Despite the recent decline, Bitcoin is seeing an interesting shift in investor behavior, with analysts like Crypto Tony betting on possible bullish momentum in the near future. Though the market is still highly unpredictable, a tendency for consolidation and holding on to gains is slowly showing up.

Related Reading

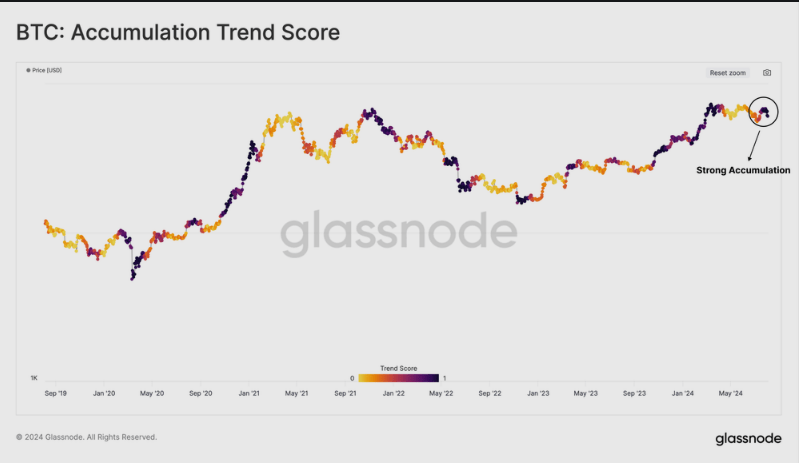

Crypto Tony recently commented that a break above could show the beginning of a new uptrend, referring to $58,300 as the key resistance level. The most recent data from Glassnode makes a move in this direction, which indicates that though the price of Bitcoin remains highly unstable, key players may be preparing for a new phase of accumulation.

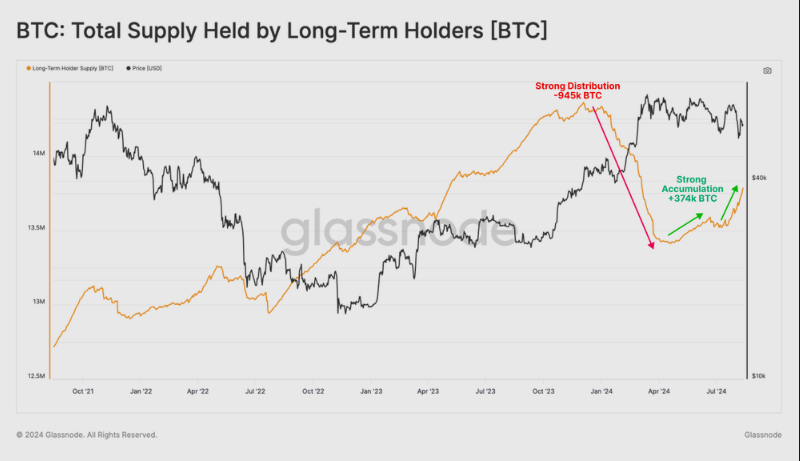

This comes after a spell of distribution that has been going on for several periods to wallets of all sizes. Following the all-time high of bitcoin back in March, investors sold their holdings for quite a while. However, it now appears that this trend is reversing and for the larger wallets often affiliated with exchange-traded funds. Major entities seem to once again start hoarding Bitcoin en masse—a potentially optimistic sign for the crypto’s future.

Bitcoin Long-Term Owners Change Course

The behavior of long-term holders is also changing course. LTHs are showing a renewed propensity to hang onto their assets after selling during the ATH run-up. In the past three months alone, more than 374,000 BTC have changed into LTH status. That means a large portion of investors are choosing to hold rather than sell, and it might just be the development to prop Bitcoin’s price in the upcoming months.

Bitcoin accumulation now sits at 1.0 of the Accumulation Trend Score (ATS), which measures the weighted balance globally—thanks to high buying in the past month, particularly from long-term holders. These holders were previously in a so-called “phase distribution”; it seems things have changed. Their newfound interest in Bitcoin holdings could mean that confidence in the market is rising.

Spot Price Continues To Be Above Critical Level

Another positive is that the current price of bitcoin has continued to remain above the Active Investor Cost Basis (AICB). This measure for active coins indicates the average purchase cost. On a spot basis, remaining above this level does appear to be a strong indication of the market, even considering the aggressive distribution from April to July. It seems that investors are riding the brisk momentum that may shortly ensue and are preparing for an upward trend.

Weekly above $58,300 is the main goal for the bulls this week. Could provide a good base if we get it pic.twitter.com/CeSUHqDmSa

— Crypto Tony (@CryptoTony__) August 13, 2024

Key Long-Term Level Of Resistance To Watch

From a macro perspective, Bitcoin approaches a make-or-break level. Analysts have called $58,300 as a key level to watch. Crypto Tony commented that if Bitcoin were able to close above this resistance, it would be the start of something more interesting. In other words, this resistance level would present itself as an important obstacle to overcome, and if it does, tremendous buying pressure would likely ensue.

Related Reading

It’s also important to keep an eye on whale activity across the market. After all, massive trades from these larger investors can easily create large changes in the market. As Bitcoin nears the $58,300 level, activities from these whales could prove to be very important in determining the next trend.

Featured image from Pexels, chart from TradingView

Source link

Christian Encila

https://www.newsbtc.com/news/hodling-resurgence-374000-bitcoin-transfer-ignites-crypto-recovery/

2024-08-14 12:00:41