As market sentiment continues to shift towards the bullish end, Bitcoin (BTC) price also appears to be towing the same path. With an 8.50% increase in the last seven days, the cryptocurrency is eyeing levels that could bring in substantial profits for its holders.

Beyond that, this on-chain analysis explains how this potential price surge could precede a new all-time high before the next quarter winds down.

Bitcoin Gives Bull Run Alert

According to crypto asset management firm 10x Research, Bitcoin is preparing for an explosive move. However, in its weekly report dated September 22, 10x Research stated that BTC needs to retest two key levels before the prediction can be validated.

“The two key levels to watch for Bitcoin are the previous cycle high of $68,330 and the 21-week moving average. Dropping below the moving average could signal the end of the current cycle, while breaking above it— especially if the previous cycle high comes into play — could indicate an extension,” Thielen wrote in the report.

Interestingly, this forecast is in line with BeInnCrypto’s prediction last week that Bitcoin price is set for a new all-time high. Backing up the thesis, the firm notes that the broader crypto market liquidity is hitting new highs. As such, BTC could gain from the influx.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

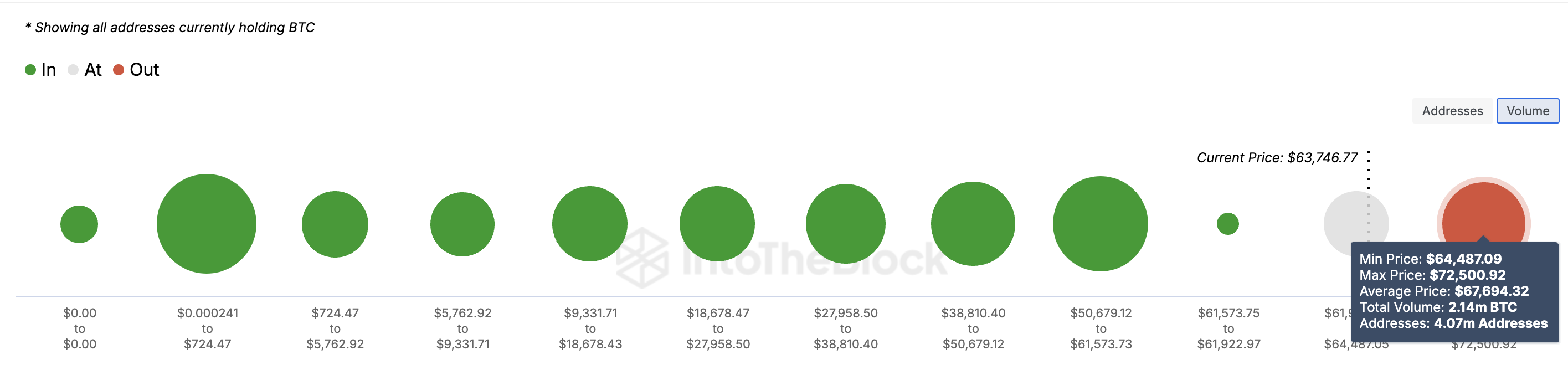

Based on IntoTheBlock’s data, Bitcoin’s potential run to $68,000 could unleash profits not seen in a long time. Using the Global In/Out of Money (GIOM), BeInCrypto observes that over 4 million addresses holding 2.14 million BTC at an average price of $67,694 are in losses.

With Bitcoin’s bullish outlook, the coin could be set to extend gain for these holders. Thus, a rally to $68,000 could translate to $145 billion in gains and make almost every Bitcoin holder profitable.

BTC Price Prediction: $76,000 Nearby

On the weekly chart, Bitcoin’s recent price surge has formed a bullish flag pattern. A steep rise forms the “flagpole,” followed by a brief consolidation between two parallel trendlines, signaling the potential continuation of the uptrend.

Currently, Bitcoin is trading at $63,447. The bullish outlook strengthens with the support level holding at $55,016. For the rally to continue, Bitcoin needs to break through the $64,196 resistance. If successful, the next target could be above its all-time high, potentially reaching $76,035.

Read more: How To Trade Bitcoin Futures and Options Like a Pro in 2024

However, if Bitcoin faces rejection at this resistance, a downward move could follow. In such a case, the bullish prediction may be invalidated, and the price could retreat back to $55,000.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/bitcoin-price-to-bring-profits/

2024-09-23 08:44:01