Solana’s (SOL) effort to reclaim its all-time high has faced strong resistance. This struggle has also allowed Solana bears to drive the price lower as it continues to hover around $238.

For now, SOL holders may be hoping for a swift recovery, but the latest outlook analyzed here suggests that might not be on the horizon.

High Liquidity at Low Range for Solana

The liquidation heatmap is one indicator suggesting that SOL’s price could be primed for a drawdown. The heatmap predicts price levels where major liquidations might occur and helps to understand the high liquidity areas on the order books.

For instance, if there is a high concentration of liquidity in a particular area, the heatmap color changes from purple to yellow. In most cases, this change in color suggests that the cryptocurrency’s price might move toward that region. On the other hand, if the concentration is low, the color remains purple.

Looking at the three-day timeframe, the liquidation heatmap shows a high concentration of liquidity at $246. However, another one also holds at $225, which seems to be a support level. With low trading volume, Solana bears are likely to push the altcoin’s price toward or below this point.

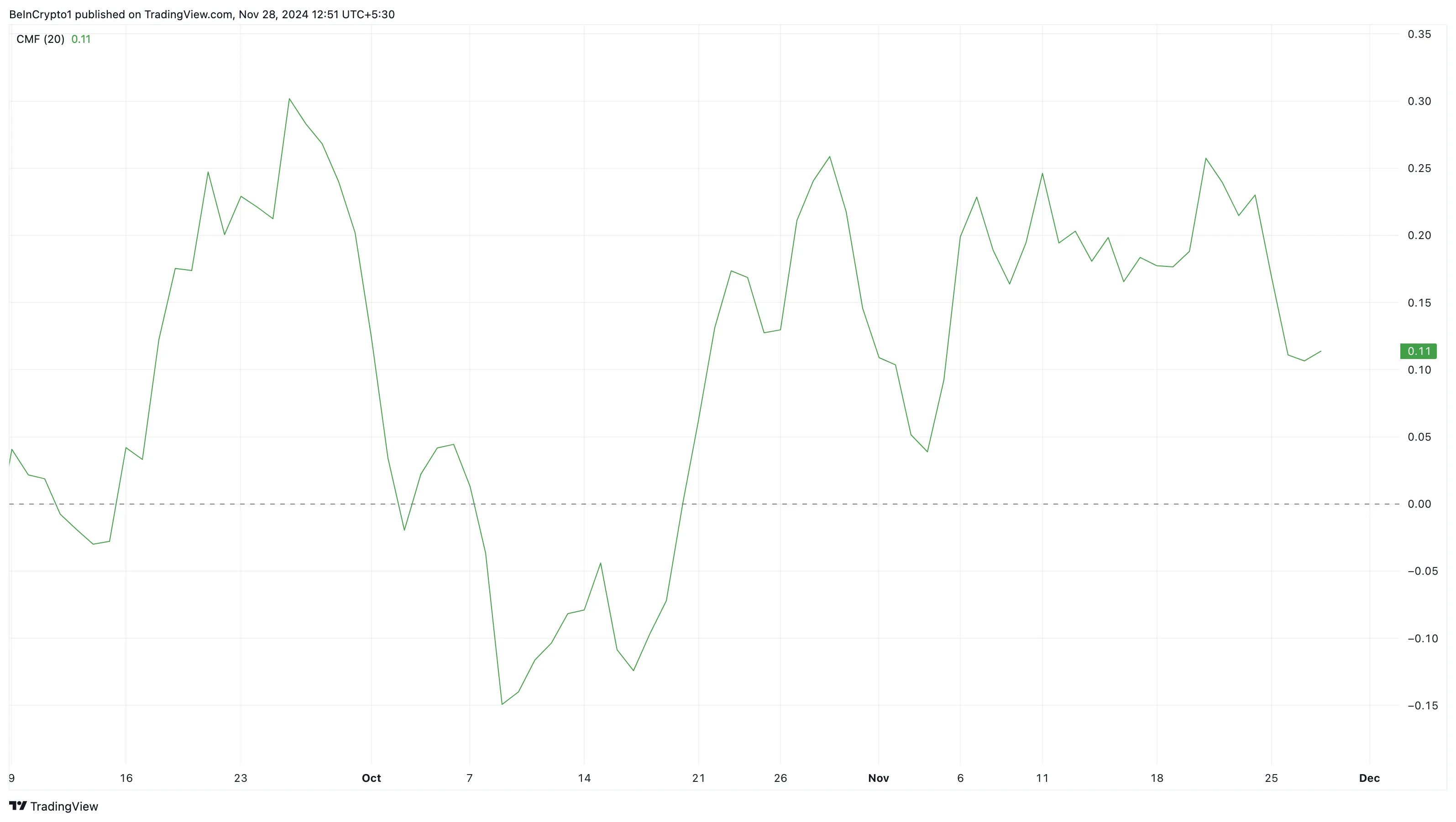

Additionally, the daily SOL/USD chart reveals a decline in the Chaikin Money Flow (CMF) metric, which tracks liquidity flow in and out of a cryptocurrency.

An increasing CMF indicates heightened buying pressure, indicating a potential price rise. Conversely, a declining CMF reflects growing selling pressure and an outflow of capital, which typically suggests a price drop.

In Solana’s case, the falling CMF aligns with rising selling pressure, reinforcing the likelihood of further price declines, as previously highlighted.

SOL Price Prediction: $300 Is Not Close Anymore

Another assessment of the daily chart reveals that the Balance of Power (BoP) has fallen into the negative zone. The BoP is a price-based indicator that compares the strength of bulls to that of bears.

When the reading rises and is positive, it means that bulls have the upper hand. But in this case, it appears that Solana bears are in control. Should this trend remain the same, then SOL’s price could drop below $225.

If sustained, the Fibonacci retracement indicator suggests that the altcoin could drop to the 23.6% level around $222. In a highly bearish situation, it coud decrease to $200.

However, if buying pressure increases, that might not happen. In that scenario, the altcoin’s value could rise to $265.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/solana-bears-threaten-support/

2024-11-28 09:30:00