Yesterday, November 13, crypto exchange Coinbase listed the frog-themed meme coin Pepe (PEPE) on its spot market. Moments after the disclosure, the price jumped and has now increased by 75% within the last 24 hours.

While the PEPE Coinbase listing appears to be a promising development for token holders, this on-chain analysis suggests that the price could soon lose some of its recent gains.

Pepe Holders Book Profits After Surge

During the early trading hours yesterday, PEPE’s price was around $0.000013. However, a cryptic post on X by Coinbase’s Chief Legal Officer, Paul Grewal, revealed that the exchange would list the meme coin.

“You’ve long wanted the frog. Well, soon you’ll get the frog. Coinbase is adding PEPE to our listing roadmap with the goal of listing later today. Thanks for your patience,” Grewal wrote.

Coinbase also confirmed the listing with a frog emoji around the same time, and as expected, it officially listed on the exchange later that day. Interestingly, the announcement also coincided with Robinhood’s decision to list the meme coin, which eventually drove PEPE’s price to $0.000022.

Furthermore, PEPE’s price increase drove the transaction volume in profit to hit $53.14 trillion, valued at $1.16 billion. From a price perspective, a rise in this metric indicated selling pressure. Therefore, it is likely that the token will experience a drawdown in the short term.

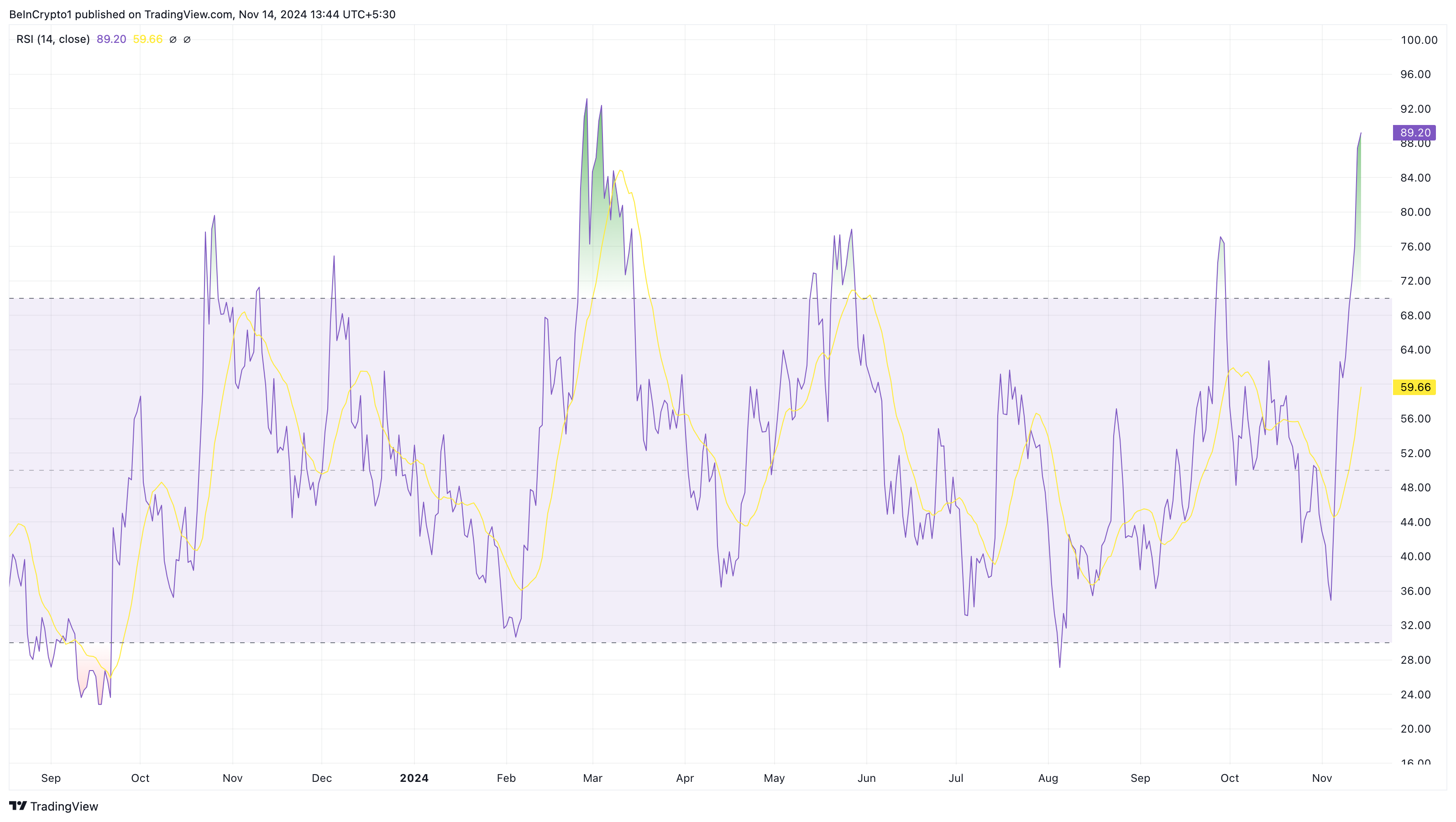

While profit-taking has decreased as of this writing, the Relative Strength Index (RSI) suggests that PEPE might still undergo a brief decline. The RSI is a momentum oscillator used to evaluate the speed and magnitude of a cryptocurrency’s recent price movements. It oscillates between 0 and 100, typically identifying overbought or oversold conditions.

When the RSI is above 70, it suggests that the asset may be overvalued and could be due for a price correction. On the other hand, if it is below 30, it suggests that the asset may be due for a potential price rebound.

According to the image below, the PEPE Coinbase listing has driven the indicators’ readings well above the minimum overbought point. Therefore, PEPE’s price is likely to retrace.

PEPE Price Prediction: Potential Decline Ahead

On the daily chart, the token hit a new all-time high of $0.000023. While there appears to be no resistance at the overhead levels, the overbought condition suggests that the token might pull back.

If that happens, PEPE’s price could drop to $0.000019, where the 23.6% Fibonacci retracement indicator positions. Also, if profit-taking after this PEPE Coinbase listing intensifies, the drawdown could be as low as $0.000015.

On the other hand, if buying pressure continues to increase, that might not happen. In that scenario, the meme coin could rally to $0.000026.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/pepe-coinbase-listing-profit-taking/

2024-11-14 10:00:00