Ethereum (ETH) bulls have a big task at hand despite helping the altcoin price rise above $2,700 earlier. This time, the new mission is to prevent ETH from going below $2,400, which is a crucial support level.

In this analysis, BeInCrypto checks if the cryptocurrency will drop below the region or if bulls will successfully defend it.

Ethereum Sees Rising Capital Injection

On October 19, the Chaikin Money Flow on Ethereum’s daily chart dropped to -0.10. Popularly called by its short form, the CMF measures the rate of capital flow in and out of a cryptocurrency.

When the CMF rises, more money flows into the crypto involved. If sustained, this could drive a notable price increase. On the other hand, a negative CMF indicates that money is flowing out and holders are distributing.

At press time, the CMF reading has returned to the positive region. This rise indicates that Ethereum bulls are accumulating the coin. If sustained, this could prevent another price crash like the one experienced some months back.

Read More: How to Buy Ethereum (ETH) and Everything You Need to Know

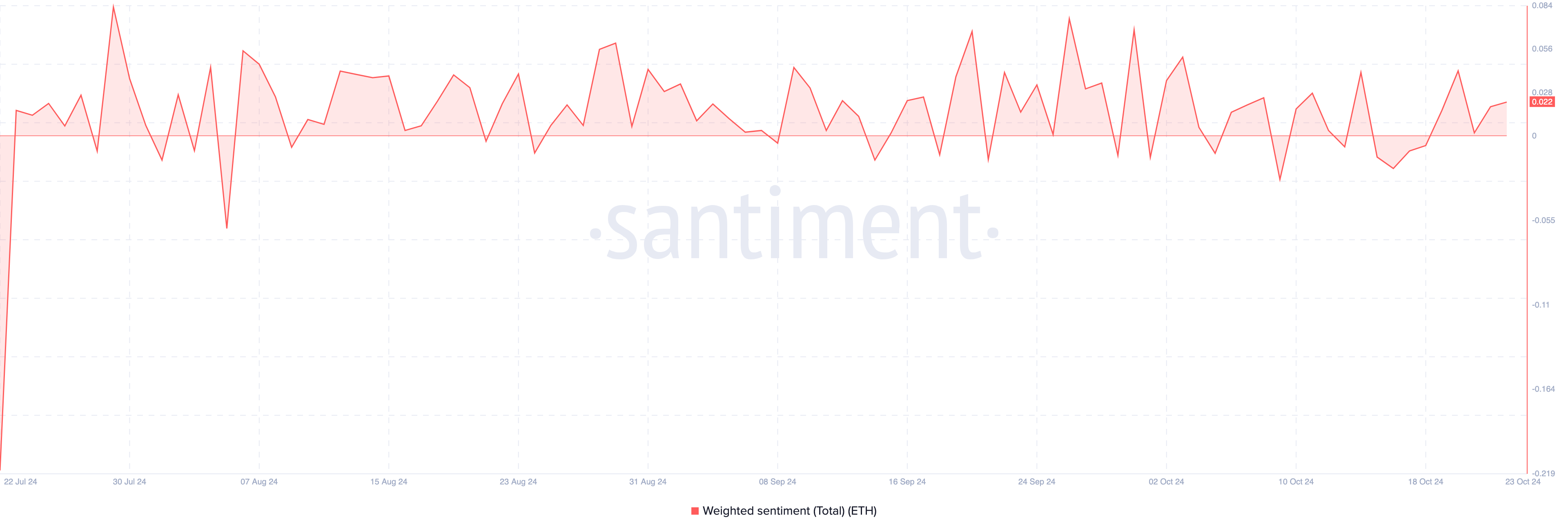

The Weighted Sentiment is another metric that suggests that ETH’s price could rebound. This metric measures the perception market participants have about a cryptocurrency. When it increases, the broader sentiment is bullish and can lead to increased demand

Conversely, a decrease implies that market participants are cautious about buying the cryptocurrency. In that scenario, it becomes challenging for the price to increase.

According to Santiment, Ethereum’s Weighted Sentiment has bounced off the neutral line to the positive sentiment, suggesting that ETH’s price could see increased demand.

ETH Price Prediction: After the Decline Comes the Bounce

Currently, Ethereum’s price is around $2,556. On the daily chart, ETH has formed an inverse head-and-shoulders pattern, a bearish to bullish technical pattern.

Even though Ethereum’s price has decreased, this pattern suggests that the trend will soon reverse to the upside. If this is the case, Ethereum bulls are likely to defend the $2,457 region.

Read More: Ethereum (ETH) Price Prediction 2024/2025/2030

If validated, then the altcoin might rally toward $2,839. In a highly bullish situation, it could climb as high as $3,010. However, the failure of bulls to defend the underlying support might invalidate this forecast. In that scenario, ETH could decline to $2,116.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/ethereum-bulls-aim-to-hold-eth-support/

2024-10-23 19:00:00