Just a few days ago, Popcat (POPCAT) traders were fully invested in the Solana meme coin, confidently betting on a price increase and reaping profits. However, after hitting a new all-time high on October 29, that sentiment has shifted.

Rather than maintaining their bullish positions, traders are now exercising caution. This on-chain analysis reveals everything happening with the situation.

Popcat Bullish Sentiment Fades

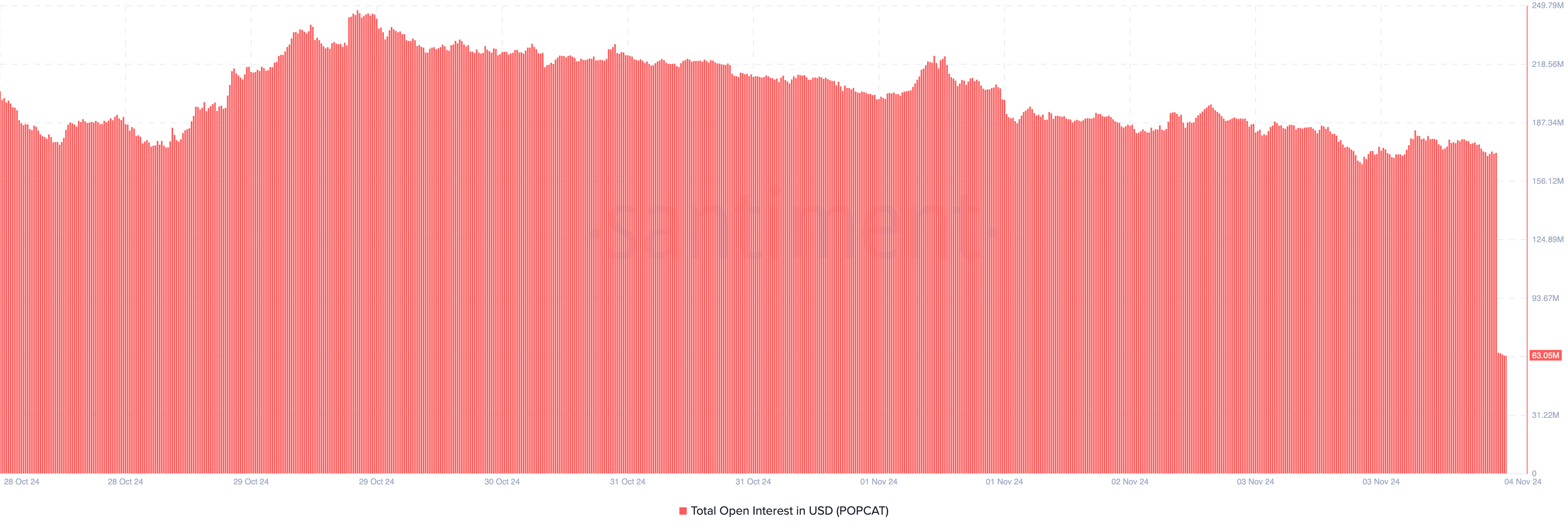

Today, November 4, Santiment data shows that Popcat’s Funding rate has dropped to the negative zone. For context, the Funding rate is the cost of holding an open position in the derivatives market.

When the funding rate is positive, traders with long positions pay a funding fee to shorts, and the average expectation is bullish. On the other hand, a negative funding rate indicates that shorts are paying longs, and the broader sentiment is bearish, which is the case with POPCAT traders.

In essence, the current funding rate combined with POPCAT’s price increase indicates that spot traders are aggressive, and this is potentially bearish for the meme coin.

Read more: How to Buy Solana Meme Coins: A Step-By-Step Guide

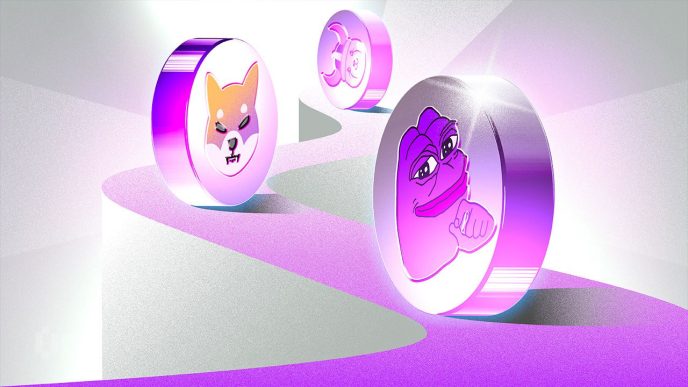

Further evidence of this sentiment is shown in the Open Interest (OI). The OI gauges the level of speculative activity around a cryptocurrency. When it rises, it means that traders are opening more contracts and adding money to the derivatives market.

A decline in OI indicates that traders are increasingly closing their positions, which is bearish for the involved cryptocurrency. In Popcat’s case, the falling OI combined with the price decrease suggests that a recovery will be challenging for the meme coin, making a rise to $2 unlikely in the short term.

POPCAT Price Prediction: Lower Lows

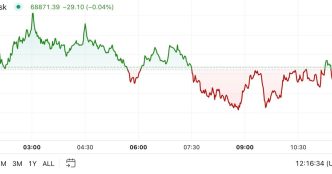

On the daily chart, POPCAT’s price has fallen to $1.28. Additionally, the Parabolic Stop and Reverse (SAR) indicator sits above the meme coin’s value. This technical indicator helps identify an asset’s price direction, signaling a potential downtrend for POPCAT.

When the dotted lines of the indicator are below the price, the trend is upward. Currently, the dotted lines of the parabolic SAR are above POPCAT’s value.

Read more: 11 Top Solana Meme Coins to Watch in November 2024

Considering this position, Popcat traders might be right to exercise caution, as the price could drop to $1.04. In a highly bearish situation, the meme coin could decrease to $0.85.

On the other hand, if buying pressure increases, the token could bounce, possibly climbing to $1.82 or as high as $2.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/popcat-traders-bearish/

2024-11-04 13:00:00