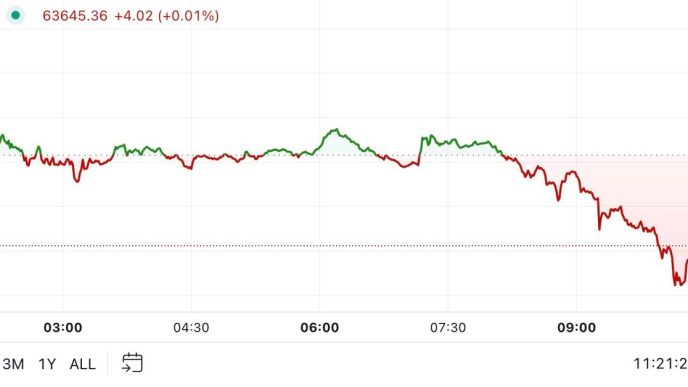

Even with today’s correction that has pushed its price south by almost three grand, BTC is on the verge of closing its most bullish September in over a decade.

Here are some of the possible reasons behind this rather unexpected increase during the month, especially its second part, and speculation about whether it could sustain and double down on the rally.

ETF Inflows

CryptoQuant’s analysis began by outlining the growing net inflows toward the spot Bitcoin ETFs. As previously reported, the BTC-based products attracted over $1 billion in the past week alone and have been in the green for 13 out of the last 15 trading days. This impressive trend began on September 9, shortly after BTC’s price plunge below $53,000 (September 7).

As such, the timing between the two seems like more than just a coincidence.

2/ The strong momentum is partly driven by increased demand for the Bitcoin Spot ETF.

Last week saw positive Bitcoin ETF flows, with BlackRock, Fidelity, and Ark reporting combined inflows of $324 million on September 26th, signaling strong demand from U.S. investors. pic.twitter.com/GGr5xkHjp6

— CryptoQuant.com (@cryptoquant_com) September 29, 2024

The monitoring resource further said that some of the investors in the spot Bitcoin ETFs have become Long-Term Holders since the supply they own has passed the 155-day mark. However, this could be the first worrying sign, CryptoQuant added, because “such shifts often happen in the late stages of a bull market.”

5/ Spot Bitcoin ETF holdings are transformed into Long-Term Holder Supply

Spot Bitcoin ETF supply is shifting to Long-Term Holder Supply as coins pass the 155-day mark. While this may seem bullish, such shifts often happen in the late stages of a bull market. pic.twitter.com/qMPE3ZVMvC

— CryptoQuant.com (@cryptoquant_com) September 29, 2024

Consequences of the Rally

Due to BTC’s 20% surge from under $53,000 to $63,500 put many investors back in profit. The percentage had shot above 90% when the asset’s price hovered above $65,000.

CQ focused more on Short-Term Holders, those holding BTC for 155 days or less. Their average purchases came at a price of $63,000, which means that this level will now act as support. BTC could tumble should the majority of them decide to sell off their stash with minor gains.

The last worrying sign brought up by CryptoQuant involved the futures market, which seems to be overheating. Open Interest has grown to over $19 billion, which could lead to trouble given the 2024 performances during similar occasions.

4/ The futures market is showing signs of overheating

Open Interest is around $19.1 billion. Since March 2024, it has surpassed $18.0 billion six times, each leading to a price drop. This marks the seventh occurrence. pic.twitter.com/NYyJL5PjOt

— CryptoQuant.com (@cryptoquant_com) September 29, 2024

Bonus: The Fed

When discussing potential reasons behind BTC’s price surge from early September until now, it’s worth mentioning the Federal Reserve, which the CQ’s analysis missed. The US central bank announced on September 18 a key interest rate cut of 0.5%, which was the first in over four years.

BTC’s price stood at $59,000 at the time but soared past $66,500 in the next week or so. This is because bitcoin, which is still considered a riskier asset, is among the biggest beneficiaries of lower interest rates as “money becomes cheaper.”

Consequently, it would be compelling to follow what the Fed will do next, and its Chair, Jerome Powell, is expected to provide more information about the bank’s policy later today, September 30. With even more rate slashes anticipated by the Fed, BTC’s price could indeed resume its bullish rally and even fight for a new all-time high by the end of the year.

The post Here’s Why Bitcoin Gained Over 20% in 3 Weeks: But Can it Go Higher? appeared first on CryptoPotato.

Source link

Jordan Lyanchev

https://cryptopotato.com/heres-why-bitcoin-gained-over-20-in-3-weeks-but-can-it-go-higher/

2024-09-30 11:44:57