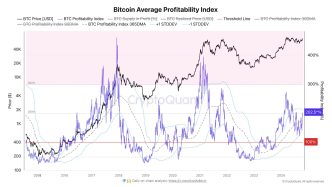

The Bitcoin price briefly crashed below $67,000 on October 21, although it quickly reclaimed this level as support before the daily close. This price decline is believed to be due to its correlation with the stock market, which also experienced a drop of its own.

Why The Bitcoin Price Dropped Below $67,000

The Bitcoin price dropped below $67,000 primarily thanks to its correlation to the US stock market. IntoTheBlock data shows that the correlation between the flagship crypto and the S&P 500 is currently at 0.63, which indicates a strong positive price correlation. The S&P 500 and Dow index dropped from their record highs on October 21 ahead of earnings reports.

Related Reading

The stock market drop and the Bitcoin price crash are believed to be driven by uncertainty in the macro environment. This market uncertainty stems from the rising inflation expectations and concerns about how government spending is contributing to this development. As such, market participants are currently cautious about their next move, with some waiting to see what steps the US Federal Reserve will take to keep inflation within their 2% target.

The upcoming US election has also contributed to the market’s uncertainty, especially with the presidential race between Donald Trump and Kamala Harris looking to be a tight one. It isn’t unusual for traders to wait on the sidelines until after the elections to gain certainty about the market outlook under the new President.

Other Factors Contributing To The Price Crash

Analyst Justin Bennett cited the “open interest (OI) being at July highs, whales trimming longs and the last week’s perp-driven rally” as other factors contributing to the Bitcoin price crash. He claimed that these factors alongside the upcoming US elections are what caused the price crash.

Regarding the impact of the US election, the analyst noted that the markets usually derisk ahead of the US presidential election, which is now thirteen days away. He remarked that it would have been a “calamity” if the markets didn’t derisk ahead of time and continued to pump into election night.

Related Reading

Bennett made this statement while noting why he had anticipated a pullback for Bitcoin and other crypto assets. Indeed, the analyst has since last week been stating that the flagship crypto would soon experience a price correction. He had before now mentioned that he wouldn’t be surprised if the BTC price corrects to around $63,000.

In a more recent X post, he highlighted the $65,800 range as the first test for the Bitcoin price. A hold above this level could invalidate his trade setup.

At the time of writing, the Bitcoin price is trading at around $67,700, down almost 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Scott Matherson

https://www.newsbtc.com/news/bitcoin/bitcoin-price-sharp-crash-67000/

2024-10-22 15:00:26