BONK, a Solana meme coin, was on the verge of a significant breakout that could have resulted in a 92% rally. The coin had been trading within a bullish pattern, nearing a potential breakout that could have propelled its price toward its all-time high of $0.00004800.

However, a sudden shift in investor sentiment and market behavior caused BONK to miss this opportunity, leaving the token stuck in its downward trajectory.

BONK Loses Big-Time

The Chaikin Money Flow (CMF) indicator had been observing an uptick since early September, signaling increasing capital inflows into BONK. This was a positive sign, as it suggested that investors were becoming more confident in the meme coin’s potential. However, just as BONK approached a breakout from the critical resistance at $0.00002400, the CMF began to show a downtick.

This shift in the CMF indicator indicated that investors were pulling back, causing BONK to lose the momentum it needed to break through the resistance. The sudden change in sentiment played a pivotal role in the coin’s failure to capitalize on the potential rally, leaving it stuck below key resistance levels.

Read more: Bonk Airdrop Eligibility: Who Can Claim and How?

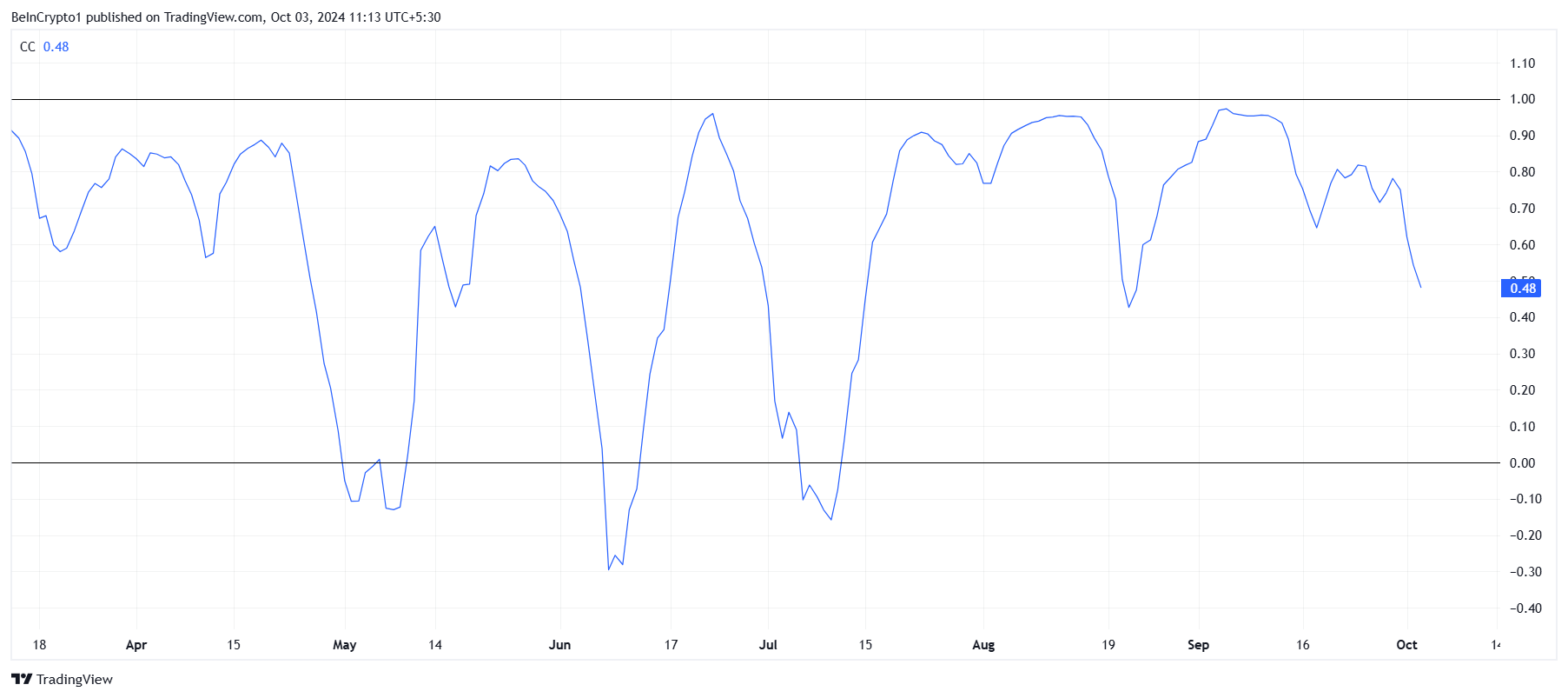

The broader macro momentum for BONK also presents challenges. BONK’s correlation with Bitcoin has been steadily declining, currently standing at 0.48.

This low correlation is a bearish sign, as it indicates that BONK is failing to benefit from Bitcoin’s recent recovery. Typically, altcoins with stronger correlations to Bitcoin can ride the wave of the crypto king’s rallies, but BONK appears to be missing out.

Without a strong correlation to Bitcoin, BONK lacks the external market support it needs to sustain a rally. This declining correlation could keep the meme coin subdued as it struggles to gain upward momentum independently of Bitcoin’s movements.

BONK Price Prediction: Slow Moves Ahead

BONK has been trading within a descending wedge since mid-May and was nearing a breakout this week. The pattern suggested a possible 92% rally upon breakout, potentially sending the coin back to its all-time high at $0.00004800. However, the failed breakout has dampened these expectations for the meme coin.

If BONK fails to maintain its current support at $0.00002153, it could enter a period of consolidation above $0.00001732, further delaying any potential bullish momentum. The coin will need stronger bullish cues to make another attempt at a rally.

Read more: 11 Top Solana Meme Coins to Watch in June 2024

However, if the broader crypto market turns bullish, BONK could see a reversal in its fortunes. A breakout would be confirmed if the resistance at $0.00002748 is flipped into support, which would invalidate the bearish outlook and potentially spark a rally toward previous highs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/bonk-price-fails-to-secure-rally/

2024-10-03 06:26:21