For most of the past few months, Telegram airdrops dominated the crypto market, fueling massive growth in Toncoin (TON) network activity. However, active addresses on the TON blockchain have now dropped to their lowest level since April.

But why has this suddenly dropped? This analysis highlights the causes and the potential impact it could have on Toncoin’s price

Telegram Users’ Disappointment Casts Doubt on Toncoin’s Recovery

Between August and September, Toncoin’s active addresses reached notable heights. That surge could be attributed to the launch of several Telegram airdrops, which market participants thought would return profitable gains.

In August, Telegram-native meme coin DOGS distributed over 40 billion tokens to eligible messaging app users. This was followed by the September launch of the widely adopted tap-to-earn mini-app game Hamster Kombat.

However, user reactions to both events revealed widespread dissatisfaction with the value of the airdropped tokens. Despite the hype before the Token Generation Event (TGE), many recipients expressed disappointment with the value of the tokens distributed.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

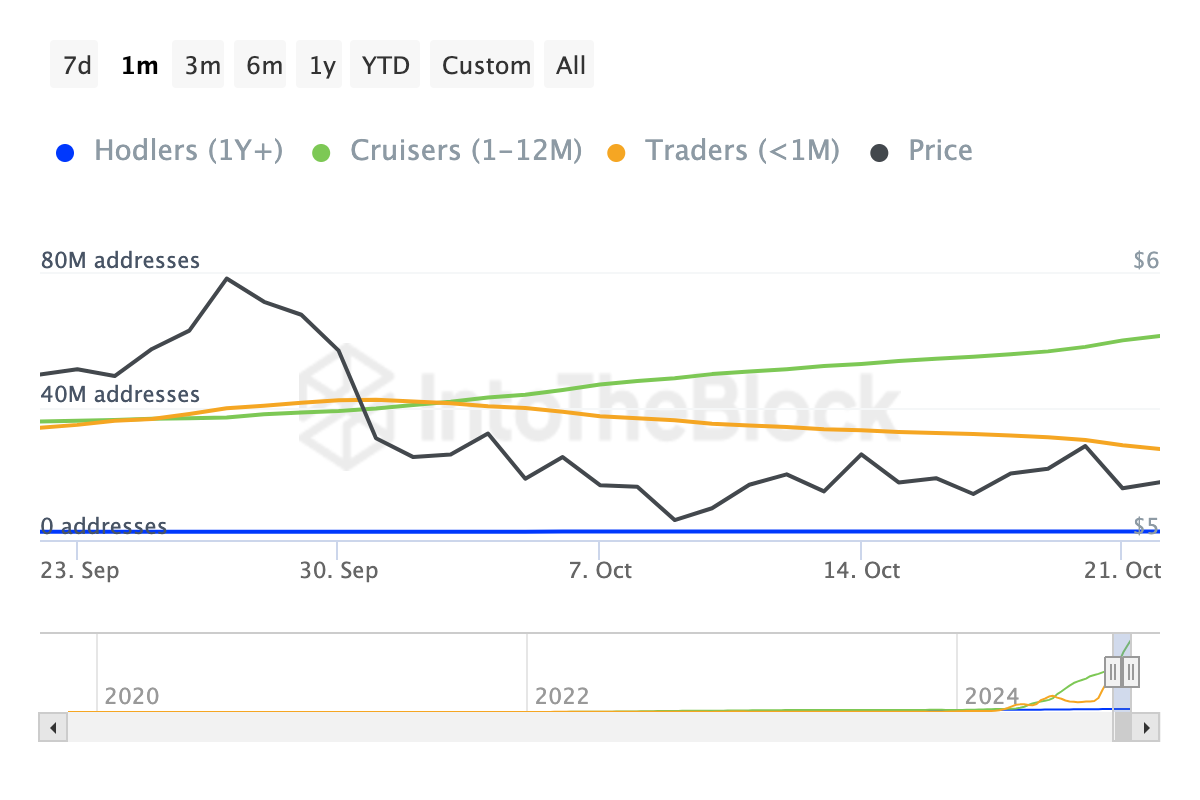

This sentiment likely contributed to the decline in engagement with Toncoin. Besides that, data from IntoTheBlock revealed a decline in the number of short-term holders. In the lead-up to the August and September airdrops, TON experienced a massive increase in the number of short-term holders.

This development fueled speculation that the TON’s price could return to $7. However, the shifting sentiment might have put that prediction to rest, as a shortage of demand might negatively affect the cryptocurrency’s value.

TON Price Prediction: Selling Pressure Could Drive It Down to $4

Currently, Toncoin’s price is $5.18, and the daily chart shows that the Chaikin Money Flow (CMF) has been in the negative zone since September 28.

The CMF is a technical indicator used to measure the buying and selling pressure of a security. Its primary function is to help distinguish between periods of accumulation (when investors are actively buying) and distribution (when investors are selling or reducing their positions).

When the CMF is above the zero line, it suggests that there is net accumulation, meaning the asset is experiencing more buying than selling pressure. This can be interpreted as a bullish signal, indicating that investors are confident in the security’s prospects.

Conversely, when the indicator is below the zero line, it signals net distribution, implying increased selling pressure and a potential bearish outlook for the asset. With the current position, Toncoin’s price could experience a decrease to $4.46.

Read more: 6 Best Toncoin (TON) Wallets in 2024

However, if the upcoming Telegram airdrops slated for October bring in good value, this prediction could change. In that scenario, demand for TON might increase as the price could rally to $6.20.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Victor Olanrewaju

https://beincrypto.com/telegram-airdrops-affect-toncoin/

2024-10-23 10:00:00