Bitcoin recently recovered from a correction that pushed its price to $89,000, reigniting bullish momentum in the market.

While the drop was alarming, it didn’t significantly impact market sentiment. Bitcoin now stands stronger than before, poised for a potential rally to new heights.

Bitcoin Investors Are Still In Profit

The MVRV Ratio, currently at 1.32, reflects Bitcoin’s positive market sentiment. This metric, which compares Bitcoin’s spot price to its realized price, shows that the average BTC unit holds an unrealized profit of 32%, according to a Glassnode report. This is reminiscent of post-ATH behavior in mid-April 2024, highlighting bullish sentiment despite the recent correction.

Additionally, Bitcoin’s MVRV Ratio aligns with the market’s recovery trajectory, reflecting traders’ confidence. Even after the correction, the positive sentiment persisted, suggesting that investors remain optimistic about BTC’s long-term potential. This metric supports Bitcoin’s current path toward breaking key resistance levels and forming a new rally.

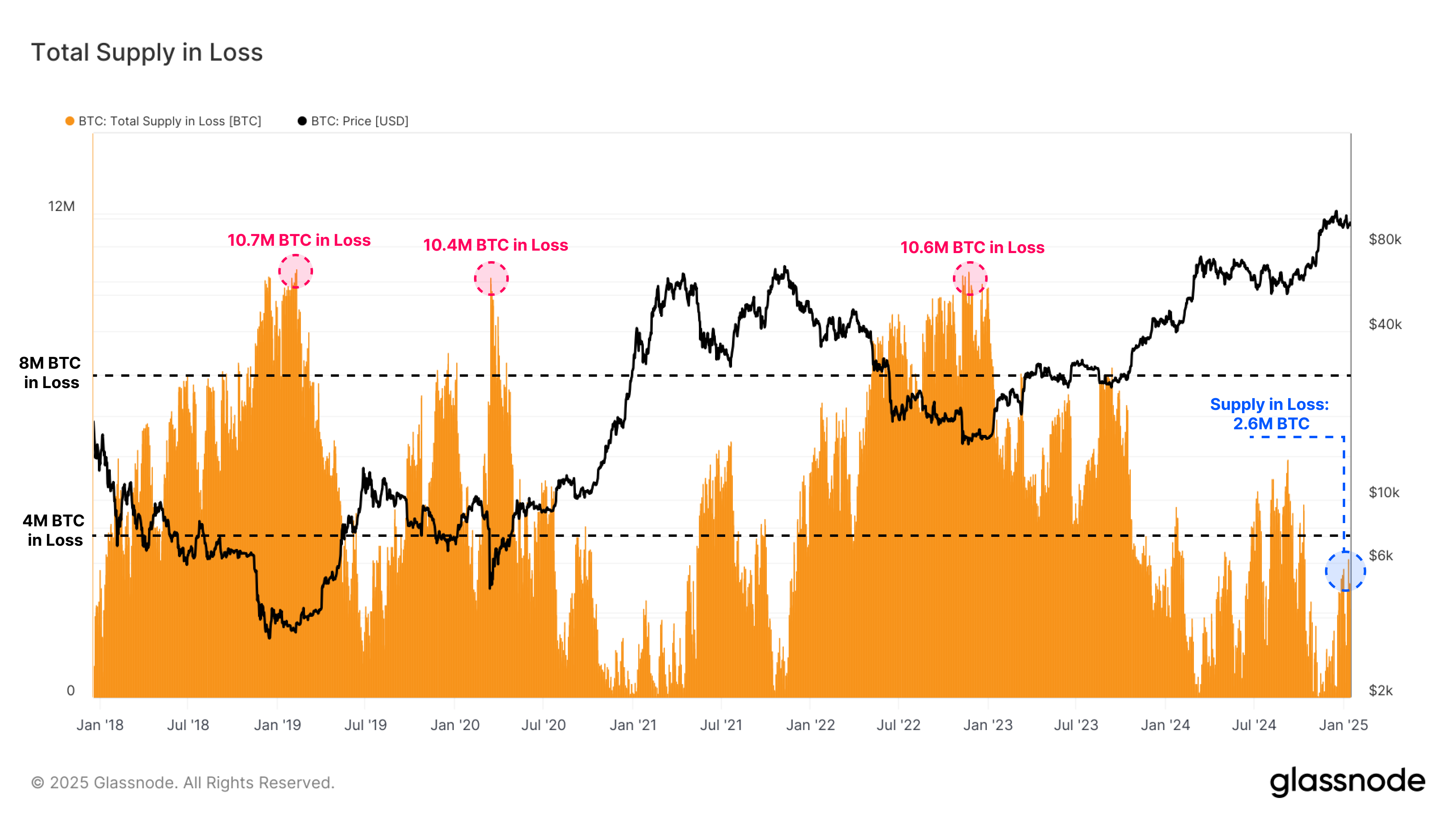

Bitcoin’s unrealized losses have shown remarkable resilience, even during its dip to $89,000. Historically, unrealized losses above 4 million BTC indicate the onset of a bear market. However, the recent correction didn’t push unrealized losses beyond this threshold, affirming the active presence of a bull market.

This stability demonstrates that Bitcoin holders are not succumbing to market pressure, maintaining their positions despite short-term fluctuations. Such behavior aligns with a bullish macro environment, increasing the likelihood of a sustained upward trend in Bitcoin’s price.

BTC Price Prediction: Rally Ahead

Bitcoin’s price currently stands at $101,394, nearing the neckline of a double-bottom pattern visible on the daily chart. A breakout above the $102,235 neckline could trigger an 11% rally, targeting $113,428. This pattern reinforces Bitcoin’s upward momentum and signals its readiness for another major rally.

To achieve this target, Bitcoin must establish support at $106,193 or $108,341. These levels are crucial for sustaining the rally and preventing a reversal. Securing these supports would solidify BTC’s bullish thesis, encouraging further investor confidence.

However, failing to breach $102,235 could spell trouble for Bitcoin. Such a scenario could lead to a drop below $100,000, with the next critical support at $95,668. This would invalidate the bullish outlook, potentially setting the crypto king back significantly.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bitcoin-price-rise-likely-bull-market-remains-intact/

2025-01-17 10:00:00