. This indicates that investors are increasingly betting on a decline in BONK’s price. This negative sentiment is reflected in the overall market positioning, where short positions are becoming more dominant.

The combination of a strengthening downtrend and a negative funding rate supports the growing bearish sentiment among BONK investors. If these factors persist, BONK’s price could face further downside pressure, making it challenging for the asset to recover in the short term.

BONK Price Prediction: No Breakout for Now

BONK price will most likely remain on its path of decline since the broader market cues are not supporting recovery. The meme coin changing hands at $0.00001759 after crashing by 23% in the last ten days and could be losing the crucial support of $0.00001732.

This could send it to $0.00001375, the critical support for the meme coin. Losing it would create significant selling pressure, resulting in a further drawdown.

Read more: 11 Top Solana Meme Coins to Watch in June 2024

But if the support of $0.00001732 is maintained, BONK could bounce back. This would give the meme coin a chance to validate the descending wedge bullish pattern but would require breaching the resistance at $0.00002748.

This could be far away, but the bearish thesis could be invalidated even if BONK manages to breach $0.00002153.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bonk-price-demand-for-a-decline/

2024-08-19 12:00:00