It has been almost three months since the launch of the exchange-traded funds tracking the performance of the second-largest cryptocurrency, and CryptoQuant decided to observe the differences between their inflows compared to the data from the BTC ETFs’ initial days.

The numbers don’t lie, and they clearly rule in favor of BTC.

ETF Battle Between BTC and ETH

Although the highly anticipated bull run in this halving year has yet to transpire, 2024 will go down in the history books as the one when two cryptocurrencies received massive validation by US regulators by having their own ETFs. Naturally, Bitcoin led the pack, and 11 such funds saw the light of day in mid-January after over a decade of rejections by the US Securities and Exchange Commission.

Ethereum’s path was similar, and it perhaps faced some more hurdles in the end. Nevertheless, seven such financial vehicles were launched in late July.

The similarities end here as investors’ perception and behavior toward the two assets have been entirely different. CryptoQuant’s data from the first 79 days after the ETFs’ respective launches confirms previous CryptoPotato reports that the demand for Ethereum is missing while the interest in Bitcoin was (and sometimes still is) substantial.

Within the first few months of trading, the ETH ETFs saw more than $4 billion in net outflows. The same timeframe for the BTC ETFs shows net inflows of over $29 billion.

The #Ethereum ETF is showing signs of weak demand, with outflows observed, while the #Bitcoin ETF has experienced significant inflows.

After 79 days of ETF trading:$BTC ETF Flow: +$29.1B$ETH ETF Flow: -$4.1B pic.twitter.com/b9ss5tUuA0

— CryptoQuant.com (@cryptoquant_com) October 10, 2024

ETH vs. BTC Price Performances

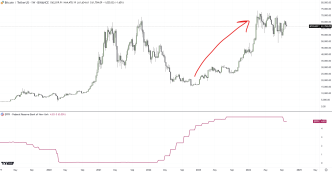

The spot Ethereum ETFs went live on July 23, and the underlying asset’s price stood at around $3,500 that day. Since then, it has lost over a grand and now sits below $2,400, representing a 32% decline within the aforementioned 79 trading days.

BTC’s price traded at around $47,000 on the day the ETFs launched (January 11) and faced immense volatility immediately. However, it skyrocketed to a new all-time high of $73,800 within two months, and even though it had retraced by the 79th trading day (May 3), it still stood at approximately $60,000.

This means that the largest cryptocurrency had gained about 28% of value in the first 79 days of ETF trading in the States, while the products attracted more than $29 billion in net inflows. And, as mentioned above, the landscape around the Ethereum ETFs is quite the opposite.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Source link

Jordan Lyanchev

https://cryptopotato.com/79-days-after-launching-heres-the-massive-difference-between-bitcoin-etfs-and-ethereum-etfs/

2024-10-10 12:58:12