DePin token Helium’s (HNT) price has grown considerably in the last few days while the rest of the market struggled to recover.

While following Bitcoin’s example is usually considered to be the more beneficial option, HNT chose the other path and came out on top.

Helium Continues Its Gains

Helium’s price crossed the $7 mark over the last 24 hours for the first time in a little over four months. The reason behind this growth has been the altcoin’s decision to step away from the king of cryptocurrencies, Bitcoin.

Since the beginning of August, HNT’s correlation with Bitcoin has deteriorated, currently standing at 0.05. This weakening correlation has been notable as Bitcoin has been experiencing bearish conditions over the past few days.

Read More: Helium Staking for Beginners: Earn Passive Income With HNT

Despite Bitcoin’s recent downturn, the DePin token has managed to rally, which is likely influenced by this declining correlation. The separation from Bitcoin’s performance has been providing HNT with an opportunity to move independently.

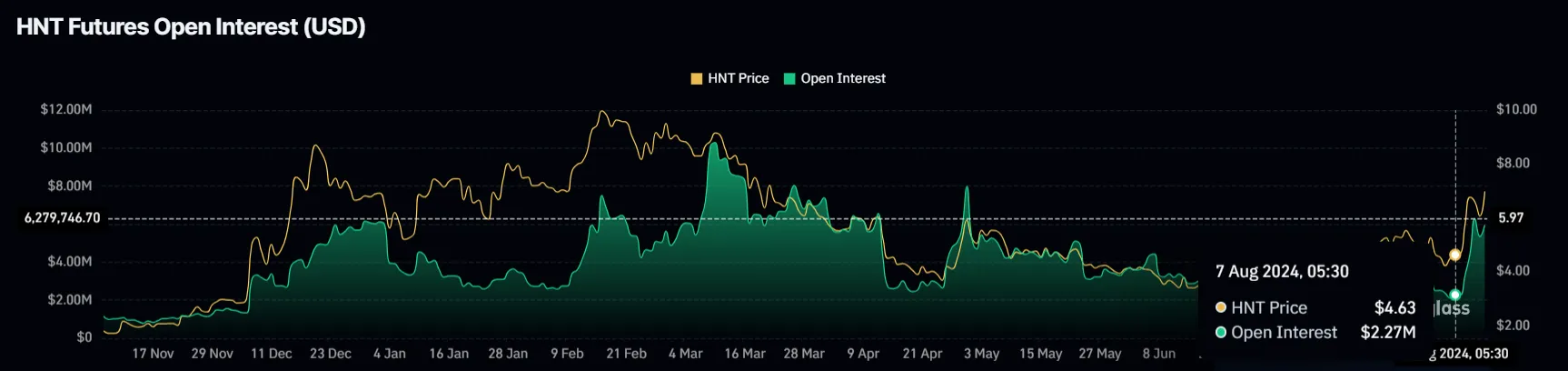

Additionally, the rise in HNT’s price could be sustained by increased investor interest, as indicated by a significant increase in Open Interest. Over the past week, Open Interest has surged from $2.26 million to $5.95 million.

This more than doubled the open interest rate, reflecting growing investor confidence and participation. If this momentum persists, HNT’s bullish trend might continue.

HNT Price Prediction: Up Next, $8

Helium’s price benefit from separating from Bitcoin’s price action could be noted in a further rally. The altcoin is currently at $6.47, attempting to secure $6.33 as a support floor. This would enable HNT to note further rise.

Looking at Helium’s past performance at price, HNT could face consolidation upon rallying. This is because $8 is a key barrier that would require stronger bullish momentum to break through.

Read More: Helium (HNT) Price Prediction 2024/2025/2030

However, the price could take a hit if HNT holders move to book profits and sell their holdings. As a result, the DePin token could lose its support at $6.33, sending it to the psychological support of $5 and invalidating the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/depin-token-heliums-hnt-price-rallies/

2024-08-13 16:00:00