In 10 days, modular blockchain project Celestia (TIA) will release 80.77% of its circulating supply, valued at $1.05 billion. This impending token release has sparked concerns about potential selling pressure, which could affect TIA’s price.

BeInCrypto explores how the altcoin, which has experienced volatile price swings in recent days, might perform before the event.

Celestia Faces Selling Pressure as Huge Token Unlock Approaches

For Celestia, this upcoming token release represents one of the largest since the project’s inception. As a result, TIA’s price is expected to face significant volatility in the lead-up to the event.

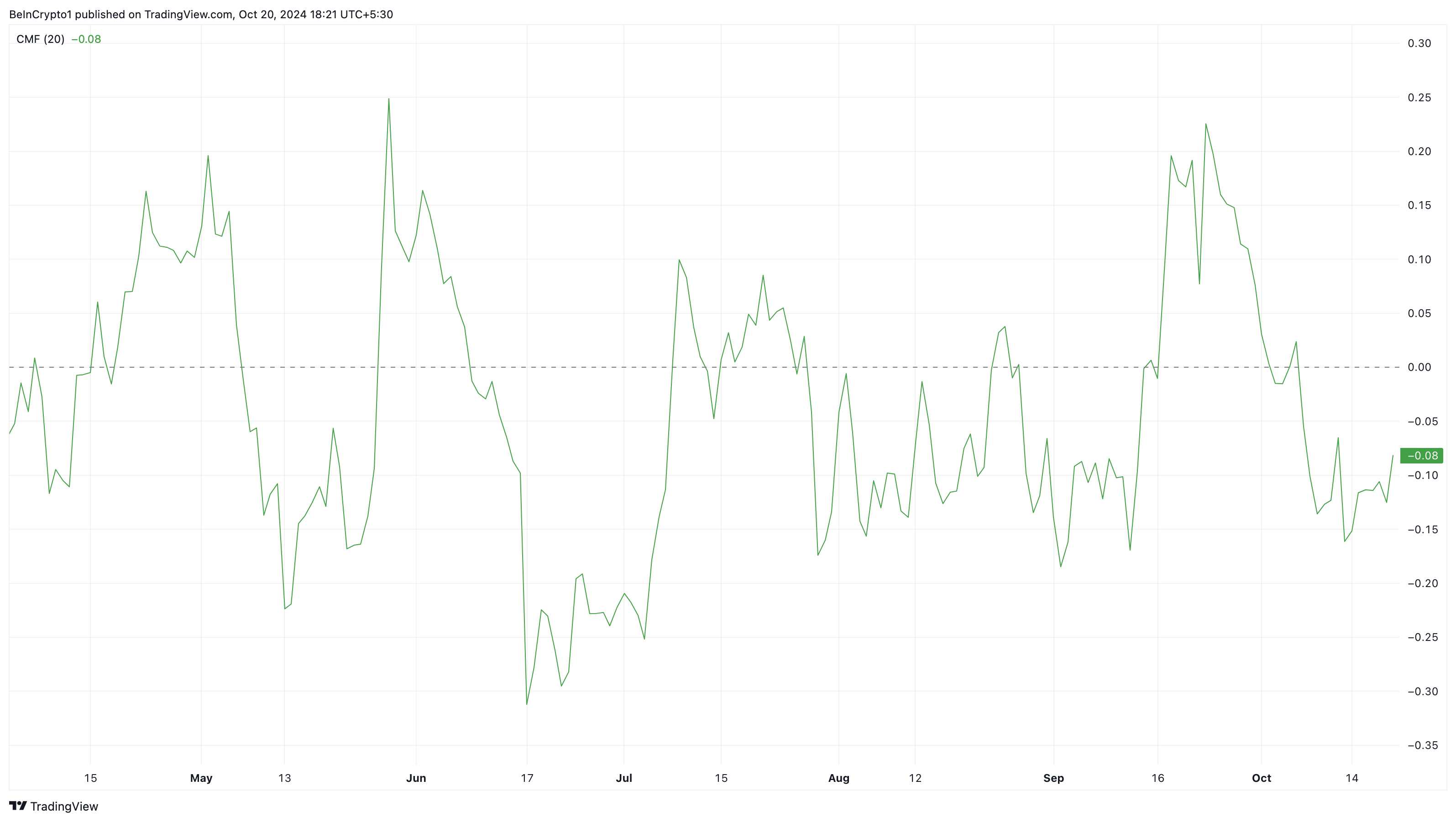

Currently, Celestia’s price is $5.95 and has been hovering around that same region for some time. However, based on the signal from the Chaikin Money Flow (CMF), the altcoin might drop below $5.

Read more: Top 5 Blockchain Protocols For End-to-End Transaction Security

The CMF is a volume-weighted oscillator that tracks the flow of money into or out of a cryptocurrency over a set period. It’s commonly used to identify trends, spot potential reversals, and gauge overbought or oversold conditions.

Furthermore, the indicator oscillates above and below zero, with positive readings indicating an uptrend and negative readings indicating a downtrend. As seen below, the CMF reading is in thhe negative region, suggesting that TIA’s price might soon experience a significant downturn.

TIA Price Prediction: Bears to Put It Below $4

From a technical perspective, the TIA/USD chart shows the formation of a head and shoulders pattern. This pattern is a chart formation that signals a potential bullish-to-bearish trend reversal in a cryptocurrency’s price.

Typically, when an asset’s price drops below the neckline of the pattern, a significant correction appears. On the other hand, a rise above the neckline invalidates this prediction. Based on the chart below, Celestai’s price looks likely to drop below the neckline at $4.73.

If that happens, the token’s value could sink to $3.87. However, if bulls defend the token from declining below $4.73, the drawdown might not happen.

Read more: 10 Best Altcoin Exchanges In 2024

In that case, TIA could surge to $7.30, and after the supply shock, the altcoin might rise to $10.40 if buying pressure increases.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/celestia-price-enters-critical-phase/

2024-10-20 18:00:00